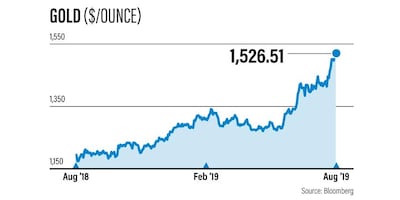

Gold prices climbed above the $1,500 mark to six-year highs on Tuesday as investors concerned about the state of the global economy sought a safe haven as an asset.

The spot gold price rose as high as $1,526.95 per troy ounce at 3.05pm in the UAE on Tuesday, reaching a record since April 2013. Spot gold is up 19 per cent this year-to-date

Inflows into gold assets reached $1.7 billion last week, said Adam Perlaky, a manager of investment research at the World Gold Council.

“There have been $2.5bn of inflows so far in August,” Mr Perlaky said in a blog post on Monday. “Year-to-date flows surpassed $10bn last week as assets in global gold-backed ETFs [exchange-traded funds] have grown 8 per cent this year,” he said.

The recent wave of buying by investors meant that gold prices were now at all-time highs in more than 20 countries, driven by continued low interest rates, said Mr Perlaky.

Ole Hansen, head of commodity strategy at Saxo Bank, said a “renewed race to the bottom in global yields as major central banks return to easing mode” has been the main driver behind the rise in gold prices.

“The drop in global bond yields has resulted in close to $16 trillion worth of bonds now yielding less than zero. This development, and worries about the impact on global stocks from the US-China trade war increasing the risk to the global economy, has created a very friendly investment environment for gold,” he said.

Hussein Sayed, a chief markets strategist at foreign exchange broker FXTM in Dubai, said demand for treasury bonds were nearing record highs.

"There is a kind of bubble being created in bond markets, much more than is happening in equity markets," he told The National.

Mr Sayed said that as long as investors continue to insure against geopolitical risks and the interest rate environment remains benign, gold prices should continue to rise.

“At the beginning of the year, I was expecting gold to end up in the range of $1,450 to $1,500, but now probably it can shoot above even $1,600 easily,” he said.

On futures markets, the net position of long gold contracts to those shorting the market neared all-time highs at 1,078 tonnes last week, said Mr Perkaly.

Trading volumes were also significantly higher at $213bn per day – an 87 per cent increase on last year’s daily average.

Samson Li, a senior metals analyst at Refinitiv, told The National he expects gold prices in the short term to retreat as traders take profits.

“The price has shot up by over 16 per cent in less than three months. That is a very lucrative return, especially considering that people use leverage in the futures market. Those who longed gold early are bound to take some profits off the table,” he said.

However, Gerhard Schubert, founder of Schubert Commodities Consultancy in Dubai, said that over the long term, prices are likely to continue rising as central banks continue to buy gold to reduce their exposure to the US dollar.

A report by the World Gold Council earlier this month said that in the first half of this year, central banks bought 374.1 tonnes of gold – a 57 per cent year-on-year increase and the highest amount since exchequers became net buyers of gold in 2010.

Mr Schubert said the difference between central bank buyers and other investors such as hedge funds is that the former are buying gold and holding it – effectively removing it from the market.

“They are not hedge funds –they do not sell it when it goes $100 higher,” he said.