The steel sign in the hallway of Dubai International Finance Centre's Building Number 6 still has Lehman Brothers engraved in big letters. A year after the collapse of the bank, its impact on the emirate's financial hub is just as visible. Collins, the elegantly-clad concierge, still wears the white gloves he had on a year ago to the day, when Lehman filed for bankruptcy protection, triggering a series of bank bailouts in the US that were repeated around the world.

"I definitely felt the action," he says, pointing to the surveillance camera and the glass lifts that shuttle clients up and down. "It was so sad, even shocking," he says. "Some carried boxes and some cried. I knew so many of them. There was no opportunity to say goodbye." The decor seems to go back a long way. Three oversized white vases are home to withered tree trunks. The fluffy carpet, designer coffee tables and leather couches also seem to belong to a bygone era. A year can be a long time for the global economy.

These days, Nomura, Japan's largest broker, occupies the office. The firm bought Lehman's regional assets for US$225 million (Dh826.4m) a week after the collapse. Philip Lynch, now the regional chief executive of Nomura, says that a year after the collapse, over-ambitious growth funded by debt is still haunting the region. "Some companies invested too much in markets where they did not have enough experience, went too fast and with too much debt. It was just over-expansion," said Mr Lynch, who had worked for Lehman for 21 years, and who took the regional helm just two weeks before the company collapsed on September 15 last year.

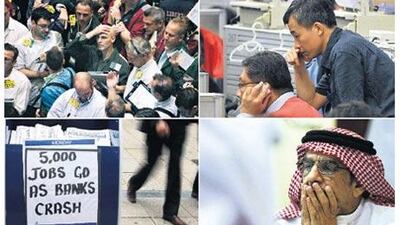

President Barack Obama yesterday told an audience on Wall Street that while the financial system was returning to normality, it should not produce complacency. He said the US needed a new regime of common sense regulations. "There are some in the financial industry who are misreading this moment," he said. "We will not go back to days of reckless behaviour." In the year since Lehman filed for bankruptcy protection, hundreds of jobs have been lost across the banks and brokerages that are located in and around the Dubai International Financial Centre.

The impact on the emirate's property market, where prices have fallen by as much as 50 per cent from their peak, is even more apparent. Yet despite the turmoil in the region's financial markets, local banks have stood up remarkably well, according to Mr Lynch. "In general, they are very well capitalised due to a fundamentally conservative regime being deployed in most country's banking systems." He believes the lessons from the Lehman collapse are clear: "Institutions the size and scale of Lehman Brothers cannot be allowed to fail. It precipitated a crisis a lot worse than it needed to be."

The second big lesson, he says, is the need to regulate financial institutions more closely. "There should be more control of leverage and capital requirements. Only now that the worst is over are regulators turning their attention to that." While the legacy of Lehman remains at the heart of Dubai's financial hub, the new tenant of Lehman's Dubai office remain's upbeat. Nomura is on course to match last year's profits in the Middle East this year, according to Mr Lynch.

Outside, in the lobby of Building 6, Collins is also confident things are changing. "Next time you come, the sign will say Nomura," he says. @Email:uharnischfeger@thenational.ae