Qatar will withdraw from the 15-member Opec on January 1 to focus on its gas production, but analysts said the symbolic move from the group's 11th largest producer is unlikely to dent plans to cut output next year.

Qatar, which joined Opec in 1961 and is the first Middle East country to withdraw from the organisation, currently produces around 600,000 barrels of oil per day, which is equivalent to less than 2 per cent of the group's 32.9 million bpd output in October.

"This decision reflects the desire of the State of Qatar to focus its efforts on the development of the natural gas industry and to implement recently announced plans to increase the country's production of liquefied natural gas from 77 to 110 million tonnes annually", the country's oil minister Saad Al Kaabi said.

Qatar has informed Opec of its decision, which comes days before the December 6 meeting in Vienna, where members headed by kingpin Saudi Arabia and Russia-led allies in the Opec+ group will decide whether to trim output next year.

An Opec spokesman couldn't be reached for comment.

"In a global context and within OPEC, Qatar is a small producer, but from a sentiment perspective it is an unfortunate decision a few days ahead of the OPEC+ meetings considering that the group likely wanted to send a message of a united group," said Giovanni Staunovo, a commodity analyst at Swiss bank UBS.

The news of the agreement announced by the leaders of Russia and Saudi Arabia to extend the Opec+ accord and the US-China trade truce over the weekend helped prices recoup on Monday some of last month's losses.

Brent was trading up more than 4 per cent to reach $61.92 a barrel in morning trading in London on Monday. Oil prices had lost more than a third of their value since early October because of the increase in US oil production and the White House granting waivers to eight countries importing Iranian crude.

"The nature of the animal as far as Opec is concerned is the bigger production capacity you have then the more weight you carry," Vandana Hari, founder and chief executive of Vanda Insights, told The National. "If you aren't on board with a tough decision like to reduce, and Qatar was never in that position since it is a relatively small producer" then you have no sway, she said.

Now Qatar will be able to produce at whatever level it wants “but I wouldn’t see it as a threat to Opec’s efforts to cut their production because [Qatar] is not capable on its own of flooding the market”, Ms Hari said.

Mr Al Kaabi said Qatar's decision to withdraw from Opec is not related to the boycott, referring to actions by Saudi Arabia, Bahrain and the UAE to cut relations with Doha in June last year, accusing it of seeking closer ties with Iran and supporting extremism in the region.

"Qatar’s crude oil production is too small to have an impact on the Opec+ accord as the compensation that will be needed from other countries is not material," said Olivier Jakob, head of Petromatrix. "Decisions in Opec+ are currently driven by Saudi Arabia, the UAE and Russia; Qatar will not change the collaboration from those heavyweights."

The Opec+ agreement struck in 2016 helped oil prices recover in 2017 and this year since it trimmed 1.8 million bpd of crude from the market and brought down inventories to their five-year average. However, the reversal of cuts in the second half of this year allowed members to turn on the taps at a time when global demand is forecast to taper.

_______________

Opec meeting

Oil set for its worst month in a decade over fears of a supply glut

Russia's oil output dips in November ahead of Opec+ meeting

Russia and Saudi Arabia to extend Opec+ accord, Putin says

Quicktake: Why are oil prices plunging?

_______________

"Basically, Qataris have brought the biggest weapon out and it only means more instability between the Qatari and Saudi relationship," Naeem Aslam, chief market analyst at ThinkMarkets, told The National.

“For now, there is optimism that Saudi Arabia and Russia are committed to keep the supply under control. This has jolted the price of oil higher especially the fact that Canada's largest oil-producing province is curbing the output.”

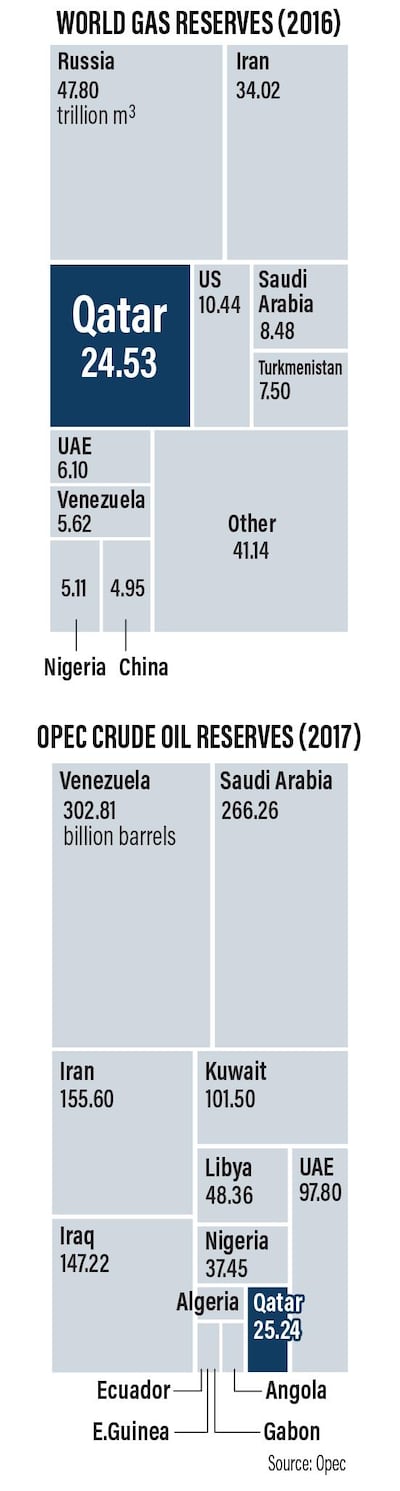

Apart from crude, Qatar sits on the world's third-largest gas reserves and is the No. 1 producer of liquefied natural gas, which is gas cooled to liquid to be transported by ships.

"Qatar sees its future in LNG and it is not the only one to see more growth potential in LNG than in oil," said Mr Jakob. "Qatar’s decision to leave Opec can be interpreted as a short-term political statement but it is also an illustration of upcoming long-term changes in the supply and demand of energy, which will be more focused in natural gas than in oil."