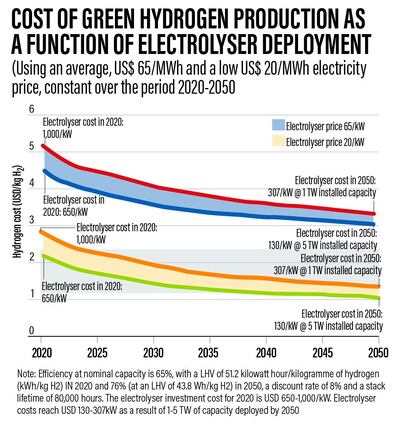

A scale-up in production of green hydrogen, which refers to gas produced entirely from renewable sources could lower costs by 40 per cent in the short-term and 80 per cent long-term, according to the International Renewable Energy Agency.

A number of climate policymakers have been pushing for countries to develop green hydrogen, as opposed to 'grey' or 'blue' hydrogen as they increasingly factor in the clean fuel as part of their energy transition.

Grey hydrogen refers to manufacture of the gas using fossil fuels and currently accounts for 95 per cent of production. Blue hydrogen is extracted from natural gas, through a process called methane reformation, which relies on carbon capture and storage.

Technology that uses renewables to split water molecules through electrolysis, is being increasingly favoured, as countries look to eliminate fossil fuels from future energy mixes.

"Green hydrogen is already close to being competitive today in regions where all the favourable conditions align, but these are usually far from demand centres," the intergovernmental agency said in its report.

It cites Patagonia as an example, where wind energy could have a capacity factor of almost 50 per cent, with an electricity cost of $25-30 MWh. That is enough to achieve a green hydrogen production cost of about $2.5/kg, which is close to the blue hydrogen cost range, Irena said. But Irena also points out that green hydrogen is still 2-3 times more expensive than blue hydrogen and the cost of the former is defined by electricity costs, investment cost, fixed operating costs and the number of operating hours of the electrolyser facilities.

Costs for green hydrogen, currently considered steep, could fall below $2 per kilogram, enough to make it competitive with other fuels, within a decade, according to the agency's report.

"Green hydrogen forms a cornerstone of the shift away from fossil fuels," said Irena director general Francesco La Camera. "Its uptake will be essential for sectors like aviation, international shipping and heavy industry, where energy intensity is high and emissions are hardest to abate."

Several energy firms, including national oil companies such as the UAE's Adnoc are factoring in development of a hydrogen ecosystem as part of their long-term growth plans.

Saudi Arabia, the world's largest oil exporter, is also putting together a strategy to develop hydrogen production capabilities as it looks for newer, alternative fuels to be part of its energy mix.

Hydrogen is being trialled as a promising alternative to fossil fuels, particularly in transportation. Clean hydrogen can slash green house gas emissions from the hydrocarbons sector by 34 per cent, according to BloombergNEF. The growth of hydrogen can fuel a €120 billion (Dh523.1bn) industry in Europe by 2050, according to Aurora Energy Research.

McKinsey, meanwhile, estimates that the development of a hydrogen economy could generate $140bn in annual revenue by 2030 and help support 700,000 jobs in the US.

Irena estimates that industry investors are planning the deployment of at least 25 Gigawatts of electrolyser capacity for green hydrogen by 2026.

"Still, far steeper growth is needed – in renewable power as well as green hydrogen capacity – to fulfil ambitious climate goals and hold the rise in average global temperatures at 1.5°C," Irena said in the report.