Abu Dhabi National Oil Company is seeking to boost its petrochemicals, energy and technology partnerships with China, the world's second-biggest oil consumer which has expanded its participation in the UAE's hydrocarbon sector, its CEO said on Wednesday.

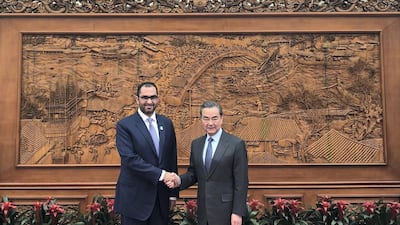

Dr Sultan Al Jaber, Minister of State and Adnoc Group chief executive, is currently in China to bolster ties with the Asian country, the UAE's largest trade partner.

“China represents a key strategic partner for the UAE and the growing ties between Chinese companies and Adnoc is a testament to the depth and importance of the relationship,” said Dr Al Jaber. “We are keen to explore how Adnoc can continue to serve the growing demand for energy, and, in particular, for chemical and petrochemical products in China, as a key growth market.”

Adnoc is currently revamping its business model, consolidating various businesses and streamlining its operations as part of an overhaul that has seen it seek more international partners, and sell shares in its retail fuel distribution unit on the Abu Dhabi stock market.

The company will allocate Dh400 billion in investments over the next five years on investments including additional international downstream projects, and further exploration for unconventional gas resources.

"Adnoc's focus on the application of advanced technology, in support of its 2030 growth strategy, is one area where China's experience in developing artificial intelligence and predictive data, through companies such as Huawei, could be deployed to create additional value from its resources. Adnoc is keen to advance and lead the digitisation of the oil and gas industry," Dr Al Jaber said.

_______________

Read more:

Abu Dhabi to increase petrochemical production capacity beyond current targets

Adnoc to invest Dh400bn as it eyes downstream expansion

_______________

China is already a significant investor in the UAE's energy sector. Adnoc last February awarded China National Petroleum Corporation (CNPC), the country's largest oil and gas producer and supplier, an 8 per cent stake in Abu Dhabi’s onshore oil concession, in a 40-year agreement backdated to January 1, 2015.

Adnoc and CNPC subsequently signed a framework agreement in November to look at collaboration opportunities including in Abu Dhabi’s Lower Zakum, Umm Shaif and Nasr offshore concessions, as well as the Bab Bu Hasa, Ghasha and Hail sour gas development projects.

The UAE, which is seeking to triple its petchems production by 2025, is also keen to boost its petchems exports to China, the largest Asian customer for Abu Dhabi's Borouge, the chemical joint venture between Adnoc and Austrian Borealis.

“Adnoc is focused on market expansion in China and Asia, where demand for petrochemicals and plastics, including light-weight automotive components, essential utility piping and cable insulation, is forecast to double by 2040,” the company said on Wednesday.

Separately, Adnoc has cut allocations of its Murban crude to customers by 25 per cent for March, in line with a deal between Opec and other producers to reduce output, the UAE's energy minister said on Tuesday.

"In March, Adnoc will reduce its Murban crude oil allocation by 25 per cent. Customers have been notified accordingly by Adnoc," said Suhail Al Mazrouei, who is also current Opec president, in a post on Twitter.

Adnoc's cuts to allocations of Murban, the UAE’s flagship crude grade, is one of the deepest since the output reduction deal came into force in compliance with Opec curbs began in January 2017.

Opec, which pumps more than a third of the world's oil production, and a group of larger producers outside the bloc, have trimmed output by 1.8 million barrels of oil a day since the start of last year, to lift oil prices and lower global inventories to their five-year average.