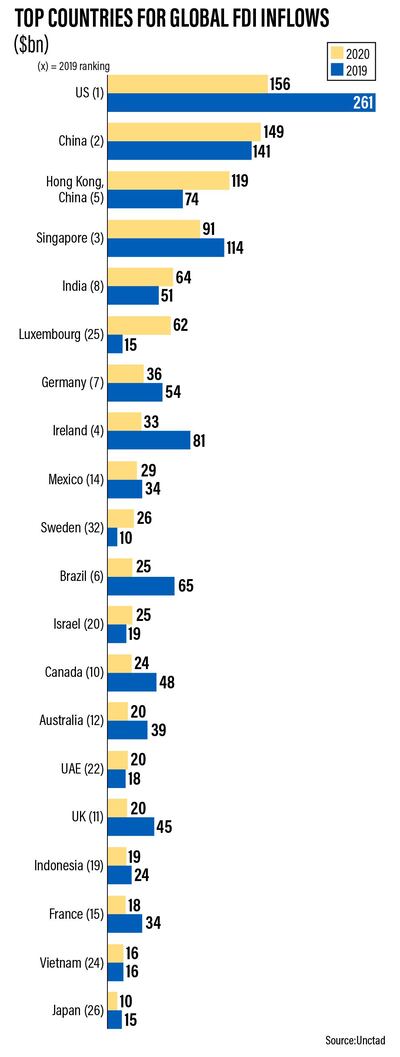

The UAE was the world's 15th-biggest recipient of foreign direct investment in 2020, ranking one place above the UK and seven places higher than the prior year, according to the UN Conference on Trade and Development.

Although FDI flows plunged 35 per cent globally last year, investment into the UAE increased 11 per cent to almost $20 billion (Dh73.45bn), as Vice President and Ruler of Dubai Sheikh Mohammed bin Rashid revealed last month.

"Natural resources transactions drove investments in the country”, primarily the $10bn brought in from investors to Adnoc’s gas pipelines, Unctad's World Investment Report said. By contrast, the UK's FDI inflows fell by 57 per cent last year to $19.7bn.

Adnoc's strategy of releasing capital tied up in non-core assets has been a key driver of foreign investment into the UAE in recent years. In 2019, it attracted $5bn into its oil pipelines and last year's $10bn sale of a 49 per cent stake in the company that has the leasing rights to its gas pipelines brought in funds from a number of sovereign and institutional infrastructure investors, including US-based Global Infrastructure Partners, Canada's Brookfield Asset Management and Singapore's sovereign fund GIC, among others.

Adnoc also raised $2.7bn by monetising future rents from non-core property assets in September through a deal with US-based Apollo Global Management.

The UAE also attracted investment into other sectors. Some 53 per cent of FDI into Dubai in the first half of last year was into medium and high-tech sectors, according to Unctad's report. Pakistan's CCL Pharmaceuticals also took a majority stake in Dubai's StratHealth Pharma for an undisclosed sum.

Although the Adnoc deals were responsible for a large part of the FDI inflows, they demonstrate that an "investor can still be attracted to the right opportunity even when the global market is tight", Scott Livermore, chief economist at Oxford Economics, said.

The UAE made a number of changes to commercial and company laws over the past few years in a bid to spur investment. New rules allowing 100 per cent foreign ownership of onshore companies in most sectors of the economy came into force earlier this month.

The country was also the 13th-biggest investor in terms of other nations' economies, recording an FDI outflow of $19bn as major investors, such as International Holdings Company, invested in Sudan's agricultural sector and Mubadala invested $201 million in Uzbekistan's power industry, according to the report.

Saudi Arabia also managed to grow FDI inflows last year by 20 per cent to $5.5bn. Investment picked up as the year progressed, with inflows of $1.9bn generated in the final quarter. Bahrain's Gulf International Bank investing $450m to begin commercial operations in the kingdom and an investment of $200m into the Saudi Digital Payments Company by Western Union were two of the bigger deals.

On Friday, Saudi Aramco closed a $12.4bn deal with a consortium led by EIG Global Energy Partners for the acquisition of a 49 per cent stake in its oil pipeline business.

Globally, FDI fell 33 per cent last year to $1 trillion from 2019, as all foreign investment segments witnessed a fall in activity. FDI fell by 58 per cent in developed economies and by a more moderate 8 per cent in developing economies, mainly because flows in Asia remained resilient, the Unctad report said. Flows to China increased 6 per cent and to India by 25 per cent, driven by acquisitions in the IT sector.

However, flows to Europe fell 80 per cent, Latin America and the Caribbean dropped 45 per cent, North America declined 42 per cent and Africa slipped 16 per cent.

Globally, funding flows for greenfield projects were hit hardest and continued to decline – by 29 per cent annually at the end of the first quarter of this year. Cross-border M&A flows fell 13 per cent and international project finance deals declined 5 per cent during the same period, according to Unctad.

Although the global outlook for FDI is likely to remain "challenging", the investor-friendly reforms being undertaken by a number of economies in the region means that competition for the funds that are available is likely to grow, Mr Livermore said.

"The UAE has boosted its competitive position [through] reforms such as 100 per cent foreign ownership of onshore companies and measures designed to attract foreign talent, as well as setting out ambitious growth plans to diversify the economy," he said.

"These reforms should support a symbiotic relationship of supporting non-oil economic growth and increasing the UAE's attractiveness" to foreign investors, he added.

Unctad will host its week-long World Investment Forum event this year in Abu Dhabi from October 17 to 21.