Chinese car makers have struggled to break into international markets against fierce competition from existing players. Now, many are trying to make a go of it in Africa, with mixed success.

With cheerful names such as Geely, Chery, Hafei, Chana and Foton, Chinese automakers are opening up assembly plants all across Africa. For consumers though, it is in Toyota they trust. Rusty used Hilux pickups imported from Japan are everywhere. So are secondhand imports of other established brands such as Volkswagen, Ford and Nissan.

Nigeria alone imports around 150,000 used cars a year, according to PriceWaterhouse Coopers. These vehicles cost around 10 per cent of a new car and present a formidable market hurdle to companies trying to compete.

“If African countries are serious about industrialisation, they have to put a stop to the dumping of cheap cars, especially those over five years old,” says Martyn Davies, Managing Director of Emerging Markets & Africa at Deloitte South Africa.

Mr Davies is working with several African governments, including Nigeria, helping to devise a policy framework that will stem the flow of cheap used cars. This, he says, will help assemblers open new factories in African countries that will create jobs and skills locally.

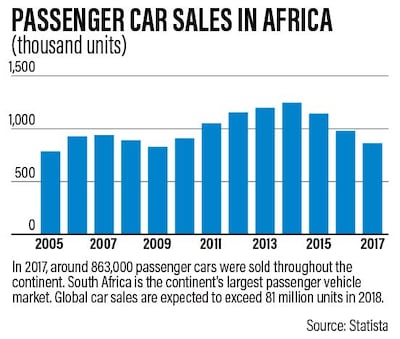

Despite the challenges, it’s easy to see why Chinese firms are interested in Africa. The continent is home to more than 1 billion people, and an expanding middle class. Growth of personal transport is low however, with only 42 vehicles per 1,000 inhabitants, compared to the global average of 182, according to a 2016 data from the International Organisation for Motor Vehicle Manufacturers.

Currently South Africa is the only country on the continent that has a de facto automotive industry. At least nine major carmakers have plants, including Volkswagen, Toyota, BMW and Ford. These compete internationally; for instance, BMW’s factory in Pretoria makes the German firm’s X3 SUV for export to the US market.

_______________

Read more:

Daimler and China's Geely to launch ride-hailing service

Uber's Middle East rival Careem secures $200m in funding

_______________

Mr Davies says Chinese manufacturers have noted the success of South Africa’s industry and are hoping to do the same elsewhere in Africa. For some this has become a matter of survival as China now has more than 100 car companies, all fighting for business in a saturated market.

“They need to grow sales and it’s tough to do so in China where there are so many competitors. So they are trying to grow sales offshore,” says Mr Davies.

Over time many of these companies will probably fail or be swallowed up by competitors – much the same happened during the early years of the Western automotive industry.

For those that hope to survive, Africa is seen as a crucial market, which is why companies such as Guangzhou Automobile Group (GAC) have opened an assembly plant in Lagos, Nigeria.

“Nigeria and Africa at large, has the potential to perform well for the automotive industry,” General Manager of GAC Motors, Yu Jun said. “We are willing to make the necessary investments to ensure our Nigerians customers – and those in the wider region – become familiar with our brand.”

Mr Jun said GAC would for now concentrate on developing its brand locally, before expanding beyond Nigeria.

“We’ll first establish ourselves in the Nigerian market, then look to which others offer the best opportunity; Ethiopia, Algeria, Egypt, etcetera.”

For some Chinese companies, it has not been a smooth road. Foton, a Beijing-based manufacturer that produces pickup trucks and delivery vehicles, entered Kenya in 2011. By 2017 however, Foton East Africa was broke, forced into bankruptcy and its production plant in Niarobi shut.

Now it’s staging a comeback. Earlier this year Foton took control of the Kenyan operation directly, recapitalised the business and set out to reopen the production line. “This is our target market,” says Apple Sun, the new head of Kenya Foton. "We need to be here.”

Perhaps the most ambitious of the African-focused Chinese automakers is Beijing Automotive Industry Holding Company, better known by its brand name BAIC (pronounced ‘bike’).

This year the company opened an 11 billion rand (Dh3bn) assembly plant in Port Elizabeth on the East Coast of South Africa. The BAIC facility is said to be China’s largest direct investment in Africa to date, and will create 2,500 jobs. Port Elizabeth is responsible for more than 60 per cent of the country’s automotive manufacturing, and the main hub for car exports.

_______________

Read more:

First Mercedes electric SUV makes UAE debut in Abu Dhabi – in pictures

Here's a look at the Dubai Police's new electric car addition

_______________

BAIC has made it clear it sees the Port Elizabeth plant as a springboard to sell its line of SUVs, passenger cars and luxury sedans across Africa.

Mr Davies of Deloitte notes that while many African countries are inviting manufacturers to set up shop, including landlocked states such as Rwanda and Uganda, it is those located in the coastal economies that will prevail.

“It is a nice idea to set up a factory in Rwanda, but the costs of exporting or selling those cars will be prohibitive. They need to be close to a port.”

In the meantime, Chinese companies are also learning that what sells in China does not necessarily translate into sales in Africa.

Du Rong, Deputy Manager BAIC International, attended the rolling off of the first vehicle from the company’s Port Elizabeth plant in July. He appeared slightly bemused at the reception BAIC cars got from South African consumers.

“South Africans test the bluetooth and play the music very loud,” he said. “That’s usually the first car feature they try out. They tend not to like the sunroof very much, maybe for security concerns.”