Business leaders in India are optimistic about Narendra Modi's landslide victory in the general election that gives him the premiership of Asia's third-largest economy for a second term.

His return to the corridors of power in New Delhi is seen as a continuation of his economic agenda despite his mixed track record in handling issues such as unemployment and a slowing economy during his first term. However, there's more enthusiasm than skepticism at the moment.

“The re-election of Mr Modi has put an end to the uncertainty and raised hopes of momentum gaining [pace] in the Indian economy,” says Dhiraj Relli, the managing director and chief executive of HDFC Securities, a Mumbai-headquartered stock brokering company.

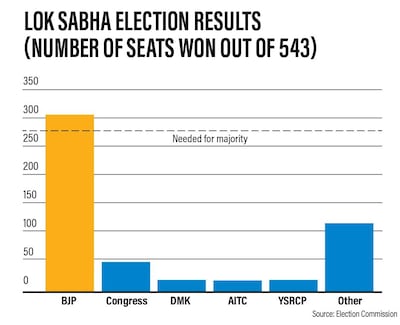

Mr Modi's Bharatiya Janata Party (BJP) stormed to a clear win last week following India's six-week long general election, which saw some 600 million people casting their votes. The BJP's return is seen as a win for the economy and its prospects of growth as the government will now have a chance to build on its work of the past five years.

“The return of the Modi government is very positive for the country and its economy,” says Anand Rathi, the chairman of Anand Rathi Group, a financial services company based in Mumbai. “Any strong and stable government is in a better position to push robust economic reforms.”

He cites the goods and services tax (GST), a new bankruptcy law, and various welfare schemes for the poor as examples of “far reaching reforms” that have been introduced by Mr Modi during his first tenure when he rose power in 2014. However, the government has not ticked all the boxes and it has not "achieved its target for employment and investments in the economy”, he noted.

Tulsi Tanti, the chairman and managing director of Suzlon Group, a renewable energy company based in Pune, says he looks forward to “the government delivering on its promises by spearheading the growth of the agriculture sector and industry with dynamic policy changes, which will fuel overall economic growth, energy security, and job creation”.

Mr Modi has made some very ambitious promises during his 2019 election campaign, including doubling farmers' incomes by 2022 and plans to spend a staggering $1.44 trillion on infrastructure, including roads and railways, by 2024.

However, his achievements on the economic front during his first tenure were mixed at best when it comes to delivering on promises to the farming community, broadening the country's tax base and luring foreign direct investment.

The country has the title of being the world's fastest growing major economy, expanding by 7.1 per cent in the financial year to the end of March, according to the IMF. The overall gross domestic growth in the quarter to the end of December, however, has slowed to 6.6 per cent.

Inflation is still in check, with retail inflation at 2.92 per cent, still under the central bank's target of 4 per cent, according to the Central Statistics Office's data. However, In recent weeks, there have been questions on how India's GDP data is calculated.

There are many who question the wisdom behind Mr Modi's economic policies. His demonetisation initiative in 2016 stirred controversy because the shock ban on the two highest value banknotes sapped liquidity from the markets and left many labourers dependent on cash payments out of work.

That was followed in 2017 by the introduction of GST, which many small businesses, in particular, struggled to get to grips with, as the new regime added to their accounting costs and dented the capital they needed for expansion.

Today, there are mounting concerns about job creation. Mr Modi in his 2014 campaign promised to create a slew of jobs across sectors of the economy, where one million people enter the workforce every month.

However leaked government data reported by Indian media showed that the unemployment rate in the country has hit a 45-year-high of 6.1 per cent in the year to June 2018.

“If there was ever a time since May 2014 that India needed Modi to pull a rabbit out of the hat and turn around the economic prospects of the country, it is today,” says Garima Kapoor, an economist at Elara Capital, headquartered in Mumbai.

“Unlike the first five years, the solution to the problems is complex and requires a radical shift in the economic policy.”

Mr Modi's next term in power “will have to dominated by investment, jobs and nursing of the dislocated financial sector, she says, adding that among the immediate priorities, "we expect the Modi-led government to take measures to revive consumption, address financial sector dislocation by recapitalising public sector banks, boost the manufacturing sector to ensure job creation, and solve the conundrum of the skills shortage in the country to ensure employability”.

Deepthi Mathew, an economist at Geojit Financial Services, echoed Ms Kapoor's views, saying unlike in 2014, the Modi government this time has a much weaker economy at its hands.

“Rural distress and slowing investment in the country are two major issues that need to be addressed in an urgent manner.”

Figures also point to a worrying trend when it comes to consumer spending.

Passenger vehicle sales, including car sales fell 17.1 per cent last month to 247,541 units from a year earlier, according to the latest figures from the Society of Indian Automobile Manufacturers.

In addition, India's shadow banks -- the non-banking financial institutions -- are facing liquidity challenges. There are also global factors that are out of the government hands such as rising trade tensions and strengthening oil prices. They have a direct bearing on Indian economy due to the country's heavy reliance on oil imports.

It's anybody's guess whether the Modi-led government, this time around, will be able to deliver on the lofty promises made during the election campaign. However, euphoria of BJP's sweeping victory is resonating through the capital markets. The benchmark BSE Sensex on Thursday rallied to a record high, crossing the 40,000 mark for the first time. The Sensex gained close to 4 per cent during the week, closing at 39,434 on Friday.

Analysts say once the initial excitement dies down, markets will be more focused on pure economic fundamentals.

"In the end, markets will move based on earnings visibility, economic policies, global sentiments and how their impact will be on corporate earnings," says Jimeet Modi, the chief executive of Samco Securities.

The biggest question the markets will be asking shortly is how the government plans to fund the promises that the party has made to voters, including its plans to spend more than a trillion dollars on infrastructure and provide cash handouts to farmers. Questions will also be asked on the economic reform agenda and the pace of policy implementation, analysts say.

"We are less optimistic about the chances of a wide-ranging labour and land reform being enacted," says Shilan Shah, the India economist at Capital Economics. "Mr Modi demonstrated in his first term that he was not willing to implement politically-contentious measures, and it is highly unlikely that this will change now, especially as reforms to labour and land markets would prove unpopular among a large section of the electorate that has just voted the BJP back into power."

To keep both the markets and his voters happy Mr Modi's government will deliver "enough reform to keep potential growth at around 7 per cent, leaving the economy on course to double in size over the next decade", Mr Shah explains.