Prashant Redekar, who owns a mobile phone store in the Indian city of Mumbai, says his customers are spending more than ever on phones.

But his biggest selling brand is not a global name such as Apple or Samsung. Instead, it is the Chinese manufacturer Vivo, which currently accounts for close to half of all the phones he sells.

"When it comes to phones, Indians want the maximum functions for the best price," Mr Redekar says.

The price range of the Vivo phones at his store start from around 8,000 rupees (Dh420) and goes up to 45,000 rupees.

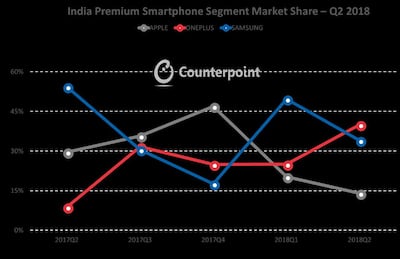

Meanwhile, China's OnePlus surpassed Samsung and Apple to become the biggest selling phone brand in the premium segment in the second quarter of 2018, grabbing 40 per cent of the market share, according to Counterpoint, a global industry analysis company.

India is the world's second-largest smartphone market after China, overtaking the United States last year, according to research company Canalys based in Singapore. There is an enormous opportunity for mobile phone brands to tap into Asia's third largest economy, with its more than 1.3 billion people, a young demographic and rising incomes.

"India is a land of opportunity for most brands and as the world's fastest growing smartphone market, it is a focus market for us," says Vikas Agarwal, the general manager at OnePlus India. "In India, strategy is key and doing the right thing at the right time can take you a long way."

Social media has been a major part of this strategy and India accounted for over one-third of OnePlus' global business last year.

The country's smartphone market expanded by 14 per cent last year over the previous year, with total shipments of 124 million units to mobile phone vendors, making it the fastest growing of the 20 biggest smartphone markets globally, according to International Data Corporation.

Half of India’s mobile phone users still have basic feature phones, but they are rapidly upgrading to more high-tech devices.

It is an opportunity that mobile phone brands do not want to miss. But the Indian market is a tough one to crack. Apple, for example, does not make it into the top five mobile companies in terms of market share for the quarter, according to Counterpoint.

By contrast, more unlikely players such as Vivo, OnePlus, and Xiaomi – all Chinese companies – have managed to hit the rights buttons in India, the figures show.

Samsung was the biggest selling brand with a 29 per cent share of the Indian market by shipments in the second quarter of 2018, according to Counterpoint's research. But Xiaomi was almost at par with a 28 per cent share, and in the previous two quarters, it overtook Samsung to be the top brand by shipments.

Figures from Canalys, meanwhile, show Xiaomi and Samsung, both attaining a 30 per cent share of the market each in the second quarter. Xiaomi achieved a 106 per cent growth over the same quarter last year, just fractionally ahead of Samsung to hold the top position.

"India has a voluminous smartphone market," says Dushyant Jani, the founder and chief executive of Mobclixs Technologies, a digital media company based in Mumbai. "Manufacturers are well aware that the wants and desires of Indian customers will have a significant impact on sales. The progress of the online market has also strongly affected the smartphone industry."

Xiaomi only entered India four years ago, and started out selling its devices online. The brand's expansion has been rapid and the company now has six smartphone manufacturing plants and more than 1,000 service centres in the country.

"Xiaomi never relied on traditional advertising methods like most other brands in India," says Manu Jain, the vice president of Xiaomi and managing director in India.

He says the company has targeted a community of what it refers to as "Mi fans" through social media and has relied on word of mouth.

“India is a truly diverse consumer market, with so many different communities and socio-cultural practices which influence consumer habits and trends,” says Mr Jain. “India has the largest millennial consumer segment who are the most smartphone friendly of the lot, and willing to experiment with smart technology.”

_______________

Read more:

Samsung bet big on winning the Indian smartphone manufacturing race

Electronics import bill is a growing concern for Indian policymakers

_______________

Vivo and Oppo's marketing strategy has been to invest in cricket sponsorship in India, where the sport is often described as "a religion" and is watched by hundreds of millions of Indians via television from the biggest cities to the remote villages. Last year,

Oppo took over the sponsorship of the Indian cricket team, while Vivo is the title sponsor of the Indian Premier League cricket tournament.

A factor that hugely influences which phone Indian consumers opt for is cost. Whether it is to buy a high-end or budget phone, they always want to get value for money, analysts and shop owners say.

“India is a cost-conscious economy, where affordable products sell the highest,” says Mr Jani. “From local brands like Micromax to Karbonn, to foreign brands like Samsung and HTC, budget smartphones have flooded the market.”

Giant global brands are facing stiff competition in India in the premium segment, too, and mobile manufacturers are increasingly looking to corner this end in addition to the mass budget market.

“The premium market demand is being skewed towards sub-40,000 rupee devices due to aggressive offering such as OnePlus through online segments,” analysts at Counterpoint wrote in a report.

“This is a new trend where ‘affordable ultra-premium’ is wooing aspiring rich and young consumers away from more expensive offerings from likes of Samsung and Apple. With the likes of Oppo, Huawei, Vivo and Google looking to be aggressive in 40,000 to 60,000 rupee segment in coming quarters, pressure on likes of Apple and Samsung will be even higher.”

Bumper sales for OnePlus in the country in the second quarter were driven by the launch of its latest flagship device, the OnePlus 6 – with its high-tech spec priced at less than half the cost of the iPhone X. The company launched its first phone in India at the end of 2014, only sold online through Amazon.in. Its management says a lot of work has gone into wooing the Indian consumer.

"If you want to succeed as a brand in India, you must truly understand the needs of the Indian market," says Mr Agarwal. The Indian customer, for example, is very "experience based" and he says that has prompted the online-focused brand to open stores.

"We realised we would require some tweaks in our model," says Mr Agarwal. "For India alone, we then set up a large-scale experience store in Bangalore as an additional offline touchpoint for our customer to engage with the brand. We are now setting up over 14 new offline touch points in key markets across the country."

After-sales service is something that is very important for the Indian customer, and consequently the company plans to set up "large-scale state-of-the-art service centres" in major cities, he says.

Social media is key for OnePlus – as is the Indian film industry. "We maintain constant engagement with our fans through Facebook, Twitter and WhatsApp for their feedback," says Mr Agarwal.

“Thus, instead of using one ambassador across the Indian market, OnePlus engages with its core fan community through various influencers that appeal to divergent demographic groups across different geographies.

"For example, while [actor] Amitabh Bachchan's endorsement worked for a certain category of consumers in urban and rural markets, comedian Vir Das helped us reach the urban young."

Analysts say India is a fickle market, though. When it comes to mobile phones, a quarter or a year of success does not guarantee that a company can hold on to its market share.

“It’s a fight everyday,” says N Chandramouli, the chief executive of TRA Research, a consultancy based in Mumbai. “The Indian market for phones is extremely complex, extremely competitive.”

________________________________

OnePlus sees huge opportunities in the Indian market

Vikas Agarwal, the general manager for OnePlus India, talks to The National about the brand's journey in the country

How does India differ from other markets?

OnePlus is present in over 35 countries with major presence in Europe, US, India and China region. [Since being] launched in December 2014, India has quickly surpassed other regions to become the biggest and the most important market for OnePlus. In 2017, it accounted for over one-third of global business.

How has OnePlus marketed to India?

We do not look at marketing the traditional way and have always relied on word-of-mouth and positive feedback.

Can you give an example of this?

One of the highlights of 2017 was our association with Star Wars whereby we launched a limited edition OnePlus 5T Star Wars device. It all started with a social media post on Star Wars which went viral within the OnePlus community. That’s when we realised that there is a huge overlap between the OnePlus and Star Wars communities in India. The Star Wars campaign further established the connect we have with our users.

What effect is India having on your strategy?

In addition to contributing to global business growth, India has also played a critical role in being a platform for experimentation and learning and therefore establishing partnerships with brands in other global markets like Amazon in Germany and UK and Disney in Nordics and China. Lastly, our Indian community has feedback has played a key role in improving product experience, such as wallpaper designs, software improvements.

What are your plans for India?

OnePlus is committed to long-term growth in India and is investing significant resources into the country. The company intends to move deeper into the ‘Make in India’ strategy and is presently finalising plans on local component manufacturing and sourcing. With an R&D centre coming up in India, the focus being on decentralisation to make India our second headquarters and the sheer potential that India offers, it is safe to say that the brand is looking to explore further exponential growth in the market.

What other interesting trends have you noticed in India?

Apart from being the largest market for OnePlus, India also has the most vocal user-base. The Indian community stays very much involved with the brand and are highly active in terms of feedback. Also, the premium smartphone segment in India is at its nascent stage right now. This means there is tremendous potential for us to explore and grow in India.