Online transactions accounted for 19 per cent of total retail sales in 2020, up from 16 per cent in 2019, as Covid-19 movement restrictions fuelled e-commerce growth, the UN Conference on Trade and Development said.

Several countries reported a growth in online sales, with South Korea topping the list at 25.9 per cent of total retail sales, up from 20.8 per cent in the previous year, Unctad said in a report.

The value of South Korea's online sales rose from $84.3 billion in 2019 to $104.4bn last year. The country's total retail sales stood at $403bn last year.

Other countries also reported higher online sales amid the pandemic.

China's online transactions accounted for 24.9 per cent of total sales last year, up from 20.7 per cent in 2019, while UK online transactions as a share of total sales rose from 15.8 per cent in 2019 to 23.3 per cent last year.

In the US, online portion of total sales grew from 11 per cent in 2019 to 14 per cent last year.

In terms of value, China's online sales stood at $1.4 trillion last year, up from $1.23tn in 2019. The US had $791bn in online sales while the UK had $130bn.

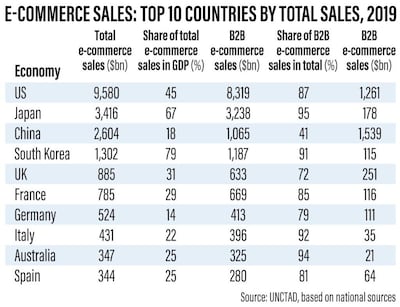

Global e-commerce sales jumped to $26.7tn globally in 2019, up 4 per cent from 2018, according to the Unctad report.

“These statistics show the growing importance of online activities,” said Shamika Sirimanne, Unctad’s director of technology and logistics.

“They also point to the need for countries, especially developing ones, to have such information as they rebuild their economies in the wake of the Covid-19 pandemic.”

The pandemic resulted in mixed fortunes for leading business-to-consumer e-commerce companies, according to the report.

Data for the top 13 e-commerce businesses, 10 of which are from China and the US, show a notable reversal of fortunes for companies offering services such as ride hailing and travel. All of them experienced sharp declines in gross merchandise volume and booking values.

Travel company Expedia was ranked 11th on the rankings after falling from fifth place in 2019 while Booking.com's parent Booking Holdings dropped from sixth place to 12th. Airbnb fell from 11th to 13th, according to Unctad.

Despite the reduction in the gross merchandise volume of services companies, the figure for the top 13 e-commerce companies rose by 20.5 per cent last year, compared with a 17.9 per cent increase in 2019.

There were particularly large gains for Canada’s Shopify and US retail company Walmart, according to the data.

Chinese e-commerce company Alibaba retained the top position with a gross merchandise value of $1.14tn last year, followed by Amazon at $575bn and Chinese site JD.com at $379bn. China’s Pinduoduo, Shopify, e-Bay and Walmart were in the top 10.

Overall, business-to-customer gross merchandise value for the top 13 companies stood at $2.9tn last year, according to the report.

Unctad also estimated the value of global business-to-business e-commerce transactions at $21.8tn in 2019, about 82 per cent of all e-commerce sales, including sales made through online market platforms and electronic data interchange transactions.