Middle East and North Africa venture funding jumped 32 per cent on a quarterly basis to $250 million in the third quarter driven by a sharp rise in early-stage investments in the region, a new report has indicated.

However, the number of deals remained flat at 78 in the September quarter, according to start-up data platform Magnitt’s Mena venture investment report.

Total venture funding in the first nine months of the year reached $1.4 billion in the region, down 44 per cent on an annual basis. Globally, venture funding dropped 42 per cent year-on-year in the first three quarters of 2023.

The January-September period saw 286 transactions in the Mena region, a 46 per cent decline from the same period last year. In comparison, 2022 and 2021 witnessed 702 and 694 deals, respectively.

In terms of the number of transactions, the UAE captured a third (93) of all deals closed in the region for the first nine months, despite a 30 per cent yearly drop.

“Investment activity has remained flat with investors focusing on early-stage bets. On the positive side, we have seen multiple fund announcements,” Philip Bahoshy, founder and chief executive of Magnitt, said.

After years of consistent declines, early-stage investments (of less than $1 million) saw an increased appetite from investors this year. In the first nine months, almost 44 per cent of all deals were attributed to investments in this size bracket.

In 2019, around 80 per cent of all investments fell into this bracket, and this number shrunk to 36 per cent last year.

Early-stage investments are driven by the “cautious investor sentiment favouring a shift to smaller-sized deals” in the first three quarters of this year, the report said.

The region has also seen an advent of new funds that could fuel venture investments in the upcoming quarters, it added.

“In Mena, UAE’s Chimera Capital and Aliph Capital have launched new funds, and in Saudi Arabia, Impact46 and Kaust have raised funds to deploy in local start-ups. What we will be keenly tracking is the pace at which this dry powder translates into investments,” Mr Bahoshy said.

Last month, Chimera Investment, an Abu Dhabi-based private organisation, launched an independent alternative investment company with more than $50 billion in assets under management, to tap into investment opportunities globally.

In August, Saudi Arabia launched a $200 million fund to invest in domestic and international high-tech companies as part of the kingdom's economic diversification plan. The fund is part of the new strategy of the King Abdullah University of Science and Technology (Kaust).

In October last year, private equity fund manager Aliph Capital raised $125 million for its maiden fund from Abu Dhabi holding company ADQ. In August, it joined forces with the Jada Fund of Funds – a subsidiary of the kingdom’s Public Investment Fund – to support small and medium enterprises in Saudi.

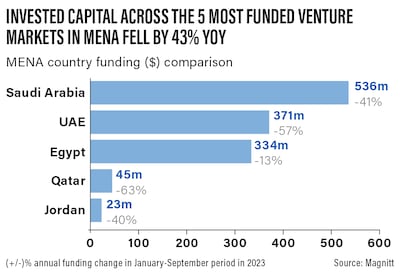

Magnitt said that in the first nine months of the year, invested capital across the five most-funded venture markets in Mena dropped by 43 per cent.

Saudi Arabia attracted $536 million in investment which was 41 per cent less than the same period last year.

The UAE attracted $371 million (57 per cent less), Egypt attracted $334 million (13 per cent less), Qatar attracted $45 million (63 per cent less) and Jordan attracted $23 million in funding (40 per cent less).

Magnitt said it is still early to predict when a recovery will take place.

“Historically the summer has always been a slower-paced investment cycle in Mena. The third quarter is the second quarter where no mega deal investments have taken place, which is a key indicator of late-stage activity and funding growth,” Mr Bahoshy said.

“Investment activity in the fourth quarter will be a good indicator of the strength of 2024's VC landscape,” he added.