With India and the UAE starting to settle bilateral trade in their respective currencies, the move is set to further strengthen economic relations between the two countries and could provide a significant boost to exports from Asia's third-largest economy, analysts say.

Last month, India signed an agreement with the UAE to allow it to settle trade in rupees instead of US dollars — which is widely used for India's trade settlements.

This move aims to lower transaction costs by cutting expenses that accompany payments made in foreign currencies and the uncertainty created for businesses by fluctuating exchange rates.

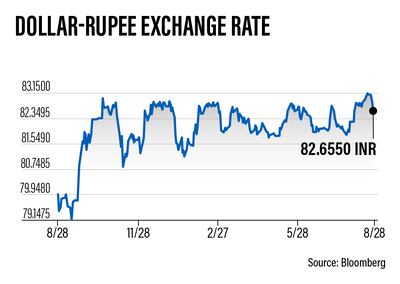

The Indian rupee hit a historic closing low of of more than 83 against the US dollar two weeks ago.

Foreign exchange costs present a significant expense for India in terms of its crude oil imports. The country is the world's third-largest importer of the commodity and it pays for oil imports in the US currency, which has fluctuated a lot in recent quarters.

“There are many benefits to such a development,” says Ratnadeep Roychowdhury, co-head, private equity and sovereign wealth funds, at Indian law firm Nishith Desai Associates.

“It protects the bilateral trade from geopolitical risks and currency fluctuations. It strengthens the trading relation and underlines each country’s commitment to the other. Moreover, it helps both countries to de-risk their dependence and exposure to the reserve currencies in use today.”

The pact will have a "major impact” as “the removal of hedging costs should make [India's] export pricing more competitive”, he adds.

India is the UAE's second-largest and the UAE is India's third-largest trading partner. Bilateral trade between the two countries increased by 16 per cent to $84.5 billion between April 2022 and March 2023 from $72.9 billion in the previous financial year, according to Indian government data.

However, India has a trade deficit with the UAE, which stood at $21.62 billion in the last financial year.

While India's major import from the UAE is oil, its exports to the country include jewellery, refined petroleum products, food, textiles, and machinery.

The first crude oil transaction under the local currency settlement (LCS) system took place this month between Abu Dhabi National Oil Company (Adnoc) and the Indian Oil Corporation, according to the Indian embassy in the UAE.

The transaction involved the sale of about a million barrels of crude oil, settled with Indian rupees and UAE dirhams, it said.

The new payment option “symbolises the deep-rooted trust and strategic partnership between India and the UAE”, says Swati Babel, a cross-border trade finance business specialist.

“Not only does it simplify the trade process, but it also elevates the prominence of both the Indian rupee and the UAE dirham in global trade. It’s a positive step towards a multipolar economic world, indicating a shift from the traditional dependencies on dominant reserve currencies.”

The two countries have also been striving to grow their trade ties with other steps.

In a major move aimed at expanding trade relations, last year saw the implementation of the India-UAE Comprehensive Economic Partnership Agreement.

The trade pact has helped to drive bilateral trade between India and the UAE to record highs during the last financial year, according to the Indian government.

The growth in exports to the UAE far outpaced India's overall rise in exports globally in this period.

Indian exports to the UAE increased by 11.8 per cent to $31.3 billion, compared to a growth of 5.3 per cent in India's total exports worldwide.

The move to use local currencies “is a step forward” in the goal of CEPA, which is to boost bilateral trade between the two countries to $100 billion within five years of its introduction, says Ms Babel.

“The mechanism can be employed in a variety of trade-related activities, ranging from buying and selling of goods and services to investments in both public and private sectors,” she says.

“For instance, Indian businesses importing oil from UAE or Emirati businesses procuring IT services from India can directly use their local currencies. Additionally, direct investments, infrastructural projects, and even tourism exchanges could see the application of this mechanism.”

With a direct currency exchange mechanism in place, this can make Indian commodities more competitive in the UAE market and attract more businesses to trade with the UAE, as transaction costs come down and exchange rate risks are minimised, says Ms Babel. In turn, this could help to increase export volumes.

She says it could also “be instrumental” in sectors including aviation, defence, and health care, and help to increase collaboration in several sectors.

“The move represents a significant departure from traditional trade practices,” says Akash Shukla, founder of the Uprise India Initiative, which promotes entrepreneurship.

“It fosters bilateral ties, minimises currency risk, cuts costs, and demonstrates confidence in the stability of local currencies.”

India and the UAE have a long history of economic ties, and “this collaboration extends beyond trade”, says Pushpank Kaushik, chief executive of Jassper Shipping, a logistics company in India.

“It involves areas like energy and economic diplomacy. The shift signifies a strategic step in elevating economic ties, promising a more integrated and prosperous economic partnership between India and the UAE.”

“This agreement is broadening trade between nations and improving the import-export logistics and shipping sector by facilitating smoother transactions, investments, and straightforward financial planning,” he adds.

Lal Bhatia, chairman of Hilshaw Group and chairperson and director of think tank UAE STRAT: 2071, says the significance of the development cannot be underestimated.

“The decision of India and the UAE to settle bilateral trade in their own currencies signifies a landmark shift in the dynamics of international trade,” says Mr Bhatia.

“This move, fuelled by aspirations for economic autonomy and financial stability, has the potential to deepen their economic engagement, catalyse investments and strengthen ties between the two nations.”

The move is significant not only for the bilateral relationship but also has "broader implications for the global financial landscape”, he adds.

“It demonstrates the evolving capabilities of emerging economies to harness their strengths and collaboratively design mechanisms that serve their collective interests,” says Mr Bhatia.

While experts agree that the move is highly positive, they also note that it is not without its challenges.

“There's the task of creating the essential financial infrastructure to facilitate dirham and rupee settlements,” says Edul Patel, chief executive and co-founder of Mudrex, a cryptocurrency investment platform.

“This might entail substantial investments in technology and systems, with a particular emphasis on establishing secure and streamlined payment channels.

Secondly, it's vital to emphasise the importance of raising awareness and educating businesses about the advantages and possible obstacles associated with conducting transactions in these currencies. This educational effort will play a pivotal role in encouraging widespread adoption.”

While there should be more stability for Indian exporters, they could miss out on certain benefits that do come from dollar fluctuations, analysts say.

“Export volumes are likely to see a marginal improvement from [the agreement], as it reduces one level of currency risk when it comes to settling,” says Utkarsh Sinha, managing director of Bexley Advisors, a boutique investment bank based in Mumbai.

“However, it also means that Indian exporters will lose the value gain they would normally experience when the Indian rupee depreciates against the US dollar in export transactions.”

“The move is especially significant because of the current geopolitical environment,” Samir Somaiya, president of the IMC Chamber of Commerce and Industry, says.

“The impact of settling bilateral trade with the UAE in local currencies on India's exports can be substantial,” he adds.

But it still remains to be seen how widely the option will be used.

“The speed and scale of the same will depend on factors, including the scale of adoption and ease of implementation,” says Mr Somaiya.

“But smaller Indian companies will more easily be able to do business since it will reduce the complexities of currency risk.”