India is stepping up efforts to boost local manufacturing of electronic goods as it seeks to capitalise on demand from global companies that are looking beyond China for production.

The South Asian country needs to seize the opportunity to expand its home-grown electronics industry, experts say.

“Fostering domestic electronics manufacturing … can significantly enhance our economy by creating job opportunities and attracting foreign investments,” says Saket Gaurav, chairman and managing director of Elista, an Indian electronics manufacturer.

Earlier this month, India restricted imports of laptops, tablets and personal computers, in a move aimed at helping the industry grow.

The government announced new rules that require companies to secure licences before importing products including laptops, tablets, personal computers and servers into the country. Previously, there was no requirement for such licences.

The move will affect the likes of Apple and Samsung, analysts say.

The latest regulations were originally meant to come into effect immediately when they were announced on August 3. But New Delhi the next day backtracked and deferred the decision, which had been met with great surprise and confusion by the industry, as companies scrambled to try and establish what they needed to do to comply with the rules. Companies now have until November 1, when the licensing rules will come into force.

“India is becoming one of the fastest growing markets for digital products, including laptops, servers,” the country’s electronics and information technology minister Rajeev Chandrasekhar said in a post on social media platform X, formerly called Twitter, as he explained the decision.

The government’s “objective is to ensure trusted hardware and systems, reduce import dependence and increase domestic manufacturing of this category of products”, he said.

Sandeep Gupta, chairman, managing director and co-founder of Indian consumer electronics brand Skyball, says that with India aiming to reduce its dependence on China in particular, “the initiative aligns with the government’s expansion of the production-linked incentive scheme for IT hardware, which will attract investments and foster a conducive business environment for both local and international firms”.

“With increased domestic electronics production, India hopes to enhance its technological autonomy, protect critical supply chains, and strengthen national security interests,” he adds.

Ramping up its manufacturing capabilities and capacity is a critical part of India’s push to expand its economy, which is particularly important as it tries to create enough jobs in what is the world’s most populous nation with more than 1.4 billion people.

Make in India, one of the flagship initiatives of Prime Minister Narendra Modi’s government, aims to transform the country into a global manufacturing hub.

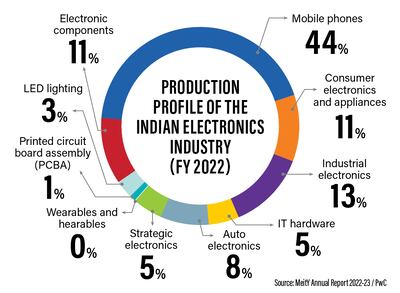

The electronics sector is one of the areas that has been identified as an industry that has enormous potential for growth as part of these plans.

India has set an ambitious target of achieving $300 billion worth of domestic electronics manufacturing by 2026.

The country’s young demographic and growing economy are factors that are boosting local demand for such products, analysts say.

“With some commodities gaining aspirational value and an increase in discretionary spending, this decade is poised to bring major market opportunities for global players to enter India and leverage its markets along with its young demography,” according to a recent report by PwC.

As part of the government's drive to expand electronics manufacturing, it is seeking applications for a 170 billion rupee ($2.05 billion) financial incentive scheme to attract makers of products including laptops and tablets. This comes as many companies are trying to diversify their supply chains beyond China.

The government is also promoting skill development initiatives in electronics manufacturing.

India has massively scaled up its mobile phone manufacturing in recent years to become the world's second-largest maker of the goods. Production of mobile phones increased to 310 million in 2022, from 60 million in 2015, according to PwC.

But there is scope for India to manufacture much more across a range of different electronic products, experts say, as the country also strives to lower its trade deficit by reducing its dependence on imported goods.

India's move to add licensing requirements for some products could help accelerate this process.

“The intention is to get the multinational companies to make these products in India and cater to the market and requirements,” says Sanjay Lodha, chairman and managing director of Netweb Technologies, which manufactures computer hardware products including servers.

“We would say that this is a win-win situation for all. India also has long-term security concerns, with the rise of electronics and it being a basic building block of everything.”

With servers also covered by the new rules, domestic companies like Netweb stand to benefit, says Mr Lodha.

“We are proudly an indigenous server manufacturer and have an early-mover advantage here,” he says.

He adds that India, “in the longer term, can mitigate the electronics import bill” with its focus on increasing domestic electronics manufacturing.

However, there is more to be done.

“It is still a long journey,” says Mr Lodha. “Further nurturing and creating real incentives for manufacturing and developing the ecosystem will be required.”

In the near term, global companies importing products into India will have to adapt to the new licensing requirements, and this could affect their business.

“This move poses challenges for global tech giants like Dell, Apple and Samsung, prompting potential pricing adjustments,” says Jitender Ahlawat, founder and managing partner of HJA & Associates, a corporate law firm in New Delhi.

“However, the decision presents an opportunity for local electronics manufacturers,” he adds.

“Focused on increasing domestic production, the government aims to reroute demand to local laptop and computer producers, driving industry growth. These restrictions align with the Make in India goal of fostering job creation and economic development.”

There are several multinational brands that are already manufacturing laptops in India, including HP and Dell.

Indian companies are increasingly making these products, too.

This month, Reliance Jio, which is part of the conglomerate controlled by India’s richest man Mukesh Ambani, unveiled a new budget laptop model, priced at 16,499 rupees.

Other local brands are focused on making a wider range of electronics.

“We are taking significant strides to expand our manufacturing operations in India,” says Mr Gaurav of Elista, which makes products including televisions, smartwatches and speakers.

He says that the company recently announced an investment of 1 billion rupees in Andhra Pradesh to set up a new manufacturing unit.

“We aim to create more job opportunities, enhance technological advancements and contribute to the growth of domestic production.”

However, some hurdles that may be holding back the sector need to be addressed.

“Electronics manufacturing in India faces substantial obstacles that hinder its growth,” Mr Gaurav says. “Outdated infrastructure and complex logistics systems hamper efficient production and distribution.”

There is also a shortage of skilled workers in electronics manufacturing, he adds, while “cumbersome regulations and unclear policies discourage investment [and] reliance on foreign suppliers and inadequate investment in research and development make supply chains vulnerable”.

Greater and easier access to financing is needed too, according to Mr Gaurav.

“Addressing these challenges requires modernising infrastructure, simplifying regulations, fostering local supply chains, promoting skill development, increasing research and development funding, and creating specialised financial mechanisms,” he says.

There are strides being made, but even greater efforts will be needed to power the sector forwards.

“While a lot of progress has been made on all fronts in recent years, a concerted effort involving government, industry and educational institutions is essential for nurturing a thriving electronics manufacturing sector in India,” says Mr Gaurav.