Inflation in the OECD area rocketed to a 30-year high in the 12 months to December, reaching 6.6 per cent.

The highest recording since 1991 compared with 5.9 per cent in November and only 1.2 per cent in December 2020.

A surge in annual inflation in Turkey (to 36.1 per cent in December) was largely responsible the increase. Excluding Turkey, inflation across OECD member states increased more moderately to 5.6 per cent, after 5.3 per cent in November.

For 2021 as a whole, annual inflation in the OECD rose to 4 per cent, compared with 1.4 per cent the previous year. This was the highest annual average rate since 2000.

Soaring global energy costs bite in member states

The Organisation for Economic Co-operation and Development – an intergovernmental forum with 38 member states including the United Kingdom – also reported a rise in energy prices. These soared by 25.6 per cent in the 12 months to December – two percentage points lower than November’s 27.6 per cent but high compared with 4.2 per cent in December 2020.

Food price inflation picked up strongly to reach 6.8 per cent in December – up from 5.5 per cent in November. The month’s figure was more than double that of December 2020 when the rate was at 3.2 per cent.

Excluding food and energy, OECD year-on-year inflation also rose sharply to 4.6 per cent, compared with 3.9 per cent in November.

There was also a 15.4 per cent increase in energy prices, the highest rate since 1981. By comparison, those prices had decreased by 6.5 per cent in 2020.

When food and energy costs were excluded, annual inflation rose to 2.9 per cent, compared with 1.8 per cent in 2020.

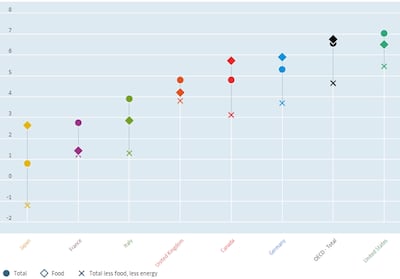

In December, year-on-year inflation increased moderately in most G7 countries as compared with November.

The UK recorded a 0.2 per cent rise (to 4.8 per cent, from 4.6 per cent in November), as did the United States (to 7.0 per cent, from 6.8 per cent). Inflation figures similarly increased in Italy (to 3.9 per cent, from 3.7 per cent) and Japan (to 0.8 per cent, from 0.6 per cent). Inflation increased by only 0.1 percentage point in Germany (to 5.3 per cent, from 5.2 per cent) and Canada (to 4.8 per cent, from 4.7 per cent), while it was stable in France (at 2.8 per cent).

Turkey’s ‘vicious cycle’ fuelling inflation

Meanwhile, OECD member Turkey is caught in a “vicious cycle” of economic woes.

The country’s inflation has accelerated to its highest level since President Recep Tayyip Erdogan took power two decades ago. This has challenged a push for lower borrowing costs that has battered the Turkish lira and hit his working-class base before next year’s elections.

Consumer price inflation surged to an annual 48.7 per cent in January, the highest since April 2002, leaving the central bank between a rock and a hard place. The bank is faced with making a decision to raise rates, which will anger Mr Erdogan, or cut them, which will only add to runaway price increases.

Under pressure from the president, who is keen to boost growth before the 2023 polls, Turkey’s central bank has slashed its policy rate by 500 basis points to 14 per cent, or minus 35 per cent when adjusted for inflation, the lowest real yield across emerging markets. The move sent the Turkish lira into a tailspin and accelerated the surge in consumer prices.

A worldwide increase in the cost of gas and other commodities has also contributed to the dire situation in the country.

“Turkey is in a vicious cycle. A weaker currency raises inflation, which reduces the purchasing power of lira savings, prompting locals to switch to dollars, which then weakens the currency further,” said Ziad Daoud, chief emerging markets economist for Bloomberg Economics. “Higher interest rates can break this cycle, but President Recep Tayyip Erdogan vehemently opposes this move.”