The International Monetary Fund called on the G20, which comprises the world’s 20 largest economies, to put into effect a co-ordinated global strategy to end the Covid-19 pandemic and support the global economic recovery.

Global leaders must take bold action now to end the pandemic and create space for a more sustainable and inclusive economy, IMF managing director Kristalina Georgieva said on Wednesday.

“The foundations for recovery remain strong because of the combined effect of vaccines and the extraordinary, synchronised policy measures led by the G20,” she said. “Yet, our progress is held back especially by the new virus variants and their economic impact, as well as by supply chain disruptions.”

IMF chief

Earlier this month, the fund lowered its growth forecast for the global economy to 5.9 per cent for 2021 because of what it said was a "hobbled" recovery due to the Covid-19 Delta variant, the divergence in the vaccine campaigns among countries, continuing supply-demand mismatches, rising inflation, high debt levels and financial market volatility.

The global economy contracted 3.3 per cent last year.

“Widespread vaccinations and continuing policy support have set the stage for strong recoveries in many G20 advanced and some emerging market economies," the fund said.

"However, in many others, access to vaccines remains limited, unemployment remains significant among the most vulnerable groups, including women, youth and the low-skilled, and potential scarring to medium-term prospects is sizeable,” the fund said.

While elevated price pressures are expected to persist in some economies next year as higher food and oil prices continue to pass through to consumer prices, inflation in some countries is set to return to the pre-pandemic range as supply-demand mismatches are resolved, the fund said.

Public debt increased sharply, from already high levels for some, and is projected to remain elevated. As of mid-2021, revenue and spending measures in G20 economies, in response to Covid-19, amounted to about $9.5 trillion, the fund said.

An additional $5.5tn was provided in the form of equity injections and loans and guarantees. However, the measures have caused sovereign debt ratios to hit record highs, averaging about 110 per cent of gross domestic product across the G20.

The IMF recommended that G20 economies share vaccine doses to end the pandemic and address large disparities in fiscal firepower.

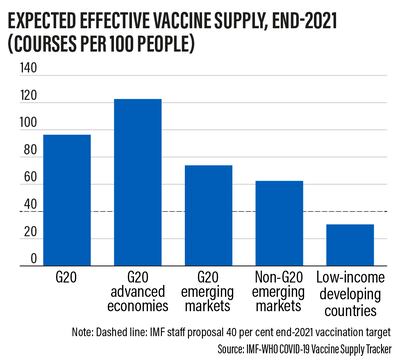

Further action is needed to vaccinate 40 per cent of the population in every country by the end of the year and at least 70 per cent by mid-2022, the fund said.

However, about 75 countries, mostly in Africa, are not on track to meet the 2021 target, Ms Georgieva said.

Vaccine surpluses need to be shared urgently and an additional $20 billion of upfront, grant-based financing is needed for treatment, testing and the procurement and distribution of vaccines in developing countries, the lender said.

Ms Georgieva stressed that if Covid-19 were to have a prolonged impact, it could reduce global GDP by a cumulative $5.3tn over the next five years.

The Washington-based fund also urged the G20 to further support developing countries through grants and concessional financing.

Improved measures to enforce the G20 common framework for debt treatment would ensure it is available when needed, the fund said.

The IMF also sought the G20’s support in channelling its Special Drawing Rights from the strongest economies to those more vulnerable to strengthen liquidity.

It urged G20 economies to commit to a comprehensive package to reach net zero carbon emissions by mid-century.

“Increasing energy efficiency and transitioning to renewables could be a net job creator because renewable technologies tend to be more labour-intensive than fossil fuels,” the IMF said.

“A comprehensive investment plan with a combination of green supply policies could lift global GDP by about 2 per cent this decade and create 30 million new jobs.”