The Dubai Real Estate Centre (DREC), a property development and management company in the emirate, will use Al Etihad Credit Bureau’s (AECB) reports and scores to assess eligibility and financial standing of tenants.

The company, which is part of Dubai investment company ARM Holding, manages a portfolio of more than 3,200 residential and commercial units across the UAE and is the first large-scale private real estate company in the emirate to use AECB reports.

When signing new leases or renewing existing contracts, tenants with better credit scores will be able to get more competitive rental payment plans, Mohammad Al Shehhi, chief executive of ARM Holding said on Tuesday.

“DREC will use the AECB credit reports and credit scores to better assess the risk associated with new tenants fulfilling their payment obligations and renewals of existent tenancy contracts,” Mr Al Shehhi said. “The DREC’s establishment of this quality control and risk assessment standard is demonstrative of our overall approach to ensure equitable and ethical business practices and protect our investors,” he said. The move is aimed at aligning with like-minded organisations, he added.

The AECB, set up in 2014 to help assess credit risks, collects information from multiple entities including banks, finance companies and telecom operators to produce reports, scores and indicators available to individuals and companies in the UAE. Financing companies and lenders in the Emirates analyse credit scores before making a decision to either approve or reject credit card or loan applications.

"We believe this is the start of a positive transformation within the property rental sector whereby tenants will undoubtedly receive added benefits for maintaining a high credit score and a good credit history," said Marwan Lutfi, chief executive of AECB.

“Mature international real estate markets use credit scores as a key factor when determining renter’s eligibility and we are delighted that DREC is exhibiting such maturity, which will ultimately benefit their portfolio of clients in Dubai.”

FAB Properties, a real estate management company owned by the UAE's biggest lender First Abu Dhabi Bank, is also using AECB's credit data to assess prospective tenants.

The company last month said credit data will help assess "the risk associated with tenants" and decide whether they are financially sound to meet their payment obligations.

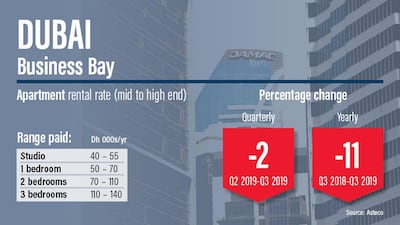

The UAE real estate market slowed in the wake of a three-year drop in oil prices that began in 2014, as well as ongoing concerns about an oversupply of properties in the market. According to a recent report from consultancy JLL, sale prices were 7 per cent lower year-on-year for apartments and 9 per cent lower for villas in Dubai in the third quarter of 2019.

A number of new measures introduced by the government including the 10-year long term visa for investors and professionals as well as Dh50 billion economic stimulus package in Abu Dhabi is expected to boost the sector going forward.

__________________