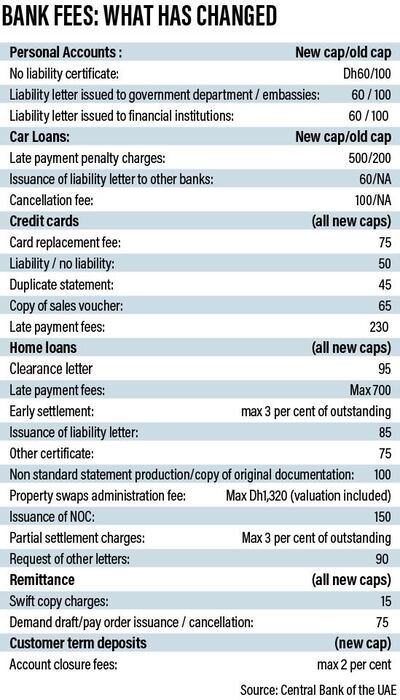

While credit card and home loan customers will benefit from the bank fees overhaul by the UAE's Central Bank, some borrowers will lose out, according to analysts who have seen the Amendment circular detailing the changes.

Of the 43 capped fees on retail consumer-related banking services listed on the amendment, seen by The National, some fees are merely clarified or amended while others have been introduced for the first time.

“The biggest changes come to charges related to credit cards and home loans,” said Jon Richards, chief executive of the financial comparison site yallacompare. “Previously, there were no caps on a range of fees for credit cards and loans, but these new rules introduce limits on what the banks can charge for these services.”

The circular Amendment to Annexure 2 of the Regulations Regarding Bank Loans & Services Offered to Individual Customers (2011) - announced on Tuesday - updates changes issued in February 2011 by the Central Bank to help curb lending. It states: "Upon coming into force, this Amendment … is mandatory and enforceable."

Among the updates, car loan customers will see a range of changes with the cap on late payment charges increased to Dh500 from Dh200 and a higher liability letter fee of Dh60.

"If you’ve got a big car loan that you’re unable to keep up with - the new caps are actually bad news for you – as the limit that your bank can charge you for late payments has just been raised," said Mr Richards. "In the worst case, you could be looking at a Dh500 fee for every late car loan payment – not exactly handy if you’re in chronic debt.”

For personal loans, the charges for liability letters has dropped slightly from Dh100 to Dh60 and there is now an upper limit of Dh10,000 for settling your loan early, or 1 per cent of the remaining balance - whichever is lowest.

“That’s not going to affect many people, given that you’d have to owe Dh1 million just to reach that upper limit,” said Mr Richards.

_______

Read more:

UAE Central Bank caps retail banking fees in boost to expat-friendly economy

Ramadan spirit: Generous readers clear single mother's debts after The National plea

What the new bank fee caps mean for UAE customers

Listen:

Business Extra podcast: The Debt Panel, clampdown on bank fees and financial literacy

________

Ambareen Musa, founder and chief executive of Souqalmal.com said some of the new maximum caps “seem unusually high".

"Take late payment fees on home loans for example," she said. "Most banks currently impose a penalty of up to Dh200 on delayed instalments, which is much lower than the Dh700 cap issued by the Central Bank. While this will rein in the outliers, it won't necessarily bring respite to many bank customers."

Ms Musa said there is also ambiguity surrounding fees like early settlement charges on home loans.

"While previous Central Bank regulations limited this fee to 1 per cent of the outstanding home loan amount, not exceeding Dh10,000, the latest amendment increases it to a maximum of 3 per cent of the loan amount. If banks were to resort to using this maximum cap, it would have a significant financial impact on borrowers in the country.”

For credit card holders, analysts say consumers will benefit from having set caps in place for the first time as it limits the charges lenders can levy.

"If you’re struggling with paying your outstanding balance back, your provider can only charge you so much in penalties," said Mr Richards. "Depending on your credit card provider, there’s a half-decent chance that the new cap of Dh230 for late payments will be lower than what you were previously paying."

According to a UAE-wide survey conducted in 2017 by Souqalmal.com, the lack of transparency in rates and fees across banks was rated as the second biggest pain point among bank customers, after customer service.

“The newly introduced fee caps will help address this issue, and bring greater transparency to the overall fee structure used by individual banks,” said Ms Musa.

However Ms Musa, said the new list of caps only goes so far.

“The list is not yet fully comprehensive. It remains to be seen how the remaining fee categories will be standardised."