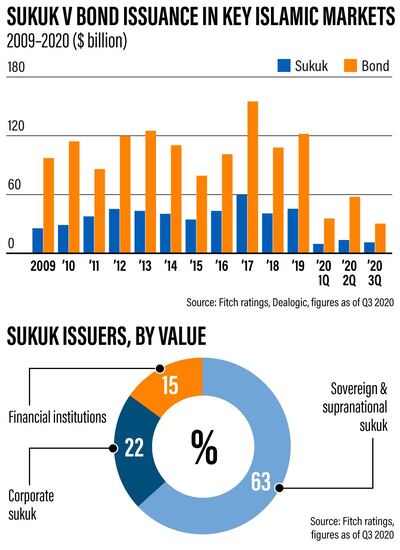

Over a 10-year period between 2009 and 2019, the annual growth rate of sukuk in terms of issuance volume has outstripped conventional bonds. Global sukuk registered a 5.2 per cent compound annual growth rate, compared to 2.3 per cent for conventional bonds. Annual growth rates alone do not convey the full story, though, as the conventional bond market towers over the sukuk market in volume terms.

The global bond market stood at $170 trillion at the end of last year, compared to $490 billion of global sukuk. A quick push of the calculator's buttons shows that the sukuk market is a paltry 0.3 per cent of the conventional bond market, although this is hardly an equitable comparison given the much longer history of conventional bonds and their universal appeal.

While bonds are accepted in every corner of the world, including in the core Islamic finance countries, sukuk remains heavily concentrated in Gulf Cooperation Council countries, Malaysia, Turkey and Indonesia. This brings a sense of reality that for all the much-touted phenomenal growth in Islamic finance, the sukuk market lags far behind conventional bonds, both in terms of issuance volumes and global acceptance.

The sukuk market represents roughly 20 percent of total Islamic finance assets of $2.4tn as of 2019. This is certainly a respectable achievement given that it stood at $25bn in 1995. However, after 25 years, Islamic banking assets continue to dominate the Islamic finance landscape, with a 72 percent share of the industry. Putting this into context, the global conventional bond market is already larger than the total global banking assets. Sukuk clearly has a very high mountain to climb to catch up and with rapid advancements in the technology and digital space, as well as in ESG investing there is a real danger the sukuk market could lose momentum and end up consigned to the margins of the financial markets.

The dual shock of lower oil prices and the economic crisis triggered by the Covid-19 pandemic has dampened sukuk issuance volumes so far this year. Core Islamic finance countries have either not tapped the sukuk market or opted for conventional bonds instead. GCC states have largely given sukuk a miss, with only Dubai and Bahrain issuing sukuk alongside bonds in dual tranche offerings. Between April and September, a total of $34bn in sovereign bonds were raised from the GCC. During the same period, only $2bn worth of sovereign sukuk were sold. Given the difference in these amounts, it is hard not to think of this as a lost opportunity for the sukuk market and the Islamic finance industry.

However, all is not lost as there have been positive developments in the form of the local currency sukuk and green sukuk issuance, as well as advancements in financial technology that could promote sukuk adoption.

Domestic sukuk issuance in Saudi Arabia increased by 45 percent year-on-year to 84 billion Saudi riyals ($22.4bn) in the first nine months of the year, according to Moody’s Investors Service. The government’s efforts to promote a more vibrant local currency sukuk market has yielded results. More efforts are needed to maintain and increase momentum but the Saudi domestic sukuk market seems to be heading in the right direction. The successful development of the domestic market in Saudi Arabia may also spur other GCC states to develop their own local currency sukuk markets.

Another bright spot in Islamic finance is the growth of green sukuk – Sharia-compliant instruments for financing environmentally sustainable projects such as the development of solar plants and other renewable energy schemes.

Green sukuk seems to be gaining traction in the GCC. In May last year, Majid Al Futtaim became the first corporate entity from the GCC to complete a benchmark green sukuk with a $600m ten-year fixed rate issuance and in November, the Islamic Development Bank raised €1bn ($1.19bn) through a five-year green sukuk. More recently, Saudi Electricity Company sold $650m of green sukuk to finance the company’s existing and future green projects.

Islamic FinTech, though still nascent, has the potential to boost Islamic finance growth. The UK currently has the most Sharia-compliant FinTech startups ahead of core Islamic finance countries such as Malaysia, the UAE and Indonesia. Looking further ahead, the growing Muslim population in Europe offers significant opportunities for Islamic challenger banks and FinTech startups. Islamic peer-to-peer (P2P) financing and crowdfunding platforms targeting small and medium-sized enterprises (SMEs) have also emerged in the UK.

In Indonesia, an Islamic microfinance cooperative recently transacted the first ever micro-sukuk through a public blockchain platform. The industry is also looking towards Islamic financial institutions to lead the way by incorporating ESG elements in their business practices with a view to attracting a wave of interest in more ethical investment from conventional customers.

Islamic finance players hope these developments will help the industry to gain the momentum needed to achieve the forecast of $3.8bn of total assets by 2022, as projected by Thomson Reuters.

Lim Say Cheong is chief executive of Lootah Global Capital, a member of The Gulf Bond and Sukuk Association