Islamic banking growth in the UAE outpaced that of conventional banks last year on the back of growing investor demand for Islamic products and deep distribution networks, Fitch Ratings has said.

Islamic banks grew by 8 per cent in 2022, higher than conventional banks, which grew by 3 per cent, the rating agency said in its latest report.

High oil prices and solid economic conditions will continue to support UAE Islamic banks’ credit fundamentals in 2023, limiting the impact of rising profit rates on borrowers, Fitch said.

“Islamic banks in the UAE have a product offering that matches the conventional banks, meaning they can attract non-Islamic customers in addition to those who require Sharia-compliant products,” Bashar Al Natoor, global head of Islamic finance at Fitch Ratings, told The National.

The gross financing/deposits ratio remained stable at 91 per cent at the end of 2022 – still well above that of conventional banks.

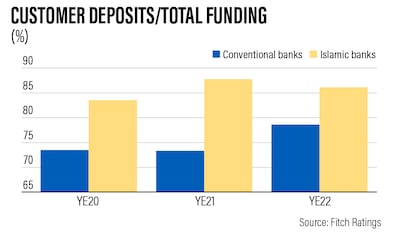

Islamic banks continue to be mainly deposit-funded, at 86 per cent of total funding, higher than the conventional banks’ 79 per cent.

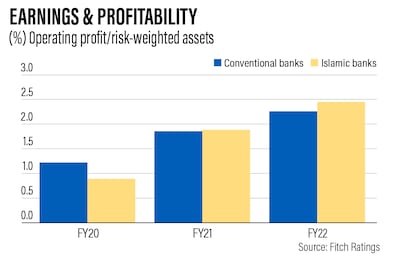

Margins were also supported by Islamic banks’ sizeable low-cost current account savings account deposits, reflecting their strong retail franchises, and remained significantly above those of conventional banks.

Islamic banks’ liquidity also remains supported by the wider availability of instruments in the UAE compared to most other countries, Fitch Ratings said.

The UAE has been issuing treasury bonds and sukuk as part of plans to build a local currency bond market and diversify its financial resources.

The first auction of the UAE's dirham-denominated treasury sukuk for this year was oversubscribed by 7.6 times, receiving bids worth Dh8.3 billion ($2.26 billion), the government said last week.

The value of the first auction stands at Dh1.1 billion.

According to Fitch Ratings, this is an important step in the development of the nascent domestic debt capital market.

“It gives all banks more options to invest their liquidity and should help build the domestic yield curve,” it said.

Continued digitalisation will enhance the need for further mergers and acquisitions to defend market share and find cost synergies, particularly among smaller Islamic banks that risk being left behind, it added.

The global Islamic finance industry is expected to grow by about 10 per cent in 2023-2024 despite the economic slowdown, after posting a similar expansion in 2022, mainly led by Gulf Co-operation Council countries, according to S&P Global Ratings.

Demand for Sharia-compliant financing is set to outpace conventional funding in 2023, driven by strong economic growth and development agendas in key markets including Saudi Arabia amid higher oil prices, Moody’s Investors Service recently said.