Investments of up to $13.5 trillion will be needed by 2050 to help hard-to-abate sectors such as production, energy and transport to transition to a sustainable and carbon-neutral future, a World Economic Forum report said.

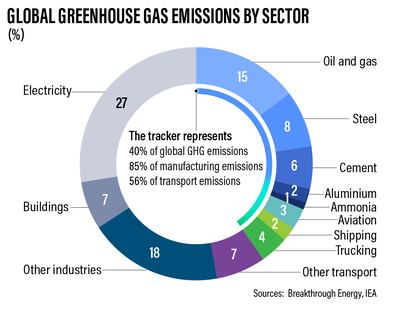

The report, released before the Cop28 summit begins in Dubai this week, focuses on progress towards achieving net-zero emissions in eight industries – steel, cement, aluminium, ammonia (excluding other chemicals), oil and gas, aviation, shipping and trucking – which depend on fossil fuels for 90 per cent of their energy demand.

While the pathway to net zero in these sectors will differ based on "unique sectoral and regional factors", greater investments are required in clean power, hydrogen and infrastructure for carbon capture, utilisation and storage (CCUS) to accelerate decarbonisation, it said.

A "robust enabling environment" is also essential to allow them to achieve their respective decarbonisation objectives, said the Net-Zero Industry Tracker 2023 report, published by the WEF along with Accenture.

“Decarbonising these industrial and transport sectors, which emit 40 per cent of global greenhouse gas emissions today, is essential to achieving net zero, especially as demand for industrial products and transport services will continue to be strong,” said Roberto Bocca, head of centre for energy and materials at the WEF.

“Significant infrastructure investments are required, complemented by policies and stronger incentives so industries can switch to low-emission technologies, while ensuring access to affordable and reliable resources critical for economic growth.”

Over the past three years, absolute emissions have grown by an average of 8 per cent due to increased activity and demand, the report found.

Sectors including cement and steel are facing the most complex decarbonisation challenges due to their energy intensity, with their use of energy "equivalent to more than three times" that of the amount consumed in the US.

Emission-intensive sectors are not currently aligned with the trajectory to reach net zero by 2050 – as determined by the International Energy Agency and industry specific scenarios and targets, the report said.

The $13.5 trillion in investments covers the average clean power generation costs of solar, off-shore and on-shore wind, nuclear and geothermal, electrolyser costs for clean hydrogen and carbon transport, as well as storage costs.

"They must be complemented by policies and incentives that can help the industries make the switch while ensuring access to affordable and reliable resources that are critical for economic growth," the WEF said.

Global investments in energy transition technology alone must quadruple to $35 trillion, the International Renewable Energy Agency said in a June report.

A record 295 gigawatts of renewable energy capacity was added globally in 2022, up about 10 per cent from the year before, according to the Abu Dhabi-based agency.

However, most of the growth was concentrated in the US, the EU and China, highlighting a growing disparity in clean energy adoption worldwide.

"The majority of the technologies needed to deliver net-zero emissions are expected to reach commercial maturity after 2030, highlighting the need for collaborative approaches to research, develop and scale them," the WEF report said.

Carbon pricing, tax subsidies, public procurement and development of strong business cases can support in mobilising necessary investments.

But raising capital for "high-risk projects with unproven technologies" could be challenging in the current macroeconomic environment.

The onus will fall on institutional investors and multilateral banks to provide access to low-cost capital linked to emissions targets.

“Collaboration between the public and private sectors is critical to a successful energy transition, and technology can be a key enabler in both managing affordable and reliable access to clean energy and addressing the incremental cost of decarbonisation,” said Muqsit Ashraf, who leads Accenture Strategy.

“Widespread scaling and adoption of clean power, carbon capture and storage, and energy efficiency technologies across sectors are vital for progress. Additionally, business model innovations can also help stimulate demand and accelerate industrial decarbonisation – achieving net-zero objectives and a resilient energy transition.”

The report urged the industrial sectors to focus on five aspects: prioritising clean power technology; promoting shared infrastructure; creating a standardised framework for low-emissions products and an auditable carbon-footprint assessment process to improve transparency; aligning on emissions reduction requirements globally; and improving transparency for low-emissions and low-carbon alternatives.