The GCC’s consulting market is expected to exceed $4 billion in revenue this year, posting a market growth of about $1 billion in two years as regional economies start to enact major “transformational” projects to support their diversification efforts.

The region's consulting market grew 15.9 per cent last year to reach $3.87 billion, with double-digit growth recorded in every sector, the latest annual report by Source Global Research found.

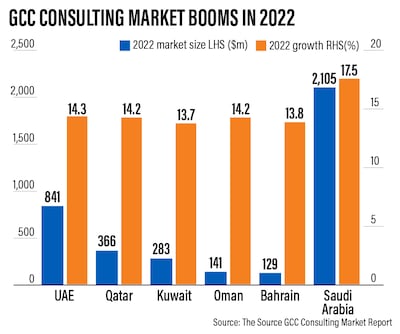

Saudi Arabia’s consulting market — the largest in the GCC — grew faster than the overall market in 2022 at 17.5 per cent, with revenue reaching a record $2.1 billion.

“The region’s economic ambitions, compounded by favourable oil prices, mean that both the volume of work and its complexity are rapidly increasing, especially in the field of digital and organisational transformation,” said Dane Albertelli, research analyst at Source.

“This is the main reason why 78 per cent of clients in the region say their use of consultants will increase in the coming 12 months.

“With long-term economic plans such as Vision 2030 reaching the implementation phase, we’re once again expecting double digit growth in 2023, but with a slightly gentler uplift than in 2022, with strategy and technology services continuing to be the key demands.”

The GCC region's economies rose sharply last year, with higher oil prices and improving tourism and travel supporting growth.

Saudi Arabia, the Arab's world's largest economy, recorded the highest annual growth rate among the world’s 20 biggest economies in 2022, according to the Organisation for Economic Co-operation and Development.

The country's economy expanded 8.7 per cent last year on higher oil prices and the strong performance of its non-oil private sector.

The kingdom is in the middle of a major economic diversification drive under its Vision 2030 agenda, amid a push to reduce its reliance on oil and tap into other high-growth industries to boost its economy, create more jobs and attract private investment.

Meanwhile, the UAE's economy grew 7.6 per cent last year, the highest in 11 years, according to the UAE Central Bank. The Arab world's second-largest economy is expected to expand 3.9 per cent this year and 4.3 per cent in 2024, the bank said in March.

The World Bank estimates that the six-member bloc grew an estimated 7.3 per cent in terms of gross domestic product in 2022, buoyed by the increase in oil prices.

The UAE recorded the second-highest growth rate in the consulting market last year at 14.3 per cent, with revenue hitting $841 million, Source said.

It was followed by Qatar and Oman, both of which grew by 14.2 per cent, Bahrain at 13.8 per cent and Kuwait at 13.7 per cent.

In terms of sectors, the consulting market for financial services, which forms a significant part of the region’s economy, rose 15.4 per cent annually to $1.1 billion in 2022, as work was mainly concentrated on technology and investment, the report said.

Public sector consulting last year also rose by 15.4 per cent to $982 million, as “GCC member states channelled their sovereign wealth funds into initiatives to ease their reliance on the fossil fuel economy”.

Similar to the previous year, cybersecurity consulting services grew the fastest, rising 19.4 per cent to $362 million in 2022.

“Although falling back from the extreme growth rates of the last two years, Source expects this service to grow the strongest in 2023 as a result of the wider focus by clients on technological transformation,” the report said.

“As cybersecurity is an area in which clients particularly struggle to recruit, it’s a strong growth market for consultancies to exploit.”

The report also found that technology companies are in high demand, with 62 per cent of clients expecting to make more use of them in the coming 12 months.

“This aligns with clients’ key objectives: increasing investment in their technology infrastructure and capabilities. A good technology offering from a firm is therefore crucial for obtaining work on large projects in the region,” it said.

The healthcare (up 18.2 per cent) and pharmaceutical (up 18.4 per cent) sectors also posted strong growth for consulting services.

Looking ahead, the GCC is also becoming one of the “most lucrative destinations” globally for foreign direct investments, which in turn is supporting the consulting market, said Source.

Almost all consulting clients (99 per cent) said that overseas investments in the region are affecting their organisations positively, the report said.

“The benefits of the uplift in FDI levels is broadly related to either regulation or growth, with the latter encompassing new geographies, offerings, and diversification — and businesses in the region are seeing and seizing opportunities, and as a result consultants are supporting with these initiatives.”