Two Oscar wins by Indian films distributed on Netflix represents an opportunity for the streaming giant in a fiercely competitive market, according to analysts.

Netflix subscriber numbers in India currently stand at 6.1 million, while Disney+ Hotstar has 51 million and Amazon Prime Video 22.3 million, analysis from consultancy firm Arthur D Little shows.

“India is one of the world’s fastest-growing markets for OTT [over-the-top] or video-on-demand platforms, a space currently seeing intense competition,” says Barnik Maitra, managing partner at Arthur D Little in India.

“But it has proved to be a tough market to crack for Netflix.”

A potential boost for Netflix in India came as its documentary, The Elephant Whisperers, which tells the story of a couple in south India who care for a baby elephant, bagged an Oscar this month for best short documentary film.

Netflix also distributed the Hindi-dubbed version of the film RRR, which won the Oscar for best original song for upbeat, catchy number Naatu Naatu. These were the first wins for Indian films in these categories.

The timing is critical for Netflix in India.

“As Netflix is losing subscribers globally, the push for growth in India feels more crucial than ever,” says Mr Maitra.

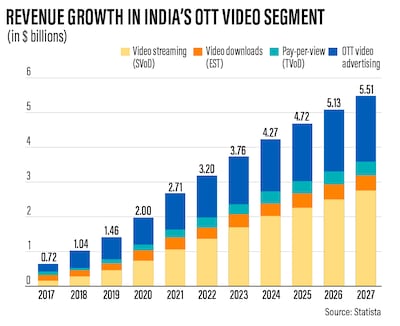

“It is important for Netflix to attract as many customers as possible, considering that the Indian OTT market is expected to grow tremendously.”

This comes after Netflix adapted its strategy to focus on Indian stories rather than simply being an American streaming platform. With India's Oscar wins, it can build on the momentum, experts say.

“[The] buzz around an Oscar win can help content jump such boundaries and find cross-geo reach,” says Utkarsh Sinha, managing director at Bexley Advisers, a Mumbai-based boutique investment bank.

“The Elephant Whisperers could well be the gateway ‘drug’ that introduces international audiences to Indian content.”

The popularity of streaming services in India has been driven by a surge in the number of internet users in recent years, helped by rising smartphone ownership and some of the cheapest data rates in the world.

The pandemic also pushed more people to view content online as cinemas closed.

For most internet users in India, a smartphone is their primary or only means of getting online.

To cater to this market, Netflix rolled out a mobile-only subscription option in India in 2019 — the first country to get such a plan.

Also to attract more Indian viewers, the company has increasingly focused on producing more local content.

Its first Indian original series, a gritty crime thriller called Sacred Games, released in 2018, was both popular and critically acclaimed.

Speaking at the Economic Times Global Business Summit last month, Netflix's co-chief executive Ted Sarandos said that the company has produced 100 original projects in India, including 28 last year alone, and that it is earmarking more of its content budget for the country.

The company's heavy investment in production and offices in India is paying off, he said.

“In India, we've had the best year of our existence,” Mr Sarandos said at the summit. “We grew engagement in India 30 per cent, so watching our content grew by 30 per cent last year. Our revenue grew by 25 per cent in India.”

He added that subscriber numbers alone were “not a real business metric”.

Understanding India's tastes in content is critical to appealing to the local audience. With many different languages and cultures found within the country, this becomes particularly challenging.

“This idea of really getting into the rhythm and groove of local taste, I think we're better at that than we ever were,” said Mr Sarandos.

However, analysts question whether Netflix has managed to gain enough traction.

“India has remained an under-monetised market for Netflix, where its subscriber base and revenues remain low, despite its efforts to tweak its model for the market,” says Mr Sinha.

“In some ways, Netflix’s impact on India has been greater than India’s impact on Netflix. It is reasonable to say that their early and aggressive bets on OTT production gave a directional change to the kind of content being produced in India, and also drew other majors — Amazon, Hotstar and Zee5 — to spend aggressively on content production and acquisition.”

Alongside the big names, there are dozens of smaller streaming platforms in India.

“The market for providing video streaming services in India is highly fragmented, with more than 40 streaming players vying for the customer’s wallet,” says Mr Maitra.

With India's wins at the Oscars, it is not only Netflix that stands to benefit.

This has not “only been a triumph for Indian cinema but also a defining moment for OTT platforms in India”, says Indian producer Neeraj Churi.

The win by The Elephant Whisperers could lead to the production of more documentaries.

“With this newfound recognition, OTT platforms have a unique opportunity to work with independent filmmakers and producers to commission and host impactful documentaries that can drive social change and broaden our understanding of the world around us,” says Mr Churi.

However, “the journey ahead is not without its challenges”, he adds.

“Content regulation, censorship and competition from traditional media outlets are just some of the obstacles these platforms will face as they continue to grow and evolve,” Mr Churi says.

“Nonetheless, the recent Oscar wins have demonstrated that the potential for growth and impact is immense in steering the OTT platforms in India towards a bright outlook.”

Amber Sharma, founder of OTT platform and production company Mowgli Productions, says there is also a shift taking place in global consumption of Indian content as a result of productions by streaming platforms such as Netflix.

“The success of films like The Elephant Whisperers and other Indian movies and TV shows on streaming platforms like Netflix and Amazon Prime has helped to showcase a different side of India to a global audience,” says Mr Sharma.

But while Netflix distributed a diverse range of films last year, including the crime drama Gangubai Kathiawadia and RRR, which became breakout successes in international markets, Mr Maitra questions whether this was enough for it to gain larger audiences.

“As per our analysis, the OTT market in India will grow by providing localised content with cultural references and vernacular language options,” says Mr Maitra.

“While Netflix is currently working on dubbing content for Indian audiences, Amazon Prime Video is already offering programming in six Indian languages and dubbing in over 10 languages.”

He believes that Netflix will also need to review its pricing strategy in India.

While the company cut its subscription rates in 2021, Mr Maitra says the prices for some of its packages are still not competitive compared to its rivals. Launching subscriptions with advertisements would be one way to lower rates further, he says.

Winning over more subscribers will be key in a market where the stakes are only going to increase.

“Given the roll-out of 5G in India and the amount of time spent by the Indian people on the devices, India is going to be a vital market for Netflix and it should try to capitalise on it,” Mr Maitra says.