India's ballooning trade deficit is posing a growing challenge to the country's economic recovery from the Covid-19 pandemic, with looming risks that could further fuel the imbalance of imports and exports over the coming months, analysts say.

The country's heavy dependence on commodity imports such oil and coal, combined with elevated prices amid geopolitical risks, are contributing to the widening trade deficit.

“Looking at the developing recessionary trends in some of India’s prominent export markets, especially [the] US and Europe, we may expect a widening trade deficit,” says Prateek Maheshwari, assistant professor at the Indian Institute of Foreign Trade in New Delhi.

“[The ] trade deficit affects a country’s forex reserves, which is considered an index of economic strength. Certainly, the widening deficits will have an adverse effect on India’s image in a global economic perspective.”

Ministry of Commerce data shows that the trade deficit — or the gap between exports and imports — hit a record high of $31 billion in July compared with $26.18bn in June, owing to steep commodity prices amid Russia's continuing military offensive in Ukraine.

A weak rupee, which has slumped to all-time lows in recent weeks, also adds to India's costs when importing goods.

In the first four months of this financial year, which began in April, India's trade deficit reached $100bn — more than double the deficit during the same period last year.

India imports about 85 per cent of its crude oil requirements. It is also one of the world's biggest consumers of gold, which has to be shipped into the country.

Outflows of US dollars for such trade can lead to further depreciation of the rupee, exacerbate inflation and weigh on the government's finances as the economy continues to recover from the Covid-19 pandemic.

Several looming risks, including a possible global recession, could negatively affect India's trade imbalance, economists say.

“Firstly, the risk to export growth momentum has increased substantially with the rising risk of recession and defaults in many countries globally along with protectionist policies, while the moderation in domestic demand — including imports — is likely to be at a lower pace,” says Arun Singh, global chief economist at Dun & Bradstreet.

July's trade data has already shown a slight decline in India's exports.

In recent months, however, India's exports hit record highs as the trade deficit continued to widen because of rising import costs.

“The rupee is not likely to strengthen in the near term, at least given the volatility in the global financial markets,” Mr Singh says.

Another concern is that “commodity prices are likely to remain elevated given the heightened geopolitical risks”, he adds.

“It is still uncertain about how strong the impact of slowdown in some of the leading economies like [the] US and China would be on the commodity prices, especially in the near term, as supply side pressures would persist.”

India's trade deficit in the second quarter of the financial year — between July and September — could surpass the previous quarter, says Mitul Shah, head of research at Mumbai-based Reliance Securities.

“A lot, however, hinges on the movement of global commodity prices, especially of oil and movement of currency,” Mr Shah says.

If the trade deficit continues to expand, this will add to the pressure on the current account deficit, he adds.

“The record-high trade deficit in July signals a further deterioration in external balances, which is likely to keep the rupee under pressure … prompting concerns on [the] ability to fund [the] current account deficit and hurting the outlook for the rupee.

“[A] stable currency is [the] most important parameter at this juncture of global uncertainty.”

India's exports were hampered last month because of a rise in taxes on petroleum product exports, including petrol and diesel, which came into effect on July 1 to prioritise meeting domestic demand, Mr Shah says.

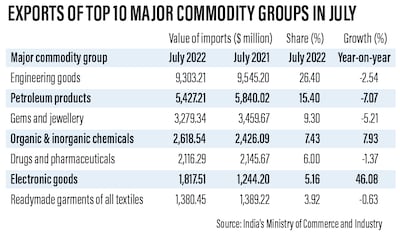

This led to a more than 7 per cent decline in the value of petroleum product exports last month, according to data from the Ministry of Commerce.

On July 20, however, New Delhi exempted petrol from the levy in a move to offset the negative impact it had on exports.

Last Tuesday, the government also slashed export taxes on diesel by more than half and cut the levies on jet fuel to zero. India is one of the largest exporters of diesel in Asia.

“Oil exports are expected to recover as a result of [a] reduction in the windfall tax on petroleum products,” says Ritika Chhabra, an economic and quant analyst at stockbroking company Prabhudas Lilladher.

“Any reduction in the elevated export duties on select steel products and iron ore will also help boost exports.”

July's data shows that India's exports of goods, including gems and jewellery, pharmaceuticals and ready-made garments, fell compared with the same period last year.

“The trade deficit can be reduced by curbing imports to some extent and encouraging higher exports,” Mr Shah says.

“[A] stable currency environment, more foreign investment inflow and lifting restrictions on exports once [the] inflation level is normalised — all these can support a lower trade deficit.”

Last month, the government increased the import duty on gold in an effort to curb shipments of the precious metal into the country to help rein in the trade deficit.

Ministry of Commerce data suggests that this had an immediate effect on gold imports, which plunged 43.60 per cent last month compared with the year earlier period.

“Actively pursuing new export market opportunities to support the buoyancy in exports” would be a measure that could be taken to rein in the trade deficit, according to Mr Singh.

assistant professor at the Indian Institute of Foreign Trade

In a recent research note, analysts at Kotak Institutional Equities said they believe the trade deficit peaked last month.

However, they predict that the deficit for the entire financial year will hit a record high.

“Risks are skewed on the upside, with exports likely to slow down given the increasing risk of global slowdown, although more favourable terms of trade may help curb imports,” according to Kotak's analysts.

Commodity prices are already cooling and this is a positive sign for India’s economy, although the outcome largely hinges on how global factors unfold, according to Ms Chhabra of Prabhudas Lilladher.

“The commodity prices, be it metals, agriculture or crude, have corrected sharply from their recent highs,” she says.

“In addition, the recent fall in [the] US dollar, if sustained, will bring down the value of commodity imports and ease the trade imbalances.

“If we do not have any further material escalation in geopolitical tensions globally, the trade deficit should come down over next few months.”

Meanwhile, India is taking encouraging steps to help address the country's trade imbalance, particularly in the longer term, Mr Maheshwari says.

These include recent trade deals that India has signed with the UAE and Australia, while it is in the process of negotiating a free-trade agreement with the UK.

“Further, India’s recent decision to join the Indo-Pacific Economic Framework [led by US] will be of great help to control trade imbalances,” says Mr Maheshwari.

“India’s participation in global supply chains is crucial to keep a check on its trade deficit and I believe recently taken measures are apt moves.”

________________