As one of the key masterminds of Britain's decision to rebuild its influence East of Suez under former Prime Minister David Cameron, Lt Gen Sir Simon Mayall has acquired a profound understanding of the challenges facing the modern Middle East.

Having spent most of his childhood living in the region, where his father served as a senior officer in the UK's Royal Air Force, Mayall then spent most of his own military career in the Arabian Gulf, most notably serving as a cavalry officer in the First Gulf War in the campaign to liberate Kuwait following its invasion and occupation by Iraqi dictator Saddam Hussein in 1990.

And it was because of the deep knowledge he has acquired of the region, both as a serving soldier and through his academic studies of the region, that Mayall was able to make a vital contribution to the Cameron government’s decision to restore Britain’s standing in the Gulf states.

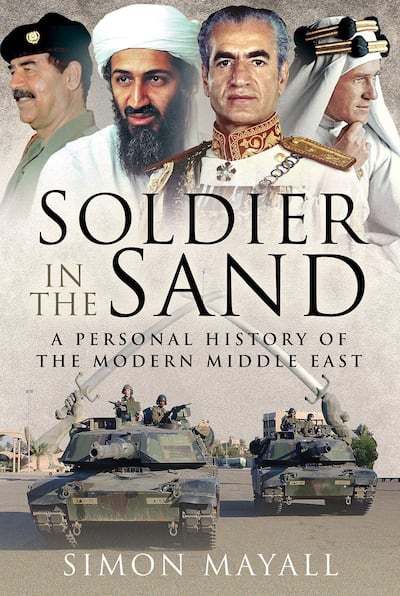

As Mayall explains in Soldier in the Sand: A Personal History of the Modern Middle East, his highly readable and well-informed account of his long-standing experience of working in and studying the Middle East, he vividly remembers the disappointment Britain's allies felt at the decision taken by Harold Wilson's government in 1968 to withdraw its forces East of Suez – a decision taken, principally, because Britain could no longer afford to maintain costly garrisons in far-flung corners of the globe.

Even so, while withdrawal was deemed to be an economic necessity by the Wilson government, it was a decision that did not go down well either with Britain's long-standing allies in the Gulf at a time when they were about to gain independence from British rule. Mayall relates how Dean Rusk, the US Secretary of State at the time, chastised British Foreign Secretary George Brown over the decision, remarking: "For God's sake, act like Britain."

Consequently, Mayall derived enormous personal satisfaction when, as a result of his persistent lobbying of the British authorities, the Cameron government finally decided to reverse this difficult decision and to begin rebuilding Britain’s presence in the region.

From Mayall's perspective, the high point came in March 2018 when, in a ceremony attended by Prince Andrew, Duke of York, the Royal Navy's new base in Bahrain, HMS Jufair was opened in the presence of Bahraini Crown Prince Sheikh Salman bin Hamad.

As Mayall recounts in his book: “The new base was a legacy of which I was immensely proud.”

Moreover, the importance of the new base was demonstrated earlier this year when, in response to increased Iranian aggression in the Strait of Hormuz, the base became a vital supply depot for British warships maintaining a presence in the Arabian Gulf. In recognition of the author's achievement in successfully lobbying for the re-establishment of a permanent military presence in the region, the Royal Navy has named the centre of the new HMS Jufair base "Mayall Square".

Mayall's ability to act as an effective lobbyist in Whitehall owes much to the many years he spent as a soldier in the Middle East, beginning with his secondment to Oman in the mid-1980s to take up a command position in the Sultan of Oman's Armoured Regiment. As Mayall explains at length in the chapter that provides the book's title, Britain has a long and distinguished history of involvement in the Gulf state, dating back to the 19th century. Indeed, it could be argued that without the support the British military provided to Oman's long-standing ruler, Sultan Qaboos, after he came to power, the sultanate might not be celebrating the 50th anniversary of its foundation this year.

Another formative experience in Mayall's military career was his deployment to Saudi Arabia in the summer of 1990 as part of the US-led military coalition build-up to the campaign that became known as Operation Desert Storm.

Mayall believes the First Gulf War was the genesis of the modern "special relationship" between Britain and America, because "so many British officers developed those professional and personal relationships that are the core lubricant of coalition operations".

Mayall's book is much more than a military memoir. It is a magisterial combination of family history intertwined with an academic's knowledge of the fundamental issues that have helped to shape the political landscape of the Middle East, from the revolutionary zeal that characterised the era of Egyptian President Gamal Abdel Nasser to more recent challenges, such as the rise of Islamist extremism in the form of Al Qaeda and ISIS.

It should be required reading for anyone seeking to understand the complex web of loyalties and rivalries that underpin the politics of the modern Middle East.

'Soldier in the Sand: A Personal History of the Modern Middle East' is out now