Anthony Bourdain's television programmes, including A Cook's Tour (2002-2003), No Reservations (2005-2012) and Parts Unknown (2013-2018), make great last-minute travel guides. His shows, for instance, have helped me to find underground cafes in Chile and discover spots for Fado singing in Portugal.

Food writer and Bourdain’s assistant Laurie Woolever must have recognised how useful his programmes are for the adventurous traveller searching for the authentic, the local, the unusual and the tourist-free.

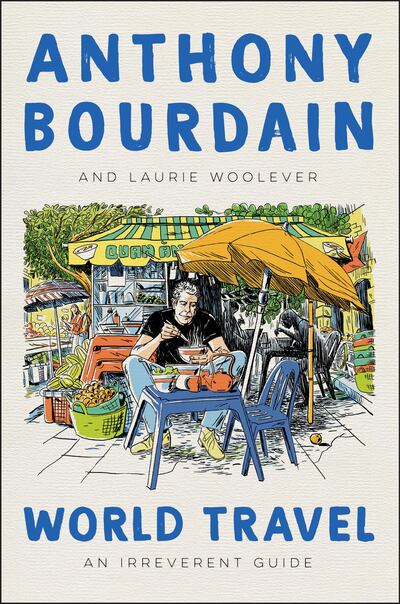

This must be why she produced World Travel: An Irreverent Guide, out next Tuesday. It is a guidebook to the places Bourdain, who died in June 2018, loved best, and which he co-wrote with Woolever.

The food writer met Bourdain in 2002 when she was hired to edit and test recipes for Anthony Bourdain's Les Halles Cookbook. Woolever went on to pursue a career in journalism and now hosts the Carbface for Radio podcast in New York.

World Travel: An Irreverent Guide is a mixture of autobiography, travelogue, guidebook and memoir. It is the first book by Bourdain to be published posthumously.

In the short introduction, Woolever writes that "maybe the world could use another travel guide, full of Tony's acid wit and thoughtful observations". However, she observes that the guidebook might produce a "Bourdain effect" for the places featured. "Once a low-key restaurant was featured on the show, its number of customers often skyrocketed ... In theory, this was a good thing ... but it could also utterly disrupt a beloved local institution, turning it into a sideshow."

The reader can alphabetically browse countries from Argentina to Vietnam, while finding quotes taken from Bourdain's TV shows, interviews and other appearances in each section. Woolever adds her own touch, not only providing vital information such as hotel prices and train stations, but also discussing her personal travel experiences.

There are also short essays provided by other chefs, crew and family members on places they have been to with Bourdain. The text is accompanied by stylish but minimal illustrations by Wesley Allsbrook. The drawings are charming but leave you wanting more: many of the dishes and cities described are left to the reader's imagination.

The book provides a large amount of information on travelling in the Mena region. However, the chapter dedicated to the US does seem oversized in comparison to sections on India and China: perhaps a revised version will give both countries their proper due. Israel, Lebanon, Morocco and Oman are also covered, and Bourdain provides his unique perspectives on the Arab uprisings, the Beat Generation in Tangier and oil production in the Gulf. Meanwhile Woolever's informative prose makes travelling in the Middle East approachable, while quotes from Bourdain never shy away from discussing the politics and history of the region.

For instance, Woolever recounts how in 2006 the crew of No Reservations became accidental war correspondents: "[We] visited Beirut and managed to film for two days before war erupted between Lebanon and neighbouring Israel. The crew continued to document ... the experience."

However, the book makes it clear that Bourdain viewed both history and politics as driving influences behind the development of national cuisines:

“I mean everyone’s been through [Beirut]: the Greeks, the Romans, the Phoenicians, the French, so I always knew this was going to be a good place to eat.”

Bourdain seemed drawn to the cosmopolitan and literary centres of the Middle East. Before we know about the mosques and souks of Tangier, we find out that the city is "at the northern tip of Africa, a short ferry hop from Spain, [and is] a magnet for writers, remittance men, spies and artists ... Matisse, Genet, William Burroughs".

This is a trend the reader will find throughout World Travel: An Irreverent Guide – an attraction to the local, the historic, the political, the artistic and the literary. It makes for stimulating reading. However, it is probably a book for veteran Bourdain fans rather than those who want to find an easy entry point into his writing, work and world.

World Travel: An Irreverent Guide is out on April 20