An enormous, nearly five-tonne, eight-point star has been suspended from Riyadh’s renowned Kingdom Tower, the 300-metre-tall building that dominates the city’s landscape.

Hanging 256 metres high in the sky, Star in Motion lights up on the hour in a dramatic display of light. The work's artist, Koert Vermeulen, says it simulates the birth and extinction of a star, condensed into a one-minute display.

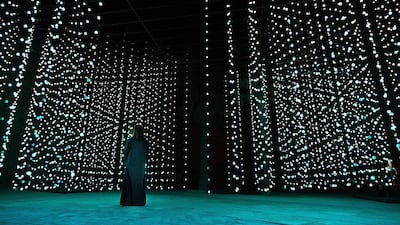

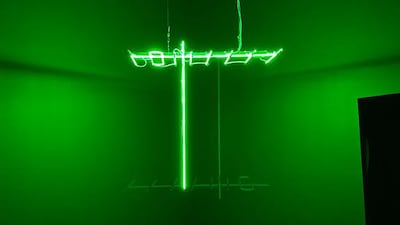

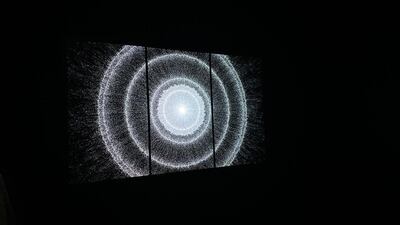

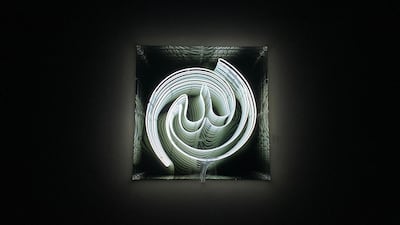

The installation is part of the city's Noor Riyadh festival, a vast, multi-venue exhibition that is devoted to the artistic play with light, which runs until April 3. The event has brought in major international artists, such as Daniel Buren, Yayoi Kusama and Dan Flavin, as well as some 20 artists from Saudi Arabia's burgeoning art scene.

To see images from the Noor Riyadh festival, take a look through the gallery below:

Vermeulen got his start designing light shows for electronic music DJs in the 1990s. With a 22-person studio in Brussels, he now straddles the worlds of commercial lighting design and art, making displays for major events as well as creative projects.

This is his third work in Saudi Arabia; last year, he created the performance Leila: The Land of Imagination, via the use of light.

For this new project, he says: "The title of the show is Under One Sky, and I immediately knew that the light festival needed to have a star in the sky – and in the middle of the most iconic building.

"I've made a sun and a moon for other projects, so it made sense for me to make a star now. The sun [I made] is in India, the moon is in Belgium and the star is here.”

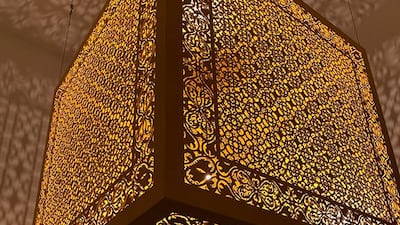

Far from being a static object overlooking the city, the star shimmers and glows, with reflective surfaces and moving light patterns. As well as its explosive birth and rebirth on the hour – like a rather more dramatic Big Ben – more subtle light effects occur every 15 minutes to emphasise how stars are actively changing in the sky.

“I wanted people to have the patience to wait and watch it for a little while longer, to see how things change,” Vermeulen explains. “It becomes like a clock for the city.”

It was also a logistical feat. Vermeulen originally planned to make it nine metres across, but engineers warned him that a structure of that size would be too heavy to withstand the 160-kilometre-per-hour winds that can race through the desert city.

He and his team scaled it down to six metres, a size that still requires cables 80 millimetres in diameter – about the size of an upper arm – to hold it in place.

The star was produced in Belgium, and then dismantled and flown to Saudi Arabia. Its 317 parts were brought up the Kingdom Tower in a lift, and then carried by hand up the remaining two floors to a platform that had been constructed at the base of the tower's U-shaped void.

There, more than 200 metres above the city, the star was put back together. It was then winched up via rigging, and affixed to cables attached to the tower's sky bridge and other points in the gap.

The process was enough to impress even the lighting design veteran.

“Being more than 25 years in the entertainment industry, and seeing all those things that have been done before, I've never seen rigging like this,” he says. “Even performances for the Rolling Stones didn’t use that kind of rigging. I saw rigging elements that you only see in the shipping industry.”

The star is visible across Riyadh. In the day it resembles a necklace, hanging prettily down in the centre of the tower. At night, it becomes a dramatic feature of the city. The work will be up for the 17 days of the festival, and then dismantled and brought back down to Earth.

Noor Riyadh runs until Saturday, April 3.

More information is available at www.noorriyadh.sa