The Bank of England has raised interest rates by 0.25 percentage points to 5.25 per cent, taking the cost of borrowing to a new 15-year high.

The 14th consecutive rate rise was widely expected and economists are forecasting more to come.

Struggling UK households had feared the Bank would repeat the 0.5-percentage point increase it made in June.

The nine members of the Bank of England's Monetary Policy Committee (MPC) voted by a majority of 6–3 to increase rates by 0.25 percentage points, to 5.25 per cent. Two members voted to increase by 0.5 percentage points, and one member preferred keep interest rates at 5 per cent.

"This split does leave a sense that the MPC itself is uncertain over what to do, and indeed of how much of a danger the UK economy is at risk of being tipped into recession as monetary policy is tightened ever further," said Stuart Cole, chief macroeconomist at Equiti Capital.

Last month, the Office for National Statistics figures that showed inflation had fallen to a better-than-forecast 7.9 per cent in June, which seems to have convinced the six members of the MPC to vote for the 0.25 per cent rise.

The Bank of England now expects the rate of inflation to fall "significantly further" by the end of the year and to return to its 2 per cent target by the second quarter of 2025.

But to reach that target, the Bank of England said that monetary policy will remain “sufficiently restrictive for sufficiently long”, signalling that interest rates are extremely unlikely to fall in the foreseeable future.

“It is taking time for the fall in energy prices to work through the supply chain, and the prices of imported goods have continued to rise despite a fall in world export prices," said Bank of England governor Andrew Bailey on Thursday. “That is why, in our central projection, we expect core goods price inflation to come down only gradually.

“But let me be clear, we do expect goods price inflation to ease over the rest of the year, and there are indicators that suggest it could happen faster than in our projection.”

The comments acknowledged market expectations that rates could rise further, even if monetary policy is already restrictive. "Given the current high level of inflation and rather resilient economy, the Bank of England left the door open for further tightening," said Janet Mui, head of market analysis at RBC Brewin Dolphin.

"Markets are pricing in almost two more rate increases by the end of the year."

The British pound, which was already trading at close to lows it hadn't seen in a month before the rate decision, dipped slightly on the decision announcement, but recovered somewhat.

On the bond markets, the yield on the benchmark 10-year gilt, which had been higher ahead of the decision, was flat at 4.4 per cent immediately afterwards, and the rate-sensitive two-year yield was down 0.8 percentage points at 4.91 per cent.

Eye on inflation

Reacting to the rate decision, Chancellor Jeremy Hunt said the government would continue to assist those faced with increasing mortgage payments.

"If we stick to the plan, the Bank forecasts inflation will be below 3 per cent in a year's time without the economy falling into a recession," he said.

"But that doesn't mean it's easy for families facing higher mortgage bills, so we will continue to do what we can to help households."

Many mortgage brokers said the 0.25-point rise was already factored into the market and fixed-rate loans would be unaffected by Thursday's Monetary Policy Committee decision.

“What is going to impact them, though, is the release of the inflation data on August 16 and what that does to Swap rates, which influence mortgage pricing,” said Craig Fish, managing director at Lodestone.

“If, as expected, inflation falls then I suspect we may see more lenders continue to lower rates as we have seen over the past week.”

Meanwhile, Rob Gill, managing director at Altura Mortgage Finance, speculated that the rise could actually “ease pressure on fixed rates and even encourage lenders to deliver cuts”.

'Sticky' UK inflation

The Bank of England decision follows similar ones at the US Federal Reserve and the European Central Bank last week.

However, economists believe the Fed and the ECB are closer to a peak in interest rates, because inflation has fallen much more sharply in the United States and Europe than in the UK.

Inflation has eased to 3 per cent in the US and 5.3 per cent in the eurozone.

Britain's particularly 'sticky' inflation is proving more difficult to reduce, which is leading to interest rates being higher for longer.

For many UK households, the real shock is still around the corner, because of the prevalence of two-year and five-year fixed-rate mortgages.

About 2.5 million of these short-term mortgage deals are due to expire by the end of next year, meaning around a million households will be hit with a £500 ($640) monthly increase to their mortgage repayments by 2026, said Mr Bailey.

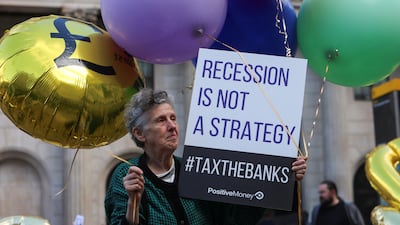

A small group of demonstrators gathered outside the Bank on Thursday morning, protesting against the rapid rise in interest rates and what they see as the increased risk that prolonged high borrowing costs will tip the UK into recession.

Meanwhile, a business survey on Thursday showed growth across the UK's services sector slowed in July to its lowest level since January.

The final reading of the S&P Global Services Purchasing Managers' Index fell last month to 51.5 from 53.7 in June, unchanged from an earlier preliminary “flash” reading. Figures above 50 point to growth, while those below 50 denote a contraction.