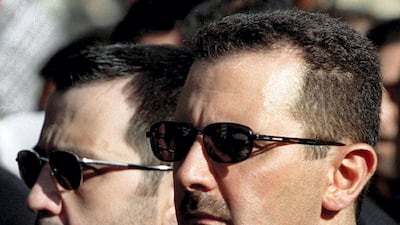

The tribulations of Syrian President Bashar Al Assad's tycoon cousin took another twist on Thursday, with the billionaire defiant after his assets were seized by the government.

Rami Makhlouf said on Facebook that he was transferring his shares in banks and insurance companies to an organisation called Ramak Humanitarian.

He said Ramak Humanitarian was a charity dedicated to the regime's "martyrs", members of the Alawite sect who died defending the regime of Bashar Al Assad.

The sect has dominated politics, the military and the security apparatus in Syria since mostly Alawite officers took power in a 1963 coup.4

But Mr Makhlouf heads Ramak Humanitarian, the parent company of a corporate structure that combines business and non-profit organisations that are linked with an array of regime frontmen, according to regional bankers who have dealt with Mr Makhlouf.

"I started the process of transferring the ownership of all these shares," he said.

Fifty-year old Mr Makhlouf said the donation gave him "the feeling of huge satisfaction and force".

The move appeared to be in response to an official seizure on April 19 of his assets in a tax dispute involving telecoms company Syriatel, which he controls.

Syriatel is the largest company in the country but represents a fraction of the fortune Mr Makhlouf manages on behalf of the innermost circle of the regime, the financiers say.

"Any profit relating to those shares will be totally benefiting charities that serve the parents of every martyr whose blood had irrigated this beloved homeland, and every wounded person who had suffered greatly," Mr Makhlouf said.

He confirmed that shares in 10 banks listed in an official asset seizure document circulating on social media belong to him.

Among the banks are the Syrian subsidiaries of Jordan's Arab Bank, Lebanon's Banque Audi, Byblos Bank and Blom, as well as Qatar National Bank's operation in Damascus.

It is unclear how, or if, Mr Makhlouf can transfer the shares to Ramak Humanitarian given the asset seizure.

One company linked with Ramak Humanitarian, Rawafed Damascus, is a partner in a multibillion-dollar building project in Damascus.

The project has largely stopped because of EU sanctions imposed on the company and most of its shareholders in 2019.

Another subsidiary is a charity called Al Bustan, which distanced itself from Mr Makhlouf by announcing this week that it performs its "charitable and humanitarian work under the follow-up and supervision of the President of the republic".

Bankers say the seizure of some of the known assets in Mr Makhlouf's name is relatively insignificant compared with a huge fortune in a maze of front companies around the globe.

It was built largely by him and his father Mohammad, who is in Moscow. Mohammad is the brother of Bashar's late mother Anissa, who was the matriarch of the ruling family.

They say only Rami Makhlouf may know where all the money is, making his life invaluable to his new and bitter enemies, Mr Al Assad and his brother Maher, the de facto commander of the military.

The three men, until the rift with Mr Makhlouf started last year, formed a triumvirate that has ruled Syria since the death of Bashar's father Hafez Al Assad in 2000.