Britain suppressed allegations of torture against military interrogators who were accused of beatings and violent abuse of suspected insurgents held in Aden in the 1960s, according to secret files released by the government.

The military documents provide the factual backdrop to the tensions being played out in the BBC drama series The Last Post, which follows the loves and lives of a military police unit dealing with an increasingly violent insurgency.

Concerns raised by the lead character, Lieutenant Ed Laithwaite, about the abusive interrogation of suspects are echoed in the secret correspondence held at the British national archives in Kew. Laithwaite complains to his superior that torture is the "recruiting sergeant of the terrorist".

The declassified files seen by The National, which were cleared for release over the past five years, show how the army was forced to investigate dozens of allegations of torture made by Arabs who had been arrested at the height of the insurgency against British colonial rule in 1965 and 1966. But according to the files, the ministry of defence urged the Harold Wilson government not to include the torture allegations in an official report into the scandal.

Military and intelligence chiefs complained that it would damage army morale and reduce the effectiveness of counter-terrorism operations in the region.

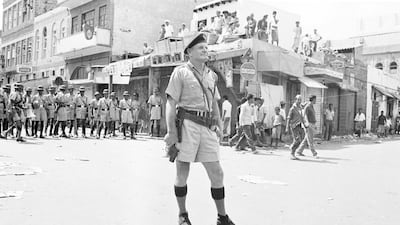

In 1966 four British soldiers and four civilians were murdered in Aden during an intense period of insurgency in which British forces were targeted by 333 bomb and grenade attacks and 36 shootings.

A total of 42 soldiers and four civilians were killed over the course of the insurgency. In the worst incident, Sir Arthur Charles, the speaker of the Aden state legislative assembly, was assassinated outside his tennis club. Two military wives were killed in a bomb attack.

The new documents show that the lessons from the military interrogation of detainees in Aden were ignored in later conflicts involving British troops, particularly after the 2003 invasion of Iraq. A public inquiry into the killing of Basra hotel receptionist Baha Mousa in 2003 found that British soldiers had subjected detainees to "serious, gratuitous violence". Army training manuals failed to explain that the five interrogation techniques used had been banned by the British since 1972, and were also illegal under the Geneva Convention.

By the end of 1966 it was clear Britain had lost military control of Aden. In a desperate effort to get back on even terms with the insurgents, the British rounded up hundreds of Adenis and detained them for weeks without charge.

The files, marked "secret", include allegations of beatings, sexual abuse, hoodings and threats of executions. The worst was an allegation by one prisoner that a soldier had shoved a wooden pole up his anus. These torture claims were ignored by the military and intelligence chiefs until Amnesty International published detailed allegations in 1966, forcing the government to launch an inquiry headed by a prominent lawyer, Roderick Bowen.

Although Bowen was not allowed to investigate the substance of the claims, he delivered a damning report in which he ordered the closure of the army interrogation centre and the replacement of soldier interrogators with civilians. He also made clear that he believed three soldiers, an officer and two non-commissioned officers, were at the centre of the torture claims.

In the files these men were identified only as "Omar the Maltese", the "Algerian", and a man called "Shepherd". In fact, they were British soldiers who had tried to disguise their identities when carrying out the torture on the detainees.

The files show that despite a strong case for bringing court-martial proceedings, including damaging testimony by 16 guards, the army decided to quietly drop the cases on the grounds that the incidents had taken place too long ago — 18 months. In fact, the officer at the centre of the scandal, the documents reveal, had been dismissed from the army in 1966 after he was found to have been "bouncing cheques". More significantly he had been severely reprimanded for failing to return £230 which had been seized during a raid on the home of one of the detainees.

Secret legal advice written by the treasury solicitor shows that the military could not compel the officer to give evidence now that he was a civilian. And the army chiefs said it would be wrong to take action against the two NCOs if the officer got off scot-free.

The defence ministry and the government hoped that the Bowen report had killed off the torture scandal.

But another file reveals an account of a whistle-blower corporal who was also serving at the interrogation centre. The corporal risked court-martial by writing to a newspaper saying that what the detainees alleged was true, including the "pole" incident.

He said he was so horrified by what he had seen, including a particularly severe attack in the interrogation courtyard when a prisoner was beaten unconscious, that he felt compelled to speak out.

A number of documents are considered so sensitive that they have been marked for release only in 2050.

A spokesman for the defence ministry said there were "no live inquiries" relating to any of the matters.