"The test of the machine is the satisfaction it gives you. There isn't any other test," Robert Pirsig wrote in Zen and the Art of Motorcycle Maintenance.

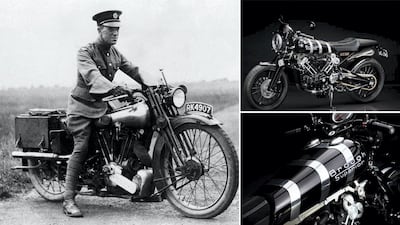

He could have been talking about T E Lawrence and his love of Brough Superior motorcycles which were his passion and, eventually, his death.

The British soldier, diplomat and Arabian adventurer died in 1935 after an accident while riding the Brough Superior SS100 near his Dorset home.

His love of the motorbike will soon be celebrated with the release of a Brough Superior model called the Lawrence.

"The design of the bike is inspired by T E Lawrence," said executive director Albert Castaigne, who in 2014 bought the rights to the brand with former motorbike salesman Thierry Henriette.

“We have been really proud to [do] justice and homage to T E Lawrence by naming this bike after him.”

The Lawrence is a limited edition, with only 188 units available – a number not chosen at random but in a nod to Lawrence's year of birth, 1888.

Brough brought back - with an aeronautical edge

Production of the original Broughs ceased in 1940 when the brand’s Nottingham factory was taken over by the UK government for its war effort.

The lengthy hiatus meant Mr Castaigne and Mr Henriette wasted little time in kick-starting the new era.

Here is a selection of their work.

After relaunching Lawrence’s legendary SS100 bike and collaborating with Aston Martin to produce the Bond car maker’s only two-wheeler, the pair decided to make the new model “the most high-end motorcycle in the world”.

The new Brough factory is outside Toulouse in south-west France and the Lawrence benefits from the area's aeronautical network, with Airbus near by.

The Lawrence’s titanium, carbon fibre and aluminium handcrafted frame shows cutting-edge engineering that would not look out of place on a fighter jet.

The Lawrence was originally due for release at last year’s Milan Motorcycle Show, but the global pandemic interfered.

It will now be launched in March 2021 and Mr Castaigne is remarkably sanguine about Covid-19’s disruptive effect.

He said Brough’s flexible and local supply chain helped to avert logistical problems, and that orders had not decreased.

They are set to deliver 100 Brough bikes this year, retailing at between €60,000 ($72,000) and €100,000.

Man and machine: an unbreakable bond

If alive today, Lawrence would probably have bought the lot. In his lifetime he owned seven Broughs and was ready to take delivery of his eighth just before his demise.

It is not hard to see why he was so enamoured.

Brough Superior in the 1920s was regarded as the Rolls-Royce of bike makers and to own one would have cost the equivalent of an average year’s wages.

"Some said you could buy a house for the same sort of money," Ian Kerr MBE, motorcycle consultant and writer, told The National.

The cost of owning a Brough could be ascribed to a change of gear for the brand in the 1920s.

George Brough took over stewardship of the marque from his father at the start of the decade, and to separate the new era added "Superior" to the name while completely overhauling its manufacture.

“They assembled the motorbike twice,” Mr Kerr said.

“They basically assembled the bike, checked everything worked and lined up, and then they took it apart chromed it, painted it, did everything else and put it back together.”

Legend also has it that all of the bikes were tested by George Brough himself, Mr Kerr said.

Perhaps it was this painstaking attention to detail that most appealed to a military man such as Col Thomas Edward Lawrence CB DSO, or perhaps it was the bikes’ giddy speeds.

Brough Superior was the first brand to produce motorcycles that could go above 100mph (160kph).

“During the 20 years, from 1920 to 1939, they were well known as the fastest, the best finished and most innovative bikes available on the market,” Mr Castaigne said.

A less romantic explanation for Lawrence's attachment to the bikes could have been Brough’s willingness to customise them to cater for the explorer's diminutive 1.6-metre stature.

His height may have made mounting a motorcycle a challenge but it did not prevent him from achieving mighty feats during the First World War.

The multifaceted army officer, archaeologist, diplomat and writer earned the moniker “Lawrence of Arabia” for his roles in the Arab Revolt of 1916-1918, and the Sinai and Palestine Campaign against the Ottoman Empire between 1915 and 1918.

His legend was burnished further in the 1962 film Lawrence of Arabia, starring Peter O'Toole.

Yet despite his remarkable feats, he was most content when biking around his native Dorset.

Lawrence's most acclaimed work is the Seven Pillars of Wisdom but in his book The Mint he dedicated an entire chapter (The Road) to the pleasure he derived from riding across Dorset in the morning to get the best ingredients for brunch.

He also regularly wrote letters to George Brough, who gave him a say in the design of coming bikes.

A regal connection

The reverence in which Lawrence held his bikes is comparable with the love many people feel for royalty, a comparison reflected in the names he chose for his seven bikes, which worked their way through England’s House of George: from George I to George VII.

Mr Castaigne hopes the 2021 iteration will inspire similar devotion among a whole new breed of Brough fans.

“People are really keen on classic cars and bikes,” he said. “They are turned on by their design, technique and capabilities.”

It is clear they will not be disappointed by the Brough Superior Lawrence, and neither would its namesake.