The price seen on the shelf should be the price paid at the till, according to new value-added tax (VAT) guidelines set out by the UAE’s finance ministry.

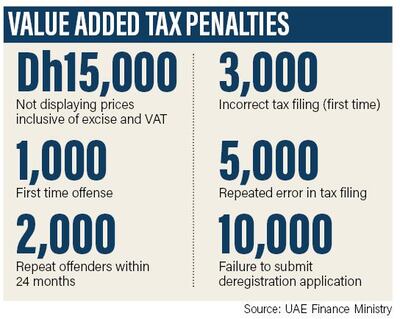

The ministry released a document on Tuesday detailing a list of violations, coupled with monetary fines. The document said administrative penalties would be in the form of “monetary amounts imposed on a person by the authority for breaching the provisions of the Federal Law No. 7 of 2017 on tax procedures or the tax law”.

The latest document said that failure by the vendor to display prices inclusive of excise or VAT will result in a fine of Dh15,000.

“The price displayed is the only price that can be charged to a consumer of that good or service,” said David Daly, a chartered accountant (Cima) who leads a consultancy practice in the UAE.

For instance, if a shopper purchases a clothing item from the rack which has a sign, Dh10.99 - that is the price that must be charged at the cash register.

“Unlike for example, the United States, where taxes are applied at the till point, in the UAE the law is clear,” Mr Daly said.

Consumers also need to remember that only businesses that are VAT registered may actually impose the 5 per cent levy that comes into effect next month.

A company must register for VAT if it makes sells goods or services that fall under the new tax regime, exceeding Dh375,000. Others may choose to voluntarily register if their taxable supplies and imports are less, but exceed Dh187,500.

On the other hand, companies will need to be careful of other vendors that could potentially charge fraudulent VAT.

Mr Daly described a hypothetical situation where a vendor could simply take a real VAT registration, equipped with an actual VAT number, and photoshop a non-registered company’s name.

In this case, the regulatory body has said that the fault will still be with the company that paid the fraudulent VAT. However, the Federal Tax Authority has said that it will not create a website that lists legitimate VAT numbers and entity names. “Mitigate [fraudulent VAT payments] by getting a certified Federal Tax Authority [FTA] VAT registration certificate, which will cost a supplier Dh500,” he said.

The FTA offered more clarity by issuing a list of supplies that will be subject to the 5 per cent VAT. Some items include products made from oil and gas, such as petrol, will be subject to the tax. Residential rentals will not be subject to the level, but hotel apartments will have the 5 per cent addition. Whereas companies located inside free zones are outside VAT jurisdiction.

Life insurance is exempt, but other insurance varieties such as health, motor and property will see their prices increase.

“Any business that is required to be VAT registered and charge VAT from January 1 must register for VAT purposes, in the manner specified by the FTA, prior to that date,” Deloitte said in its September report.

___________

Read more:

Never assume a question about VAT is silly

Federal Tax Authority urges business to register for VAT

VAT in UAE: Salaries unlikely to keep up with rising cost of goods, recruiters say

___________