Anyone who has been stuck in a thunderstorm knows the frisson of fear and wonder it creates. But very occasionally, it proves to be a once-in-a-lifetime encounter with one of nature’s most enigmatic phenomena – ball lightning.

Astonishing accounts of glowing spheres of light emerging during violent thunderstorms and flying through the air have been documented since the time of Aristotle.

Some describe the spheres eerily floating across the landscape as if searching for something, before fading out. Others describe their flight into trees, which were then blasted apart by the encounter, or their entry into homes by burning through windows.

Some point to a frightening amount of energy crammed into the benign-looking exterior. One report from the 1930s describes a glowing ball the size of an orange descending into a barrel full of water and bringing it to the boil.

Not surprisingly, such reports were long dismissed as fantasies.

But scientists have now accepted that ball lightning is real. The sceptics are on the back foot following the first detailed scientific observation of the phenomenon.

The breakthrough has come through the same kind of chance encounter experienced by eye-witnesses.

In July 2012, a team led by Jianyong Cen of Northwest Normal University, China, was carrying out a study of the thunderstorms that break out over the Tibetan Plateau north of the Himalayas.

Their aim was to observe lightning bolts with high-speed instruments able to reveal their spectra, which shows the types of atoms caught up in the bolts.

By pure luck, one of the lightning strikes witnessed by the team was followed by the emergence, about a kilometre away, of a glowing ball. The ball floated through the air, and then, just 1.6 seconds later, vanished.

All too often, eye-witnesses – such as American writer Mike Fook, who graphically described his own encounter with ball lightning in Thailand last April – have admitted being too stunned to record more than the most basic facts about what they have seen.

But the high-speed equipment of the Chinese scientists had no problem collecting a wealth of data.

In their study, published in the latest issue of Physical Review Letters, the team reports that the ball was spawned by a standard cloud-to-ground lightning bolt.

Within a fraction of a second, it had formed into a glowing purple-white sphere about 5 metres across, travelling across the sky at about 30kph.

After about a second it started to shrink and fade, its colour turning to orange, then red before vanishing.

But the big breakthrough has come from the spectrographic observations, which showed the different types of atoms caught up within the ball.

These revealed a mix of silicon, iron and calcium – all components of the soil blasted by the original bolt of lightning.

This is being hailed as a major breakthrough, as it appears to vindicate a theory for the origin of ball lightning put forward more than a decade ago.

Until recently it seemed obvious the solution to the mystery of ball lightning lay in the province of physics, because of the obvious link with electromagnetic radiation.

Yet the eye-witness reports included many oddities that defied simple explanation. Why, for example, was an object supposedly so hot so often described – as it was by Fook – as radiating no heat at all?

And why was an object that should therefore be very buoyant be so often seen near the ground?

This led to growing suspicions that the mystery was likely to be solved not by physics, but by chemistry.

In 2000, chemists Dr John Abrahamson and Dr James Dinniss at the University of Canterbury, New Zealand, duly put forward a theory for ball lightning based on two well-known chemical facts.

First, lightning bolts that strike the ground are heating material rich in chemical elements – in particular silicon, which makes up a quarter of the Earth’s crust. And secondly, silicon is notoriously unstable at high temperatures, and when combined with oxygen in the air, releases heat – and light.

In February 2000, Dr Abrahamson and Dr Dinniss combined these facts in a theory of ball lightning.

Writing in the prestigious science journal, Nature, they suggested that when a bolt of lightning strikes the soil, it creates a vapour of pure silicon which cools to form wispy groups of silicon particles so small they can float.

As these combine with oxygen in the air, chemical reactions take place releasing heat and light. The result – a glowing, floating ball of light we call ball lightning.

Nick-named the “fluffball theory”, it appeared to explain a lot. While packed with chemical energy, the fluffballs would release relatively feeble amounts of heat – explaining the reports of a curious absence of heat.

But release the chemical energy trapped inside and the effects would be dramatic – in line with reports of explosions and blasted trees.

As for the plethora of sightings near the ground, that seemed to be the result of the origin of ball lightning in superheated soil.

The biggest problem with the theory was that it was just that – a theory. Now the observations in Tibet seem to have confirmed its basic tenets.

So is it time to close the file on ball lightning? Not quite – some researchers insist that what was seen in Tibet may be just one type of a much broader phenonomen.

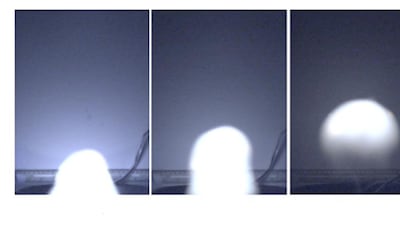

It is a view backed up by research reported last year by Dr Mike Lindsay and his team at the US Air Force Academy in Colorado, who have created something intriguingly like ball lightning over chemical solutions in the laboratory.

What is clear is that the observations from Tibet are likely to spark renewed interest in ball lightning – and demonstrate that the “crazy” claims of ordinary people are sometimes worth taking seriously.

Robert Matthews is visiting reader in science at Aston University, Birmingham