ABU DHABI // A new hotline for Pakistanis seeking help in the UAE will be launched in the next few weeks, the Pakistan ambassador to the Emirates said yesterday.

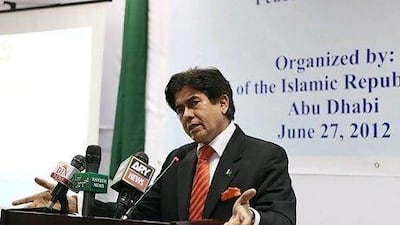

Jamil Ahmed Khan made the announcement on the sidelines of a seminar last night aimed to educate more than 50 students on international policies.

He said the hotline should start up in the "coming weeks, rather than months".

He was commenting after a student asked how the embassy was helping the Pakistani community, particularly the large number of labourers and taxi drivers. When he said this was possible and asked for volunteers to help in monitoring phones, three members of the audience said they would help.

The ambassador also called on the students to send as much money as possible back home to help the country out of debt.

Pakistan is close to US$80 billion (Dh294bn) in debt, a figure that has risen from the $63bn figure set two months ago due to inflation, he said.

"My generation had a problem, that we don't do our work properly and [we expect] others to do it," he said. "So for four hours on TV talk shows, we are blaming each other. So instead of blaming, we should see what we can contribute. Three volunteered here for the helpline. This is the future of the country."

He said that if the students each sent $10 to a "sister or a cousin", the money would add up to a billion dollars.

"They get chocolate and are very happy, and Pakistan gets the foreign exchange," he said.

He said anyone sending more than $15,000 in a year would be given a certificate by the embassy and be congratulated. He said their target for this year was to reach $3bn of remittance.

During the seminar, the university students were taught in basic terms about peace treaties and security, the United Nations, Nato, the Peninsula Shield and America's relationship with Israel.

He told them that political oppression led to security problems and conflict, adding that this drove the Arab Spring. He added they were "lucky" that in Pakistan they had freedom of speech.

"Anyone can go on television and say whatever they want to," he said. "This takes the steam out of a person. If a student at university is stopped from expressing themselves, they will explode."

He said he planned more seminars to bring the Pakistani community closer, adding this was the first initiative held in any embassy from around the world.

@ For more on PAKISTAN, visit thenational.ae/topics