About a year ago, Abu Dhabi’s start-up space Hub71 opened its doors on Al Maryah Island. It was the capital’s boldest step to becoming a destination for technology entrepreneurs.

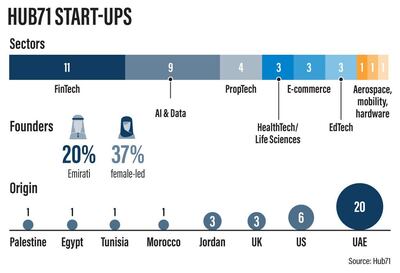

The space, created with Dh520 million from Abu Dhabi’s Ghadan 21 stimulus programme, is attracting high-tech founders and the people who support them. There are 39 start-ups from 8 different countries, a half dozen venture capital funds and global technology players like Microsoft and Chinese AI giant SenseTime under one roof. The start-ups, mostly early stage, have attracted $100 million in venture capital to date. Hub71 has built the community with support from funding and strategic partnerships with Mubadala, SoftBank Vision Fund, Microsoft and Abu Dhabi Global Market.

But today, Hub71 is tackling its biggest challenge yet - and having to adapt like never before.

As the world faces down a pandemic, economic uncertainty looms over the community as shut borders, reeling stock markets and vast swaths of the private sector are at a standstill while the public health crisis is addressed.

Earlier this year, Hub71 set a target of attracting a total of 100 ventures by the end of 2020. Its chief executive told The National the goal remains, and start-up founders, investors and private partners who spoke to The National said that Hub71's aim is still realistic.

“I think that this global crisis is going to teach us a lot about how we are using tech around the world,” Ibrahim Ajami, acting chief executive of Hub71 and head of ventures at Mubadala Capital, said. “We might admit some companies to Hub71 and if they can’t [physically] get here for six months the question is, how do we support them remotely?”

RedCrow Intelligence, a Palestinian start-up, is finding that out firsthand.

The company provides real-time intelligence to anticipate security risks and was in the midst of moving a half dozen of their technical staff to Hub71. That was put on hold in early March as the global spread of Covid-19 led to travel bans.

Chief executive and co-founder Hussein Nasser-Eddin spoke to The National from Jerusalem. He has been encouraged by the amount of communication from Hub71 and said introductions to potential investors and customers were still happening even from afar.

“They are following up remotely and talking us up to investors,” Mr Nasser-Eddin said, adding the company is working to close an investment round of $1.6m to support expansion in Mena over the next 18 months and to land a number of regional contracts.

Predictive data science, like that used in China and Singapore to help officials contain the outbreak, is getting a boost amid the crisis as other counties like the US consider adopting it. This may help RedCrow Intelligence find a bigger market for its services.

Since getting accepted earlier this year into the Hub71 incentive programme - which includes subsidised housing, health insurance and office space for the first two years - RedCrow has gotten invitations to pitch to the Abu Dhabi Investment Office (Adio) and Mubadala for funding, and been invited to several industry events to seek new business deals.

Hub71 “triggers connections. Being part of such an ecosystem, it’s all about building a network. And Hub71 is the bridge to accomplish that”, Mr Nasser-Eddin said. With some planning and caution, he thinks Hub71 can still be that bridge, even from afar and amid the uncertainty.

“We just need to be smart.”

For Lamsa, one of the oldest Abu Dhabi start-ups at eight years old, Hub71 has been a major change from what was once a lonely existence for a tech venture in the emirate. The EdTech company has nearly 30 developers and animators working from the WeWork managed co-working space at Hub71, and was among the first start-ups to join the new community.

Since moving to Al Maryah a year ago, they are lonely no more.

Amid school and daycare closures across the GCC, Lamsa founder Badr Ward told The National his company has found "the right place, the right time, working on the right problem".

Earlier this month, the Abu Dhabi Early Childhood Authority said it would offer unlimited access to the Lamsa app for children until April 9, putting Mr Ward’s products in the hands of tens of thousands of potential new clients.

For now, the company says the aim is to simply enable Arabic-speaking children to keep learning amid school closures. But it could prove to be a boon for the start-up.

“I really wish for the fast recovery of the school systems but after this crisis the role of the teacher and technology will change,” Mr Ward said. “The whole world has woken up that [remote learning] is not just a ‘nice to have’.

He added that he has gotten more calls and emails from regional and international investors "than the entire journey of Lamsa” in the recent days.

His company is looking to close a multimillion-dollar capital raise to fund expansion in research and automation, which is currently undertaken in Finland and Berlin, respectively.

Attracting researchers to base themselves in Abu Dhabi “who are really in their comfort zones, in their academic institute” abroad can be a challenge and R&D is an expensive part of any EdTech venture, Mr Ward admits.

“We have to be pragmatic to slowly attract them to be based here,” he said. Progress is incremental, but it is happening.

“For years I was preaching, Abu Dhabi is great, but people felt it was really far away and not too relevant. Now the conversation is, ‘tell me more, can I come visit?’”

Rabih Khoury, partner and chief exit officer at Middle East Venture Partners, which is a Hub71 venture capital partner, said the current global crisis is “the litmus test for technology coming in and helping the world function”. Hub71 start-ups are in a place to benefit from the shifts that will take hold amid the pandemic response and ultimate recovery, he said.

The VC, one of the oldest and biggest in the region, keeps an office space at Hub71 following an investment from Mubadala Ventures, and Mr Khoury is typically there every Thursday.

He acknowledged that the price of oil, hovering at $25 a barrel at the time of writing, would be bad for liquidity but expects it will be “a passing blip”.

In order for Hub71 to reach its 100 start-ups target, it would benefit from more interaction not just with entrepreneurs but with investors, he said.

“I know Hub71 is working on this, we’re helping them,” Mr Khoury said. The main aim is to build up an annual calendar of events and speakers so that Abu Dhabi becomes, like Dubai, a fixture on the speaker circuit. Last year, for example, Chinese e-commerce giant Alibaba hosted an event with MEVP in Abu Dhabi.

Noor Sweid, a general partner at VC fund Global Ventures, another Hub71 VC partner that took investment from Mubadala Ventures, echoed Mr Khoury's optimism about attracting more start-ups in its second year. "It's doable," she told The National. "It's a safe place with a strong framework and a vision that people are out to meet. I'm hoping that they'll get there and I'm privileged to be able to support that."

She said the collaboration with California accelerator Plug and Play is doing a good job of outsourcing a pipeline of potential start-ups, and that ADGM, the financial free zone on Al Maryah where Hub71 is headquartered, is attracting companies that need to be regulated and creating a place for founders “that isn’t too cumbersome” from an affordability or compliance standpoint.

If anything, in the year ahead expect Hub71 to emulate its tenants a lot more - to behave more like a start-up than a government initiative.

The trick is to grow alongside the start-ups, Mr Ajami, the Hub71 chief said. To do that, and to bring in dozens more ventures, the plan is to start doing greater outreach in the UK, Germany, France and US.

To support the start-ups and to attract global funds and accelerators, a Dh535m Ventures Fund was earmarked by Adio in May of last year. So far the fund has invested more than Dh60m in a half dozen entities – all of which are either based in Abu Dhabi or are expanding into the capital. Expect, too, for the relationship between Hub71 and Adio to be tighter and for those investments to be made faster, Mr Ajami said.

Providing housing, health insurance and office support is “good for the first phase”, Mr Ajami said. “But I think we need to start being more creative in what we’re offering them.”

Hub71 is starting to mull different packages for different kinds of talent and to continue to incentivise companies as they grow in order to retain them in Abu Dhabi.

“We will be a lot more nimble in helping founders as we start scaling this,” Mr Ajami said.

At the Hub71 opening a year ago, Waleed Al Muhairi, deputy group chief executive at Mubadala, offered this advice: “Adapt, or face the consequences.”

It would appear that everyone at Hub71 was listening.