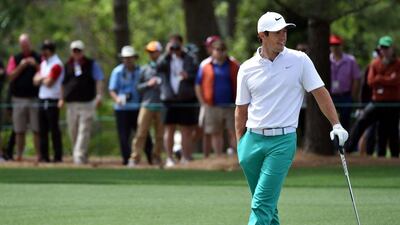

Rory McIlroy has confirmed he will miss the WGC-Bridgestone Invitational this summer by playing at the 100th Open de France.

The clash between the two tournaments has occurred following a re-working of the PGA Tour’s 2016 calendar to accommodate the Rio Olympics, where golf will return again to the programme.

Moving the WGC-Bridgestone Invitational forward a month has caused friction between the European and PGA Tours.

Four-time Major winner McIlroy won the prestigious Bridgestone event in Akron two years ago, but he feels playing at Le Golf National near Paris - the host venue for the 2018 Ryder Cup - from June 30-July 3 will help his Open chances at Royal Troon.

“I feel that playing in the 100th Open de France at Le Golf National will be the best way to get ready for The Open, which is just two weeks after the French Open,” McIlroy told the official European Tour website.

“Le Golf National might not be a pure links course, but it is traditionally firm and fast and can throw up some tricky conditions during the French Open.”

Read more: The Masters 2016 proved Big Three of Spieth, McIlroy and Day can be challenged

Also see: Tiger Woods sitting out Masters, and the game of golf moves on without him

“It’s a great test of golf and I think playing there, as well as staying in Europe, will offer the best conditions to prepare for The Open at Troon.

“It will also be great to be part of the centennial edition of the French Open, which is one of the best events on the European Tour.

“I am sure there will be a special atmosphere at the tournament this year, so I’m looking forward to hopefully being a very big part of it.”

Northern Ireland star McIlroy has previously played twice in the French Open, in 2008 and 2010.

“Paris is just one of the great cities of the world,” said McIlroy.

“It is a real melting pot of art, people, culture and history, and you can’t help but love visiting places like that.

“I can’t wait to get back there in the summer.”

The world number three from Northern Ireland failed to defend the Bridgestone Invitational title he won in 2014 last August after rupturing ankle ligaments caused during a football game with friends.

McIlroy’s decision will come as a huge boost for the European Tour which was annoyed by the PGA Tour moving the WGC-Bridgestone Invitational into the same week as the French Open, continental Europe’s oldest national championship.

Last summer the European Tour withdrew its sanction for the WGC event.

That means the Bridgestone Invitational is not part of the 2016 European Tour international schedule, and money won in it will not count towards The Race to Dubai or for Ryder Cup points.

Follow us on Twitter @NatSportUAE

Like us on Facebook at facebook.com/TheNationalSport