UAE cricket administrators say they are “honoured” the country has been chosen to host the 2021 T20 World Cup.

The ICC confirmed on Tuesday the decision had been taken to move the event from India because of the effect of the coronavirus crisis in the country.

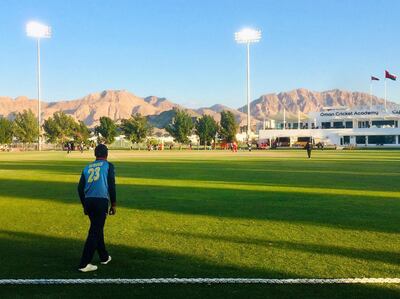

Abu Dhabi, Dubai and Sharjah will host matches, while the Oman Cricket Academy in Al Amerat, near Muscat, will also stage games. The tournament will be played between October 17 and November 14.

It will be the first time a cricket World Cup has been staged entirely outside of the sport’s Test-playing elite nations.

“The Emirates Cricket Board is honoured that the BCCI and the ICC have entrusted us with staging and delivering the ICC Men’s T20 World Cup,” Khalid Al Zarooni, the vice president of the ECB, said.

“The UAE’s reputation as being a safe country in which to host high-profile sporting events is a strong compliment to our government’s unwavering commitment to implementing and monitoring effective health practices during the pandemic.

“Having hosted a number of high-profile tournaments in recent months our team is well-prepared and ready to mobilise to ensure the success of the [World Cup].”

Although this will be the first global ICC event staged in the UAE, the country is no stranger to major cricket.

Twenty matches of the Pakistan Super League were staged in Abu Dhabi this month, while the Indian Premier League was staged in its entirety in the UAE last year.

This season's IPL will also be played to a conclusion in the Emirates in September and October, with the final set to take place just days before the start of the T20 World Cup.

Between the two competitions there will be in excess of 70 matches. That workload led the ICC to consider Oman for an extra venue.

The ground in Al Amerat has staged international cricket before, albeit with lesser crowds than might be expected for a fixture involving, for example, Bangladesh or Sri Lanka, each of whom are in the preliminary round of the World Cup.

Oman Cricket Academy does not have permanent spectator seating. There is also likely to be logistical issues created by cross-border travel, to and from a country that is experiencing a spike in Covid cases. On Monday, Oman reported its highest daily death toll from the coronavirus.

However, the country’s cricket board say they “will leave no stone unturned” to ensure the successful hosting of their matches.

“It is indeed a great moment for Oman Cricket to be selected as a venue host of the forthcoming ICC Men’s T20 World Cup,” Pankaj Khimji, the Oman Cricket chairman, said.

“We shall leave no stone unturned to exceed the requirements of BCCI and ICC. Oman will certainly extend a very warm welcome to all the teams, officials and media in October.”

Geoff Allardice, the acting chief executive of the ICC, said fans can still anticipate a “celebration of cricket,” even though the event has been moved out of cricket-mad India.

“Our priority is to deliver the [World Cup] safely, in full and in its current window,” Allardice said.

“Whilst we are incredibly disappointed not to be hosting the event in India, the decision gives us the certainty we need to stage the event in a country that is a proven international host of multi-team events in a bio-secure environment.

“We will work closely with the BCCI, the Emirates Cricket Board and Oman Cricket to ensure fans can enjoy a wonderful celebration of cricket.”

Jay Shah, the Indian board secretary, said it would have been too risky to press ahead with staging the tournament in India.

“The BCCI made every effort to stage the [World Cup] in India and provide its passionate fans with a reason to cheer after a long period of gloom,” Shah said.

“However, the prevailing pandemic situation in the country meant that the health and safety of everyone concerned was fraught with risk should a tournament of this stature is held across the country.

“The BCCI will continue to host the tournament, which will now be held in the UAE and Oman, and work closely with the ICC to make it a memorable event.”