One of the most dramatic Middle East press trips in recent years was organised by Hizbollah, the Iranian-backed Shia militia, to show off the site of its victory against Syrian opposition forces this week in the barren hills of north-east Lebanon, known as Juroud Arsal. According to participants, some 40 vehicles struggled up the mountains so that Hizbollah spokesmen could show reporters the complex of caves and tunnels where the anti-Assad fighters had operated.

Never backward in seizing a PR opportunity, spokesmen were keen to point out that Hizbollah was at the forefront of fighting “terrorism” by crushing the fighters of Hayat Tahrir Al Sham, as the former Al Qaeda franchise in Syria is now known.

As a result of the two-week battle, some 10,000 fighters, their families and Syrian refugees are to be returned to Syria, most to Idlib province in the north of the country where the armed opposition to president Bashar Al Assad is being corralled.

__________________________

Read more:

Trump meets Hariri: Hizbollah is a menace for Lebanon and whole region, says US president

Editorial: Lebanon's executive power is hijacked by Hizbollah

Nearly 8,000 Al Nusra militants, refugees leave Lebanon to Syria

___________________________

The press trip served multiple purposes. The first was to correct US president Donald Trump, who had said that the Lebanese government was on “the front line” in the fight against the terrorists of Al Qaeda and Hizbollah. In fact, the government of prime minister Saad Hariri exists thanks to support from Hizbollah. The concept of “terrorism” may be clear in the White House, but it crumbles when it meets the reality of Lebanese politics.

The second was to show that Hizbollah was defending the state against jihadist infiltrators, who it claims are responsible for a series of deadly car-bomb attacks on Shias in Lebanon. This charge is probably true. But the deeper truth is that the security organs of the Lebanese state cannot operate when Hizbollah is at the same time the most powerful armed force in the land and a significant political party. This was clearly apparent when the Lebanese army played only rear-guard role in the Arsal battle.

The third is to show that Hizbollah is reversing the flow of refugees into Lebanon. In all, 17 of every hundred residents of Lebanon are Syrian refugees, and a further eight are refugees from elsewhere, mainly Palestinians, adding up to a quarter of the population. The country’s sewage and rubbish collection services cannot cope with the population before the Syrian war, let alone the 1.5 million Syrian refugees.

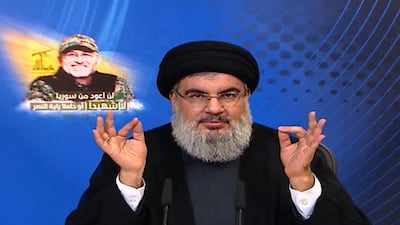

These are three reasons for Hizbollah to use as a platform for rehabilitation. When in 2012 the Hizbollah leader Hassan Nasrallah transformed the organisation from an anti-Israel resistance force into Iran’s mailed fist in Syria, it lost a lot of support. The Future Movement of prime minister Hariri accused Hizbollah of using the battle in Arsal as a way to legitimise its participation in the Syrian civil war. “We will not be party to this national sin,” it said.

While its credibility as a Lebanese institution - rather than a key element of the Iran's foreign legion – is in doubt, there is no question that Hizbollah will emerge from the battlefield stronger, no longer just a paramilitary force.

To the outside world, this battle may seem like a side show when the American focus is on destroying the ISIL “caliphate” in Raqqa, in eastern Syria. Far from it. Having driven out the Hayat Tahrir Al Sham fighters from Arsal, Hizbollah is now in control of the Lebanon-Syrian border from Qusayr in the north to Zabadani. This is a key element of the Assad regime’s plan to control so-called “useful Syria” – the most populated parts from the Mediterranean coast to Damascus.

The confidence of the regime and its Iranian allies is shown by the fact that it is ready to accept the return of some 10,000 Sunni Muslims. One often overlooked fact about the conflict is that, for years the regime was happy for huge numbers of Syrians to flee the country on the grounds that the war would be won more easily if disaffected Sunnis were absent. At the same time, an overt policy of sectarian cleansing was in force, moving Sunni populations away from Damascus.

The opposition forces are so weak and now cut off from the CIA’s covert support programme that the regime believes the opposition forces will go where they are told. The pressure to keep the refugees out of the country is no longer so strong.

The regime has invited the 4.8 million Syrian refugees back, as a way of keeping up the pretense that life has returned to normal, but it would require great bravery for them to pass through the ranks of Syrian intelligence to return to their homes.

None of this offers much hope for a new start for Syria or would guarantee peace and reconstruction. Nor is there any sign of the Trump administration being able to drive a wedge between Russia and Iran. In fact, relying on Washington in its current state to halt the advance of Iranian power would be optimistic to a fault.

One hopeful sign is the visit to Saudi Arabia of Moqtada Al Sadr, a powerful Iraqi cleric, whose relations with Iran have been ambiguous, leading some to view him as more of an Iraqi nationalist. That proposition is yet to be proved and Mr Al Sadr is a fragile vessel to carry the hopes of an Iraq less in thrall to Iran.

But still, engaging with Iraqi politicians - rather than treating them as pariahs as was the case until as recently as 2015 - is a signal of a more dynamic regional policy by Saudi Arabia. Iraq is at a crossroads and the reconstruction of Mosul will require huge injections of capital, which is an opportunity for outside powers.

But there can be no quick wins. It should be recalled that it has taken 35 years for Iran to nurture Hizbollah from a nucleus of Revolutionary Guards in Baalbek to a military force that is now the leading power broker in Lebanon.