Choose your own adventure: will mankind shut itself away, embrace techno-authoritarianism, or build a network of supercities governed by big-data-powered e-mayors?

This is the question posed by the World Economic Forum in a new paper on how technology will change politics.

The WEF extrapolates from trends in internet and tech adoption to produce three versions of the future in its “Smart Toolbox”, released in Dubai yesterday ahead of its meeting of the Global Agenda Council, to be held in the UAE this year.

But they are not uniformly optimistic. As the international relations theorist Joseph Nye warned the WEF: “Today’s trends left unattended could lead to dystopian futures”.

If nationalism rises and governments grow despotic, the WEF foresees an “e1984” scenario, in which big data is harnessed to turn the screws on citizens and dissidents alike. Government agencies leverage future-data analytics to extract a granular, invasive and deeply incriminating picture of your everyday behaviour. This is Thomas Pynchon’s world, where universal paranoia enters daily life.

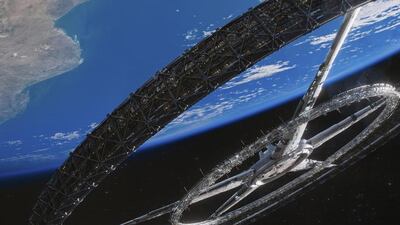

Or perhaps the libertarians will win the argument. In which case the WEF imagines a world of gated communities. It is a world of radical-right fantasy: where self-governing collectives recruit private companies to provide public services to a gated community, where ties are explicit and voluntary, and where nationhood has disappeared. This is the ringworld of Neill Blomkampf's Elysium – in which the world's wealthiest live in secluded luxury, guarded by mercenaries, while the planet suffers.

It is also the future imagined by Margaret Atwood in her novel Oryx and Crake: "Compound people [who live in gated communities] didn't go to the cities unless they had to, and then never alone … Despite the fingerprint identity cards now carried by everyone, public security in the [cities] was leaky: there were people cruising around in those places who could forge anything and who might be anybody, not to mention the loose change – the addicts, the muggers, the paupers, the crazies…Outside the [compound's] walls and gates and searchlights, things were unpredictable."

Or else, supposes the WEF, should cities continue to grow and grow, perhaps the nation state will wither away. All that will remain will be large cities, governed by charismatic, tech-savvy e-elected mayors – perhaps by some kind of cyborg Boris Johnson. Globalisation, in this vision, concentrates wealth, creativity and skills in cities, which can grow exponentially thanks to the quality-of-life enhancements that result from e-governance and smart city technologies.

This vision draws from “The World is Spiky”, an essay by Richard Florida, a professor at George Mason University in the US, and “Cities Are Good for You” by Leo Hollis – in which cities are seen as complicated devices for reducing transaction costs between individuals and organisations. Technology, in the WEF’s view, hastens this trend, concentrating people, resources and productivity in cities.

But which is it to be?

The WEF offers a classic civil servant’s fudge: “While none of these scenarios is likely to come to pass in full or in isolation from the other scenarios, all the scenarios contain some elements of truth”.

Regardless, it expects that governments around the world in the future will face “a daunting challenge” to deliver the services its people expect in “an environment of diminishing trust … increasing bureaucratic complexity and natural resource constraints”.

abouyamourn@thenational.ae

Follow us on Twitter @Ind_Insights