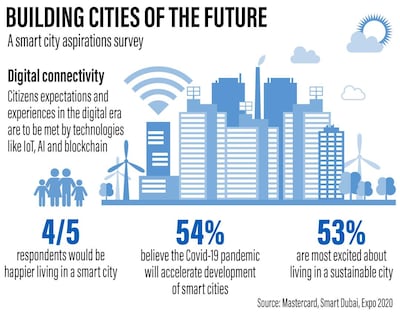

Nearly 54 per cent of UAE residents expect Covid-19 to accelerate the development of smart cities, reveals a new report.

Environmentally friendly business practices, paperless government services and fast, affordable, city-wide internet connectivity are some of the features residents expect from a smart city, states the Building the cities of the future report by Mastercard, Smart Dubai and Expo 2020 that was released on Wednesday.

The respondents cited ultra-fast mobile connections, driverless taxis and online medical diagnoses from artificial intelligence-enabled doctors as the most exciting innovations.

“There will be around 2.5 billion additional people added to the cities by 2050 ... this huge number presents many opportunities as it will make cities a melting pot for innovation and new technologies,” said Elias Aad, Mastercard’s vice president and head of strategic growth business for Middle East and North Africa, at an online roundtable on Wednesday.

The pandemic has rapidly accelerated the pace of digitisation over the past year as businesses and governments scrambled to maintain business continuity amid movement restrictions.

However, many challenges persist as countries – which have yet to start work on transforming their cities – try to close the digital chasm to keep up with the current pace.

Some challenges that stakeholders are facing include “how to build a city that is smart, self-reliant and focused,” while keeping the “citizens at the centre of all services,” Mr Aad said.

“They [cities] are just like products ... [and] like any tech start-up does, the cities/products should be first tested and validated to ensure they keep residents/users at the core,” he added.

Mastercard commissioned market research and consulting firm Ipsos to survey 1,000 people in the UAE – including citizens and residents – between 18 and 65 with a minimum monthly household income of Dh8,000.

Nearly 67 per cent of those polled said they expect their smartphones to be the primary channel to access city services.

“When it comes to pandemics like Covid-19 and safeguarding the public health, one of the keywords in the context of smart cities is data,” Meera Al Shaikh, international relations and partnerships section manager, Smart Dubai, told the roundtable.

“The more data you have … the more resilient [the] city will be … it is the backbone. We have been investing in smart cities and technologies long before Covid-19 ... so we managed to address the crisis well by creating dashboards that monitored different trends emerging out of the pandemic,” she added.

Meanwhile, 80 per cent of respondents said they would be happy living in a smart city, aligning closely to Smart Dubai’s aspiration of making Dubai the happiest city on earth through smart technology and innovation.

Nearly 53 per cent of residents consider living in a sustainable city as the most exciting innovation in smart cities, and this sentiment increases with respondents’ age.

“Sustainability is integrated throughout Expo 2020 Dubai, creating meaningful impact and inspiring the global community to take action towards a cleaner, safer, healthier future,” Iman Alomrani, deputy chief technology officer of Expo 2020, said.

“It is extremely encouraging that people consider sustainable practices as vital to their cities of the future,” she added.

Abu Dhabi and Dubai led the Middle East region for the second consecutive year in a global ranking of smart cities – outpacing advanced urban hubs such as Tokyo and Beijing.

The UAE capital jumped 14 spots to rank at 42nd place among 109 cities in the 2020 Smart City Index by The Institute for Management Development, just ahead of Dubai, which climbed two positions to 43, according to the Swiss academic institute.