The creator economy market could double in the next five years amid an increase in digital media consumption and the emergence of new technology, according to Goldman Sachs.

The total addressable market of the creator economy — made up of more than 50 million independent online content creators — could rise to $480 billion by 2027 from $250 billion currently, the bank said.

“New platforms such as TikTok have emerged, while legacy platforms like Facebook and YouTube have also introduced new formats for sharing short-form video, live streaming channels and other forms of user-generated content,” said Eric Sheridan, senior equity research analyst at Goldman Sachs.

Goldman Sachs expects influencer marketing, platform payouts and short-form video advertising to drive growth in the creator economy.

The number of global creators is estimated to grow by 10 per cent to 20 per cent annually over the next five years, the bank said.

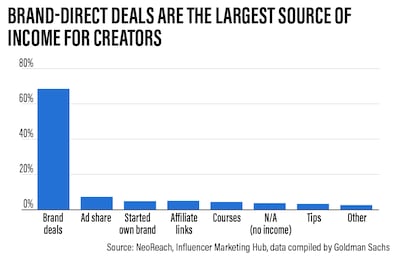

Social media creators earn through branding deals, platform advertising revenue, and direct payments from followers, such as subscriptions and donations.

Brand deals are the main source of revenue at about 70 per cent, followed by ad sharing and starting one's own brand, the report found.

The share of professional creators who earn more than $100,000 a year in the overall ecosystem will remain steady at 4 per cent even as the market expands, it said.

Digital platforms that offer multiple ways to monetise content will attract both influential creators and a larger share of spending, Goldman Sachs said.

A diverse user base, access to capital and strong AI recommendation engines are among the factors creating a “flywheel effect” for social media platforms, in which small gains build on each other over time and create further growth momentum, the report said.

Other factors include diverse product offerings, strong data analytics and e-commerce options.

Creators will flock to established platforms as competition intensifies due to economic uncertainty affecting brand spending and rising interest rates squeezing funding for emerging platforms, Mr Sheridan said.

“As a result, we expect some element of a ‘flight to quality’ whereby creators will prioritise platforms with stability, scale and monetisation potential,” he added.

The influencer marketing platform market is expected to reach $143.1 billion by 2030, growing 33.4 per cent annually, according to a report by research company Grand View Research.

“The increasing demand for over-the-top (OTT) media services and their collaboration with influencers to advertise and promote their content are opening new growth avenues for the influencer marketing platform market,” it said.

In February, Facebook’s parent company Meta reported a 55 per cent annual drop in fourth-quarter net profit, underpinned by escalating costs and a decrease in the average price per advertisement.

In the first quarter of this year, advertisement impressions delivered across Meta’s family of apps increased by 23 per cent a year and the average price per advertisement dropped by 22 per cent annually, the company said, without disclosing exact numbers.

Twitter is roughly breaking even, as most of the company’s advertisers have come back, and is expected to become cash-flow positive in the coming quarters, its billionaire owner Elon Musk said in a recent interview with the British Broadcasting Corporation.

Meanwhile, TikTok owner ByteDance’s revenue surged more than 30 per cent to exceed $80 billion last year, Bloomberg reported earlier this month, citing sources.