Facebook’s parent company Meta reported a 55 per cent annual drop in fourth-quarter net profit, underpinned by escalating costs and a decrease in the average price per advertisement.

The California-based company earned a net profit of more than $4.6 billion in the quarter that ended on December 31.

Shares of Meta surged more than 20 per cent to $183.99 a share in after-hours trading, as the company announced a $40 billion stock buyback and pledged to focus on “efficiency” while lowering its forecast for capital expenditures in 2023.

The social media company’s revenue dropped nearly 4.4 per cent annually to more than $32.1 billion in the three months to December, exceeding analysts’ estimates of $31.5 billion. It was the company’s third straight quarter of declining sales.

In the last quarter, advertisement impressions delivered across Meta’s family of apps increased by 23 per cent a year and the average price per advertisement dropped by 22 per cent annually, the company said, without disclosing exact numbers.

Meta’s family of apps includes Facebook, Instagram, Messenger, WhatsApp and other services.

Total expenses surged 22 per cent yearly to reach nearly $25.8 billion in the last quarter. This includes charges related to the company’s restructuring efforts of $4.2 billion in the fourth quarter.

The company’s earnings per share dropped 52 per cent annually to $1.76.

“Our community continues to grow and I am pleased with the strong engagement across our apps. Facebook just reached the milestone of 2 billion daily actives,” Mark Zuckerberg, Meta founder and chief executive, said.

“The progress we are making on our AI [artificial intelligence] discovery engine and reels are major drivers of this … we are focused on becoming a stronger and more nimble organisation.”

The number of Facebook’s daily active users jumped 4 per cent yearly in the last quarter, reaching two billion, exceeding StreetAccount’s estimates of 1.99 billion.

Meanwhile, Facebook’s monthly active users rose 2 per cent on an annual basis to 2.96 billion as of December 31.

The company's advertising sales contributed more than 97 per cent to overall sales in the fourth quarter, declining by about 4.2 per cent on an annual basis to almost $31.3 billion in the October-December period.

Revenue from other streams — including reality labs — dropped 11.7 per cent on an annual basis to about $911 million.

The company’s reality labs include augmented and virtual reality-related consumer hardware, software and content.

Meta, which employs 86,482 people, expects its March quarter total sales to be in the range of $26 billion to $28.5 billion. Industry analysts were expecting revenue of $27.1 billion, according to Refinitiv.

The company expects its full-year 2023 total expenses will be in the range of $89 billion to $95 billion, a drop from its prior outlook of between $94 billion and $100 billion due to slower anticipated growth in payroll expenses and cost of revenue.

“We now expect to record an estimated $1 billion in restructuring charges in 2023 related to consolidating our office facilities footprint,” Meta’s chief financial officer Susan Li said. “This is down from our prior estimate of $2 billion.”

In November, Meta announced its plans to lay off 11,000 employees — equivalent to 13 per cent of its workforce.

“We continue to monitor developments regarding the viability of transatlantic data transfers and their potential impact on our European operations,” Ms Li said.

In a February report last year, the company threatened to pull Facebook and Instagram from Europe if it is unable to continue to transfer user data back to the US amid negotiations between regulators to replace a scrapped privacy pact.

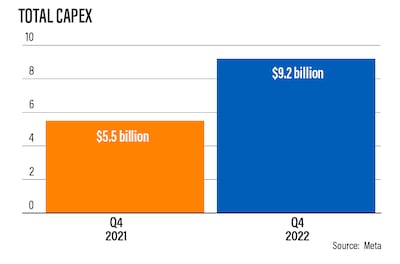

The company expects 2023 capital expenditure to be in the range of $30 billion and $33 billion, lowered from its prior outlook of $34 billion and $37 billion.

The reduced outlook reflects the company’s plans for a lower data centre construction spend in 2023 as it shifts to a new data centre architecture that is more cost efficient and that can support both AI and non-AI workloads, Ms Li said.

The company repurchased $6.91 billion of its common stock in the last quarter. As of December 31, it had $10.87 billion available and authorised for the repurchases, Meta said.

Facebook’s cash, cash equivalents and marketable securities stood at $40.74 billion at the end of the last quarter.