The rapid emergence of new technologies, such as artificial intelligence, edge computing and smart mobility, is accelerating the pace of digital transformation worldwide.

Covid-induced market disruptions and widespread adoption of hybrid work models have also fast-tracked the process along with the influx of new investment in the sector.

Global spending on digital transformation is predicted to jump almost 18 per cent annually to $1.8 trillion this year, according to Massachusetts-based researcher International Data Corporation.

“Technology is changing everything in our work and home lives,” Lareina Yee, senior partner at McKinsey and chair at McKinsey Technology Council, said.

The consultancy launched the McKinsey Technology Council to help understand new technologies and how they will affect end users.

“We will look at a spectrum of technologies, from computing to biology, and their applications across all sectors, from mining to entertainment. We look at the science, how it translates into engineering, and when it will accelerate to impact — at scale, and around the world,” Ms Yee said.

The National looks at 14 significant technology trends, suggested by the McKinsey Technology Council, which are set to change the industry's landscape.

Artificial intelligence

Over the past few years, the use of applied artificial intelligence, which recorded an investment of $165 billion in 2021 according to McKinsey, has emerged across various industries and business functions. From 2018 to 2021, it scored the highest innovation scores for all the trends that McKinsey studied.

With AI capabilities such as machine learning, computer vision and natural-language processing, companies in all industries can use data and derive insights to automate activities, add or augment capabilities and make better decisions.

Connectivity

Advanced connectivity, which attracted an investment of $166bn last year, is becoming critical for all industries as it can potentially drive growth and productivity, McKinsey said.

The latest connectivity protocols and technologies power networks with more data throughput, higher spectrum efficiency, wider geographic coverage, less latency and lower power demands.

These improvements will enhance user experiences and increase productivity in industries such as mobility, health care and manufacturing.

Companies have been quick to adopt advanced connectivity technologies that build on existing standards, but newer technologies, such as low-earth-orbit connectivity and private 5G networks, have seen less uptake to date, the consultancy found.

Bioengineering

Converging biological and information technologies improve health and human performance, transform food value chains, and create innovative products and services.

Breakthroughs in biology, combined with innovations in digital technology, could help organisations respond to demands in various industries such as health care, food and agriculture, consumer products, sustainability, and energy and materials production by creating new products and services, the report said.

McKinsey predicts that nearly 400 use cases for bioengineering, which are scientifically feasible, could have an economic impact of $2tn to $4tn per year between 2030 and 2040. The industry attracted investment of $72bn last year.

Clean energy

In 2021, clean-energy solutions attracted investments of $275bn. They support ambitions of net-zero greenhouse gas emissions across the energy value chain, from power generation to power storage and distribution.

Some of the solutions include renewable sources such as solar power and wind power, sustainable fuels such as hydrogen, long-duration battery systems and smart grids.

McKinsey estimates that annual investments in energy supply and production could double by 2035, reaching nearly $1.5tn. Overall, the shift to clean energy would trigger profound changes across both energy-producing and energy-intensive sectors.

Mobility

Mobility has arrived at a “great inflection” point — a shift towards autonomous, connected, electric and smart technologies. This shift aims to disrupt markets while improving efficiency and sustainability of land and air transportation of people and goods.

ACES technologies for road mobility saw significant adoption during the past decade, and the pace could accelerate because of sustainability pressures, McKinsey said.

Advanced air-mobility technologies, on the other hand, are either in pilot phase — for example, airborne-drone delivery — or remain in the early stages of development — for example, air taxis — and face some concerns about safety and other issues.

Overall, mobility technologies, which attracted $236bn last year, intend to improve the efficiency and sustainability of land and air transportation of people and goods.

Sustainable consumption

The concept involves transforming industrial and individual consumption through technology to address environmental risks, including climate change.

It focuses on the use of goods and services that are produced with minimal environmental impact by using low carbon technologies and sustainable materials. At a macro level, sustainable consumption is critical to mitigating environmental risks, including climate change.

For companies, the production of sustainable goods and services can support compliance with emerging regulations, create growth opportunities and help attract talent.

While many technologies that support sustainable consumption are technically viable, few have become cost-effective enough to achieve mass scale. The global push towards decarbonisation could accelerate their adoption.

The industry witnessed an investment of $109bn last year.

Web3

Web3, which attracted $110bn in 2021, is considered the future model for the internet that decentralises authority and redistributes it to users, giving them increased control over how their personal data is monetised and stronger ownership of digital assets.

It also offers various commercial opportunities, such as new business models governed by decentralised autonomous organisations and enabled by eliminating intermediaries through secure smart contract automation as well as new services involving digital programmable assets.

However, although Web3 has drawn significant general interest, it has gained only limited traction with incumbent companies due to a variety of factors, McKinsey said.

It has attracted large pools of capital and engineering talent, but viable business models are still being tested and scaled, the consultancy added.

Industrialised machine learning

Industrialised machine learning (ML), which recorded $5bn in investment last year, involves creating an interoperable stack of technical tools for automating ML and scaling up its use so that organisations can realise its full potential.

These tools can help companies transition from pilot projects to viable business products, resolve modelling failures during production and overcome limits on teams’ capacity and productivity.

McKinsey said organisations that industrialise ML successfully can shorten the production time frame for applications by 90 per cent (from proof of concept to product) and reduce development resources by up to 40 per cent.

Immersive-reality technologies

Immersive-reality technologies, which attracted investments of $30bn last year, use sensing technologies and spatial computing to help users see the world differently through mixed or augmented reality.

Such technologies use spatial computing to interpret physical space, simulate the addition of data, objects and people to real world settings. This enables interactions in virtual worlds with various levels of immersion.

However, adoption is constrained by a number of factors, including the need for technological advances, such as improvements in the feature sets, battery life, weight and ergonomics of wearable immersive-reality devices, as well as the maturity of the development tool chain required to create “great immersive experiences more efficiently”, McKinsey said.

Cloud and edge computing

Cloud and edge computing allows the efficient distribution of computing and storage across onboard and remote data centre-based resources. It frees various resources and enables companies to deliver new services.

In healthcare services, these technologies result in improvements in digital use cases, such as remote diagnostics, active drug monitoring, and wellness and fitness trackers. While financial service players can use cloud services to train, store and deploy algorithms that model risk and improve fraud detection.

A total of $136bn was invested in the industry in 2021, according to McKinsey.

Digital identity

Digital identity includes all the digital information that distinguishes an individual or an entity. With self-sovereign identity, users control which identifying information to share digitally and with whom.

Password-less identity allows users to verify and authenticate themselves using biometric devices, applications and documents.

Digital-trust technologies, which attracted $34bn last year, enable organisations to manage technology and data risks, accelerate innovation and protect assets.

Space technologies

Advances and cost reductions across satellites, launchers and habitation technologies enable innovative space operations and services.

The most significant development in space technologies over the past five to 10 years has been decreasing costs, which are making new capabilities and applications more accessible, McKinsey said.

“The use of space technologies and remote-sensing analytics is substantial today and analysis suggests that the space market could exceed $1tn,” it added.

The industry recorded investments worth $12bn last year.

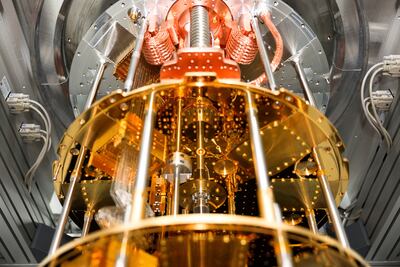

Quantum technologies

Quantum computing will provide a massive acceleration in speed and performance and is expected to accelerate solutions for some of the world’s most pressing problems, such as sustainable energy, greenhouse gas emissions and unlock new scientific discoveries, like more helpful AI.

The world's biggest economies, from the US, Russia, China and Japan, as well as tech majors such as IBM, Alibaba, Google and Microsoft, are all battling for supremacy in the field.

Quantum-based technologies attracted $3bn in investments in 2021.

Next-generation software development

Next-generation tools help in the development of software applications, improving processes and software quality.

They help simplify complicated tasks, reduce many tasks to single commands and build applications quickly — thus accelerating digital transformation and delivering productivity gains.

Adoption may be slow because of technical challenges, the need for large-scale retraining of developers and test engineers, and organisational hurdles, McKinsey said. The sector drew in investments totalling $2bn last year.