Global shipments of smartwatches rose 13 per cent to about 33.7 million units in the first quarter of 2022, as Apple continued to dominate the segment, a new study from Counterpoint Research showed.

The market is expected to continue its growth for the whole of this year as manufacturers develop more devices to cater to the need of those conscious about their health and well-being, the Hong Kong-based data provider said in its quarterly report on wearables on Tuesday.

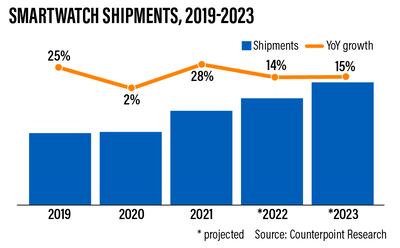

However, the expansion is expected to slow down this year. While smartwatch shipments surged 28 per cent in 2021 — a multifold increase from 2 per cent in 2020 — it is projected to halve to 14 per cent at the end of 2022 and then inch up to 15 per cent next year.

The slowdown already begun in the first quarter, largely due to Russia's military offensive in Ukraine, which has disrupted supply chains and led to inflation hitting record levels.

“Although the global smartwatch market experienced little growth in 2020 due to the impact of Covid-19, it has continued to perform well since its rebound last year,” Sujeong Lim, associate director at Counterpoint, wrote in the report.

“The market was able to record rapid growth by amplifying consumers’ interest in health and fitness. During this period, new manufacturers entered the market, bringing in more models, designs and price points. This has been another factor that has enabled market growth by broadening consumer choice,” the study said.

Wearables have increasingly become part of people's daily routines, as they converge with other consumer technology devices, including smartphones, computers, home appliances and even automobiles.

The global wearable technology market is expected to hit more than $380 billion by 2028, from almost $116bn in 2021, at a compound annual growth rate of 18.5 per cent, according to research firm Facts and Factors.

Smartwatches are propelling the market's growth, as more consumers use them to track their health metrics, it said.

Counterpoint's report showed that, geographically, most major regions posted annual growth, with North America bagging the biggest market share at 29 per cent, followed by China (23 per cent), the EU (18 per cent) and the Asia-Pacific, excluding China and India (14 per cent).

Europe's performance was flat. While Apple and Samsung continued to grow in the continent, other major brands such as Fitbit and Garmin declined.

India grew the fastest, rising by more than 7 per cent. The Middle East and Africa region only had a 2 per cent share, above Latin America's 1 per cent.

The smartwatch market is expected to “regain energy” in the coming months with major brands scheduled to release new hardware, Counterpoint said.

Apple is expected to introduce the Watch Series 8 — which is said to include a new rugged high-end version — around the time of the next iPhone's launch in September.

The California-based company is projected to maintain and further increase its market share, Mr Lim said, citing Apple's high brand loyalty and the Watch's “high performance” and “excellent connection among supported iOS devices”.

“This popularity appears to be higher among the younger generation, making Apple an irreplaceable market leader … We believe that Apple’s market share is likely to rise further by the end of this year,” he said.

Samsung, meanwhile, is expected to unveil a new Galaxy Watch at its August Unpacked event, in which it will also reveal its new foldable smartphones.

But arguably the most interesting launch will come from Google, which announced its first Pixel Watch during its I/O 2022 conference in May. The device is scheduled to be released in the autumn.

“There has been a lot of market interest in the details,” Counterpoint said of the Pixel Watch.

“Although Google did not mention the price or detailed specifications, user-friendly software such as Google Maps, Google Wallet and Emergency SoS and the body designed in the shape of a circular dome are enough to be attractive options for users in many ways.”

associate director at Counterpoint Research

Apple also continued to play a major role in the true wireless stereo (TWS) headset category, due to the popularity of its AirPods line-up.

The global TWS market grew 4 per cent annually in the first quarter of 2022, showing little volume change. However, it was more dynamic in value terms, Counterpoint said.

Devices priced between $50 and $100 fared better than low-priced products (less than $50), while ultra-premium products — those above $150 — sold more than the premium ($100 to $150) segment, as consumers are looking for more features.

“As the TWS market matures, consumers are becoming more discerning and are tending to focus on aspects important to them such as brand image, new functions, sound quality, weight and battery life, rather than simply cheap products,” Counterpoint said.

In the virtual reality (VR) headset market, the Meta Quest 2 — which was previously known as the Oculus Quest 2 — became the first VR device to cross 10 million units shipped, Counterpoint said in the report.

Meta — the parent company of Facebook and which acquired the Oculus brand in 2018 — had five VR headsets in the top eight, with a combined 18 million units shipped. The Sony PlayStation VR was second with 6.6 million, while the HTC Vive came in third with 3.3 million units.