India's surging inflation is adding to the country's economic woes, presenting challenges for businesses and policymakers alike as analysts warn of risks that could prevent prices of essential goods easing in the near future.

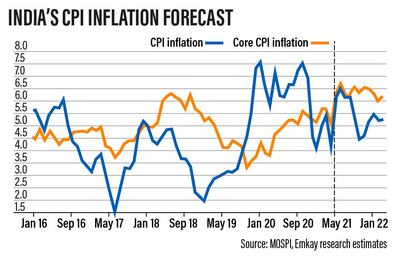

Wholesale price inflation jumped 12.94 per cent in May, a near 30-year high, driven by soaring fuel prices, while retail inflation hit a six-month peak of 6.3 per cent as food and fuel costs rose, exceeding the central bank's higher band and analysts' estimates, according to official data released this month.

“The risk of inflation turning persistent exists,” Anubhuti Sahay, head of economics research for South Asia at Standard Chartered, says. “[This is] especially because the rise in May's consumer price inflation was driven by a broad-based surge, and if commodity prices stay elevated.”

A major factor driving the spike in inflation is elevated oil prices, which have been hitting multi-year highs recently. India is heavily dependent on oil imports and this has a knock-on effect on the cost of other goods, including an increase in transportation costs. Fresh lockdown curbs imposed during a deadly second wave of Covid-19 have also affected supply chains, putting upward pressure on prices.

“Inflation pressure may remain high ahead, with upcoming prints looking to be above the May print,” Madhavi Arora, lead economist at Mumbai-based Emkay Global Financial Services, says.

The surge in inflation is posing a challenge for policymakers, with the Reserve Bank of India (RBI) instead focusing efforts on supporting economic growth. The country's economy has been battered by the second wave of the coronavirus, which has derailed what looked to be a promising start to a recovery after last year's pandemic-induced recession.

Last week, the US Federal Reserve moved up its timeline for interest rate hikes as inflation in the world's largest economy rises. The US central bank may now raise rates as soon as 2023, after saying in March that it saw no increases until at least 2024.

India’s economy contracted 7.3 per cent in the April 2020 to March 2021 financial year, according to data. Meanwhile, the World Bank this month cut its growth forecast for the current financial year to 8.3 per cent from its earlier projection of 10.1 per cent.

The pandemic's second wave prompted authorities to introduce fresh lockdown curbs, with fears of a third wave in the autumn. “India's recovery is being hampered by the largest outbreak of any country since the beginning of the pandemic,” the Washington-based lender said.

Faltering economic growth leaves the RBI with little leeway to raise interest rates to bring inflation under control because it would raise the cost of borrowing.

But the dilemma for policymakers is that soaring inflation can hamper a pick-up in the economy, particularly as consumer price inflation has breached the RBI's upper threshold of 6 per cent.

“High inflation amid low growth impacts disposable incomes and thus aggregate demand,” Ms Sahay says. “It has the potential to delay the recovery process.”

Many businesses are struggling amid the pandemic's impact and steep inflation is making profitability more challenging. If inflation remains elevated over the coming months, the situation will worsen for many business owners, analysts say.

“Some have absorbed the price rise, some have passed it on to customers and some are waiting and watching,” Naved Patel, founder and director of Mirepoix Hospitalities, which has a restaurant in Mumbai, says. “We have been affected by the rise in the most basic products: vegetables, cooking oil and pulses. Restaurants are in a miserable situation.”

"The spending capacity of the customer will [also] be low," Mr Patel adds.

Rising inflation also means he has to increase his employees' wages, which is eating into his profits. Mr Patel may have no choice but to pass the higher costs on to customers if inflation persists, which he says is preferable to reducing portion sizes.

It comes as the hospitality industry has long been feeling the heat from the fallout of the pandemic, exacerbated by the latest massive wave of infections.

“In the last few months customers have fallen and our profit margin was already nullified,” Mr Patel says. “Few of the big brands in our industry might survive this inflation but smaller brands might plunge.”

There are, however, some factors on the horizon that could help to ease inflationary pressures.

Daily coronavirus infections are currently on a downward trend compared with the peak of the second wave in May. That has prompted state governments to start easing Covid-19 curbs and allowing more business activity to resume.

“With declining infections, restrictions and localised lockdowns across states could ease gradually and mitigate disruptions to supply chains, reducing cost pressures,” according to the RBI's minutes of its June monetary policy meeting, released on Friday.

Expectations for normal rains this year during the monsoon season, which is already under way, also bodes well for easing of food prices because good rainfall leads to bountiful crops, the RBI adds in its June meeting minutes.

But the central bank warns that “the rising trajectory of international commodity prices, especially of crude, together with logistics costs, pose upside risks to the inflation outlook”.

It also notes that “uncertainties remain” because of the possibility that India could be hit by a third wave of infections this year.

“A crucial question is the extent to which the price jump will reverse as lockdowns reverse," Sonal Varma, chief economist for India at investment bank Nomura, says. “Our judgement is that prices are downward rigid in India and, as such, only part of the price rise will reverse when lockdowns are fully relaxed in coming months.”

However, the government may need to intervene as the central bank's hands remain tied, some analysts say.

“We don’t see any immediate response from RBI on the inflation front given the priority accorded to the revival of the growth impulses,” Suman Chowdhury, chief analytical officer at Acuité Ratings and Research, says.

“Given the stress that the second wave of Covid has created on the livelihoods of a large section of the Indian population, some action can be expected on price control of these food products and retail fuel if the same continues to remain high for an extended period.”

The government may “need to take suitable measures to control inflation of food products such as edible oils and pulses as well as retail fuels to mitigate any longer-term structural risks to inflation”, he says.

One option could be for the government to consider a reduction of the import duty on cooking oil, Mr Chowdhury adds.

There is also scope for the central and state governments to lower high taxes on petrol and diesel to help ease fuel prices, analysts say.

However, a cut on taxes on retail fuel products can only help “up to a point, especially in a backdrop when commodity prices are rising”, Ms Sahay says.

“A bigger relief, however, can emerge if global commodity prices' relentless rise sees some kind of a correction."

If there is no let up in rising commodity prices, including fuel, metal and edible oil, this could push the RBI “to turn less accommodative [hike interest rates] sooner, even before the growth recovery catches the desired level of momentum”, Ms Sahay says.

High inflation also has the potential to negatively impact the bond market and the value of the rupee, she adds.

For now, however, as India's economy sputters amid the pandemic, growth concerns remain the immediate worry, overshadowing the country's significant inflation challenges.

“We think at this particular juncture, policymakers are likely to remain squarely focused on economic growth,” Ms Sahay says.