FinTech and e-commerce start-ups dominated venture capital financing in the Middle East and North Africa during the first half of this year as investors continued to bet on resilient sectors, despite global economic headwinds, a new report has found.

Mega financing deals in both sectors propelled their weighting in the overall venture financing ecosystem, accounting for almost 80 per cent of the total funding in the region during the first six months of the year, data platform Magnitt said in its 1H 2023 MENA Venture Capital Report.

However, the number of deals as well as the value of financing for Mena start-ups fell amid continued global economic uncertainty and geopolitical headwinds, it said.

“Cautious investor sentiment at a time of economic uncertainty saw funding [value] and deals decline by almost 50 per cent in the region on a year-on-year basis,” Magnitt said.

“Almost half of the total capital aggregated by the Mena region in the first half came from the three mega deals.”

In February, Saudi Arabia-based grocery shopping and delivery platform Nana raised 500 million Saudi riyals ($133 million) in a new funding round to expand its services across the region.

Led by Kingdom Holding – the investment company controlled by Saudi Arabia's Prince Alwaleed bin Talal – and Uni-Ventures, the mega funding round was also participated in by Sultan Holding, Al-Jasser Holding, Red Diamond, Dallah Al-Baraka Group, Al-Jammaz Holding Company and a number of other investors.

Floward, a start-up delivering gifts and flowers in the Mena region and the UK, secured $156 million in funding in February as well to expand operations before a planned initial public offering.

The pre-IPO series C funding round was led by Aljazira Capital, Rainwater Partners and STV, Floward said at the time.

Egypt-based FinTech MNT-Halan raised $260 million in equity in its latest financing round in February. The deal was also accompanied by $140 million in the debt financing, making the funding round one of the biggest in the region.

Abu Dhabi’s Chimera was the largest investor in the equity financing round, ploughing in $200 million in exchange for a stake of more than 20 per cent in the Cairo-based company, said a statement at the time.

Overall, Mena start-ups raised more than $1 billion through 193 deals, with the region’s venture capital ecosystem seeing a 42 per cent retreat in the funding levels and a 49 per cent decline in the number of transactions closed to 193, Magnitt said.

Excluding the three large financing deals, total funding saw a 62 per cent drop on an annual basis. The second quarter of the year was the lowest funded quarter since the third quarter of 2020 at the height of the pandemic.

In terms of the quarterly number of transactions, the second quarter this year was the lowest since the second quarter of 2017, according to Magnitt data.

Fears of a looming recession and inflation that drove the equities and oil markets volatility have forced venture capital investors to stay on the sidelines this year. A continued rise in interest rates to curb consumer prices as well as rising geopolitical uncertainties have also added to global economic headwinds.

Start-ups in the broader Middle East, Africa, Pakistan and Turkey region raised $7.2 billion through 1,473 deals last year. Funding for Mena start-ups crossed the $3 billion-mark in 2022, an annual increase of 8.3 per cent, according to Magnitt data.

“With the increased probability of further interest rate hikes and subsequent economic challenges, any chance of a recovery is likely to appear after September in Q4, when deals closed in the summer are announced and high-profile tech summits are organised,” Magnitt said in a separate statement on Monday.

Individual governments in the Mena region have also taken steps in recent quarters to promote “activity in the VC ecosystem through policies and initiatives”, it said.

The UAE has launched the Dubai Economic Agenda D3, which looks to prioritise the growth of start-ups, while Egypt has announced a five-year tax exemption for start-ups.

Saudi Venture Capital has also recently launched an $80 million Saudi FinTech fund to encourage funding activity in the FinTech industry of the kingdom, Magnitt said.

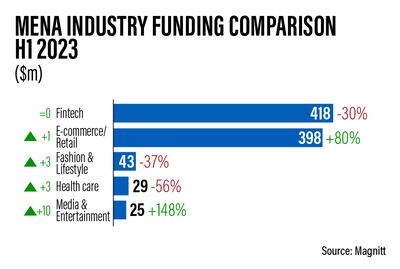

The three large financing rounds made FinTech and e-commerce/retail the top two Mena sectors by investments, followed by transport and logistics, software and media and entertainment sectors.

However, the number of deals in the top five sectors during the first half of the year halved on an annual basis amid slowing investment activity.

Globally, the e-commerce market is expected to hit $55.6 trillion by 2027 at a compound annual growth rate of about 27.4 per cent, from an estimated $13 trillion in 2021, data from US-based research firm Imarc Group showed.

Overall, venture capital investors remained focused on early-stage venture, investing in the lower-risk $1 million to $5 million bracket, which recorded a slight increase in first half of this year, the Magnitt report said.