India's residential property market is showing signs of a recovery amid low borrowing costs, reduced duties and attractive offers from developers, but the sector needs more government support to overcome the impact of the Covid-19 pandemic.

“Government support in terms of reduction of stamp duty and historic low interest rates have set the sales momentum with end-users making the most of this opportunity,” says Manju Yagnik, vice chairperson at Nahar Group, a Mumbai developer.

“We expect a good 2021 in terms of new project launches, sales ... [more people] becoming homeowners for the first time, and the industry achieving some sort of stability.”

India's property sector, the second-biggest employer after the agriculture sector, will account for about 13 per cent of the country's gross domestic product by 2025, according to data from India Brand Equity Foundation.

The industry, which was struggling even before the pandemic due to liquidity issues and weak sales amid a slowing economy, was hit hard as construction came to a grinding halt for several months at the peak of India's strict Covid-19 lockdown last year.

Unemployment in Asia's third-largest economy climbed and GDP nose-dived, drying up the pipeline of potential customers.

However, as India's economy recovers, property demand is picking up. The revival is being led by the country's financial capital, Mumbai, which has recorded a surge in home sales this year.

Last month, properties worth more than 117 billion rupees ($1.59bn) were sold in Mumbai, up 34 per cent from a year earlier and 15 per cent higher compared to January, according to data from Indian analytics and research platform Propstack.

“We posted a 45 per cent growth in terms of value of transactions till January 2021 [from the start of the financial year in April 2020] as against the same period last year,” says Percy Chowdhry, director at the Rustomjee Group.

Mr Chowdhry, whose company has a portfolio of 16.6 million square feet of completed projects in Mumbai, expects the value of sales to rise about 60 per cent by the end of the current financial year.

“The record number of property registrations [in Mumbai] for the month of February 2021 is a cumulative outcome of government fiscal stimulus, resumption of sectoral output, rise in investment to boost infrastructure, pent up demand and festive season consumption tailwinds,” says Niranjan Hiranandani, the national president of the industry group National Real Estate Development Council, or Naredco as it is known.

Maharashtra, where Mumbai is located, is among the states that reduced the stamp duty on properties, cutting it to 2 per cent from 5 per cent between October and December and to 3 per cent from January until the end of this month.

“The booster dose by the government and regulatory bodies in form of reduced stamp duty, low interest rates, deal sweeteners by the developers, and [a huge] choice of apartments available [to customers] has induced fence-sitters to convert into homebuyers across markets,” says Mr Hiranandani, who is also managing director of Hiranandani Group.

The marked improvement in economic activity has boosted investor confidence, he says.

The latest official GDP numbers for the quarter to December showed a return to growth, with the economy expanding by 0.4 per cent on the year. This came after India entered a recession last year. Moody's Investors Service now forecasts India's economy to grow by 13.7 per cent in the financial year beginning in April.

Lower borrowing costs are also stimulating the market. In its pandemic policy response, the Reserve Bank of India implemented two emergency interest rate cuts that have made home loans in the country more affordable for buyers.

“Interest rates are [at] the lowest and developers have been sensible about the pricing,” according to Renu Sud Karnad, managing director of HDFC, one of India's biggest private banks. “People are venturing out and buying homes,” she added, speaking at a virtual event on the property market this month.

Government initiatives to cushion the impact of the pandemic are "not going to be there forever”, she cautions.

Nevertheless, developers remain upbeat about the sector's outlook. The Covid-19 crisis, they say, has spurred new interest in home ownership.

“There's demand coming in from first-time homeowners,” Aditya Kushwaha, chief executive at Axis Ecorp, a developer in the coastal state of Goa, says. “Due to the pandemic and the uncertainty that followed, many people living in rental homes are now striving to get a home of their own.”

Being a Goa developer, business for Axis has boomed as “the work from anywhere lifestyle has encouraged many to look for a second home that is away from the hustle and bustle of city life”.

“The positive sentiment has returned ... and the trend is expected to continue in the future,” says Mr Kushwaha. “Buoyed by the demand that we have been getting, we [have] launched a project in the premium smart villa space”, and the firm is also working on plans for new projects in Mumbai and the north Indian hill station Shimla, he adds.

Dhiraj Jain, the director at Mahagun India, a real estate developer in the Delhi National Capital Region, says one of the consequences of the pandemic is that buyers are looking for larger homes to live “king-size lives with enough room”.

“One of the best indicators of growth is new launches in the market, which [indicates] that there is demand for property,” explains Mr Jain.

For the past few months, developers have been "gearing up" for more launches in 2021, which is a good sign for the market, he adds.

Another trend that is helping the sector is a rise in demand for homes from non-resident Indians, or NRIs.

“The Covid-19 pandemic has increased NRIs' emotional association of long-term security with physical assets,” says Prashant Thakur, director and head of research at Anarock Property Consultants

About 63 per cent of NRIs cited Covid-19 as the prime reason for buying homes in India, according to a survey by Anarock.

“They are also driven by uncertainties posed by Covid-19,” adds Mr Thakur. “Luxury properties ... [are] hot-favourite with NRIs because of the depreciating rupee value translating into greater buying power, coupled with ongoing developer discounts and offers.”

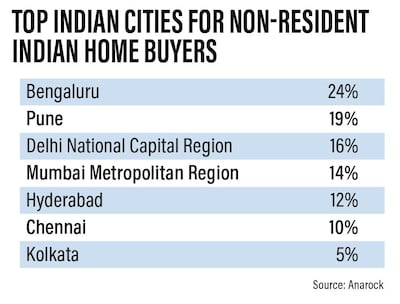

The IT hubs of Bangalore and Pune have seen the highest NRI demand, Anarock's research shows.

Nearly 68 per cent of NRIs considered real estate to be the best asset class in India, according to the survey.

Home prices in the second half of 2020 remained largely stable across seven major cities in India compared to the previous year, according to Anarock data.

“We expect that the prices will go up soon as the cost of raw material has gone up substantially,” says Ashok Gupta, the managing director of Ajnara India.

Though a revival in sales bodes well for the market, developers say there are several factors that are slowing the sector's recovery.

“There is strong demand in the market but there are certain challenges that are throttling the growth" including the goods and services tax (GST) rate in India, says Mr Kushwaha.

“NRIs investing in Indian real estate have to pay GST even if the property that they purchase is still under construction. Offering incentives and relaxation on tax to this segment will encourage better investments in the sector,” he adds.

Developers argue that more help from the government and the central bank can accelerate the revival of the sector.

"We want the government to continue the benefits [for the sector] be it stamp duty reductions, lower interest rates bank loans, [or] income tax relief, to attract more buyers to invest in real estate,” says Ms Yagnik.