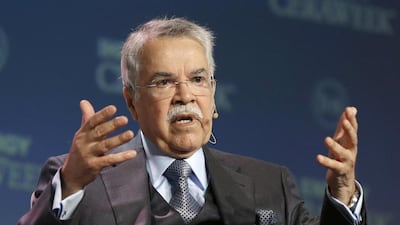

Saudi Arabia’s oil minister, Ali Al Naimi, concluded a tempestuous week for Opec with a speech in Houston on Tuesday, declaring that the country would not cut oil production.

That he should feel a need to travel halfway around the world to state that Saudi policy had not changed speaks volumes about the complexities of petro-diplomacy.

It all started a little more than a week earlier when, to all appearances, the Russians had managed to convince the Saudis to freeze oil production if other nations, notably Iraq and Iran, would do likewise. From the Saudi perspective, this idea looked a winner because a freeze would prevent Iran from increasing its exports to traditional levels, even while Russia and Saudi Arabia had no real intention of increasing their own output.

Of course, Iran had agreed on the nuclear deal with the United States and other major powers specifically to increase output and, therefore, every breathing oil-markets analyst expected Iran would reject the deal, which it did.

Moreover, every analyst – as well as the Saudis and Russians – knew that a freeze would not be the remedy for the global oil glut. Cuts are needed. As a result, the offer was neither acceptable to Iran nor a solution to the problem at hand. Why would the Kingdom make such a pointless offer to the Iranians, unless it was some opening bid in a more complex narrative of negotiations? Clearly, the proposal was a hidden Saudi signal that a production cut might eventually be agreed. Oil prices rallied on the news.

By late in the week, Mr Al Naimi was pouring cold water over the whole notion, once again categorically rejecting production cuts. The Russians, now embarrassed by the fiasco that they themselves had crafted, were backing away from the proposal at light speed, arguing that the “freeze” actually permitted Russia to increase production. The initiative had descended into chaos.

Meanwhile, analysts, including myself, were pondering how the Saudis could have played their cards so badly, particularly when a deal looked feasible.

Last year, Saudi Arabia had demurred cutting production for fears that increased oil prices would revive the US shale sector. This fear was well founded at US$50 per barrel, the prevailing price at the time. US shale production would recover at such a price. However, our analysis suggests that a West Texas Intermediate oil price up to $50 per barrel should not prompt any great revival in US supply. Shale producer Pioneer Resources puts the threshold even higher, at $70 per barrel. As the oil price is about $30 per barrel, Opec could cut production and raise oil prices by at least $20 per barrel – a 66 per cent increase – without restarting US shales.

To achieve the price increase, Russia and Saudi Arabia would have to cut production by 5 per cent each, even while allowing for increased Iranian production. If successfully implemented, oil revenues in the Gulf states would rise by a solid 50 per cent.

The Saudi oil minister did not seem to appreciate these changed circumstances. Instead, he reiterated that Saudi Arabia wants to squeeze out high-cost oil and maintain market share. This is all fine, but neither of these is a relevant metric. Only oil revenue matters, ultimately. The question to be answered is whether a given strategy maximises such revenue, or not.

Squeezing out US shale has proved punishingly expensive. First, production has proved to be resilient. Second, production will come right back with increased prices.

And third, Opec is not only selling cheap oil for consumption, it is selling cheap oil for inventory.

According to the US Energy Administration Administration (EIA), excess crude oil and product stocks – those above normal operating levels – amount to one billion barrels and are expected to peak late next year at 1.4bn barrels.

Running off these excesses, even at 2 million barrels per day, would take an additional two years – that is, to 2019.

If that is added to the current estimated surplus, supply would have to fall by a monstrous 3.5 million bpd to balance markets.

Put another way, a failure to cut production now could poison the oil price well for another four years, if EIA calculations are to be believed. Saudi policy is not only depressing prices now, its continuation may keep prices low for a long time.

Thus, Saudi prioritisation of market share and volumes is killing revenues. The Kingdom is keying on the wrong metric, not because its volume strategy is always inappropriate, but because revenue maximisation logic is far different at $30 per barrel than it is at $50 per barrel. The Saudis have not acknowledged this.

Of course, the numbers are vastly complicated by regional conflicts and politics, most notably between the Saudis and the Iranians. Clearly, the Saudis would like to deprive Iran of incremental oil revenue. However, because Saudi Arabia exports more than six times as much oil as Iran does, any recovery in price brings far more revenue in dollar terms to the Saudis than it does to Iran.

Even under the most generous, plausible production cut deal, Saudi Arabia would still earn an additional $4 for every $1 gained by the Iranians. Therefore, the question is whether this is a good trade-off for the kingdom when politics is factored in.

-- As Saudi Arabia has not articulated specific political concessions required from Iran, we just don’t know.

Russia also matters, as it would receive almost as much benefit from an increased oil price as the Saudis. Is depriving Russia of income also a Saudi goal? And if so, why did Riyadh agree on a freeze with the Russians?

And this brings us full circle to Mr Al Naimi’s speech in Houston.

He reiterated the Saudi position rejecting production cuts but really has not clarified either the question of revenue maximisation or the country’s political requirements from Iran or Russia. For that reason, the production cut question will probably not go away.

The numbers say a deal is still on the table.

Steven Kopits is the president of Princeton Energy Advisors in New Jersey