There was a sense of inevitability about the News Corp shareholder meeting last week. That is, the more things changed for this controversial media conglomerate, the more they were always going to stay the same.

Tomorrow's exclusives tonight:

Industry Insights e-newsletter Stay ahead of the pack and get the pick of the premium Business content straight to your inbox. Sign up

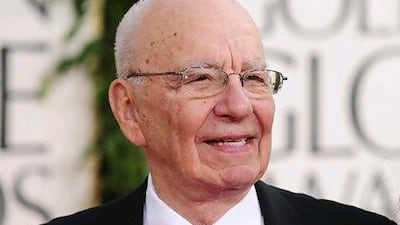

In the run-up to the annual general meeting in Los Angeles, some powerful shareholder entities - including pension funds in the US, Britain and Australia - voiced adamant opposition to the re-election of Rupert Murdoch's sons to the News Corp board, but they all knew it would not make a difference.

Mr Murdoch and his sons would remain in power whether big shareholder interests wanted them or not.

While the Mr Murdoch family owns only 12 per cent of shares, it controls 39.7 per cent of the voting shares.

Add to this the sympathetic shareholder blocs that will always vote the Murdoch family way, and you have a family company with the family still firmly in control of its destiny, not a public one attuned to the needs of its shareholders.

Among those supporting Mr Murdoch publicly has been the Saudi Prince Al Waleed bin Talal, the second-largest holder of News Corp voting shares and one of the richest men in the world.

He said recently he was "both supportive and confident in the leadership of Rupert and James Murdoch".

And yet the scale of rebellion was greater than expected. Most believed that it would not exceed 20 per cent of non-family shareholders, but when the results were released, 34.8 per cent voted against James Murdoch, 33.7 per cent against his brother Lachlan, while Rupert Murdoch, the chairman and chief executive - used to almost unanimous shareholder support in previous elections - saw a 15 per cent vote against his re-election.

A vote to decouple Mr Murdoch's dual role as chief executive and chairman was similarly foiled. The dissident shareholders wanted the heads of 13 of the 15 directors, but not one of them (not even the opera singer member of the Bancroft family, which sold Dow Jones and The Wall Street Journal to News Corp) was served on a platter.

The demands of non-family shareholders since the News of the World hacking scandal have been fairly simple, based on some clear tenets of corporate governance: to remove nepotism as a whole from the company; and in the light of the phone-hacking scandal, to usher in new and reliable stewardship.

Family members and long-serving directors should be replaced with skilled independent directors.

Edward Mason, the secretary of the ethical investment advisory group of the Church of England, which owns about US$6 million (Dh22m) worth of News Corp shares, said there needed to be "decisive action in terms of holding people to account".

Julie Tanner, assistant director of Christian Brothers Investment Services, said the "extraordinary scandals" in the UK required corporate overhaul.

Stephen Mayne, an Australian shareholder and long-time critic of Rupert Murdoch, described the meeting as "extraordinarily paranoid".

Mayne noted wryly that Rupert Murdoch gave two-and-a-half hours to a British parliamentary committee in July but gave his shareholders an hour less.

"And it only lasted this long because about 10 different shareholders got up to speak," Mr Mayne said.

His analysis of Mr Murdoch's performance at the meeting gives the impression of the octogenarian Rupert Murdoch as an ageing figure out of touch with normal practice, but retaining power no matter what the consequences.

Despite his company being subjected to withering scorn from all sectors of society, Mr Murdoch maintained that News Corp was the "stuff of legend", which started "from a small newspaper in Adelaide, to a global corporation based in New York with a market cap of $44 billion … informing, entertaining and educating at least a billion people each day".

For any governance change to be effective in News Corp, Rupert Murdoch's family would need to vote against him. This was never going to happen.

Faith in the voting patterns of his most loyal subjects, not the tenets of good stewardship, is why Murdoch offered not a single fresh concession to his detractors.

As Neil Minow, a member of the board of GovernanceMetric International, said: "When a fiduciary picks a new CEO, the job is to look for the best candidate in the world, not the best candidate in the family."