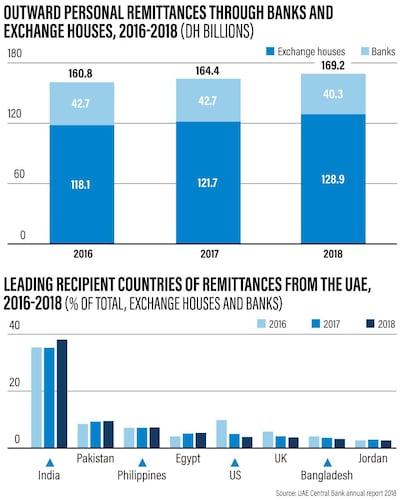

Outward personal remittances reached Dh169.2 billion last year, an increase of 3 per cent or Dh4.8bn compared to 2017, according to the UAE Central Bank’s annual report released this week.

Money sent home through exchange houses increased by 6 per cent from Dh121.6bn in 2017 to Dh128.9bn last year, while the amount sent through banks decreased by 5.6 per cent from Dh42.7bn to Dh40.3bn.

The highest share by far went to India, accounting for 38.1 per cent of the total outflows, “in accordance with the significant share of expats from India working in the UAE and the depreciation of the Indian rupee against the dirham”, the report said. Indian nationals account for about 30 per cent of the UAE’s total expatriate population, according to the Indian Embassy in Abu Dhabi.

The next five top countries receiving remittances from the UAE were Pakistan (9.5 per cent), the Philippines (7.2 per cent), Egypt (5.3 per cent), the US (3.9 per cent) and the UK (3.7 per cent).

The UAE is the second biggest outward remittance country in the world, only after the US, which sent out close to $68bn (Dh250bn) in 2017, according to the World Bank. Globally remittances reached $689bn last year, up from $633bn in 2017, and is estimated to reach $715bn this year.

“The overall increase was driven by a stronger economy and employment situation in the United States and a rebound in outward flows from some Gulf Cooperation Council countries and the Russian Federation,” said the World Bank’s Migration and Development Brief published in April.

UAE exchange houses and banks have recently been investing in digital technologies, such as mobile apps, to make it easier for customers to send money home. Lulu Exchange introduced its "LuLu Money" app last year. In April, global money transfer company Western Union rolled out digital services in the UAE with local partner Al Fardan Exchange.

“Such technologies have increased the market share of exchange houses versus banks,” said Rajiv Raipancholia, chief executive of Orient Exchange and treasurer of the non-profit Foreign Exchange & Remittance Group.

Mr Raipancholia also attributed the higher market share of exchange houses to having more competitive rates than banks. He predicts that remittances through money exchanges will continue to increase over the next two to three years as more introduce their digital platforms.

But UAE banks, too, are entering the digital market. Noor Bank partnered with ICICI Bank in India this month to allow customers to make instant money transfers to India through its online portal and mobile banking app. The Islamic bank is planning to extend its instant remittance services to other countries in the subcontinent in the next few months.

“There will be tough competition between exchange houses and banks,” Mr Raipancholia said. “The personal interaction with the customer will be a thing of the past.”