Ultra-high-net-worth individuals in the Middle East – people with a net worth of more than $30 million (Dh110.2m) – are projected to increase by 20 per cent in the next five years, according to a new report by global property consultancy Knight Frank. That means the region will add another 1,660 people to the upper band of the very wealthy by 2023.

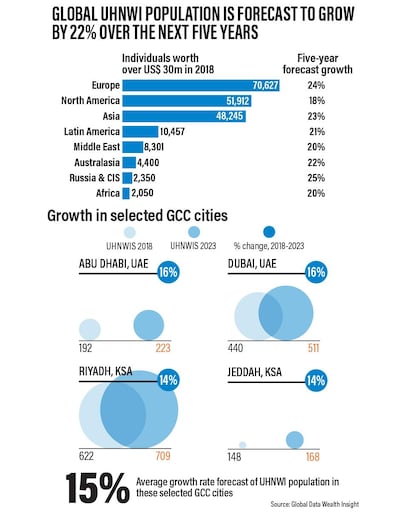

The global population of the ultra-wealthy, about 198,300, is forecast to rise by 22 per cent over the same period to almost 250,000, according to the 2019 Wealth Report released yesterday. While Europe still leads the world with more than 70,600 ultra-wealthy people, Asia hosts eight of the top 10 countries with the fastest growing rich populations. India will lead five-year growth with 39 per cent, followed by 38 per cent growth in the Philippines and 35 per cent growth in China.

Asia is the biggest hub for billionaires in particular. By 2023, there will be more than 1,000, accounting for more than a third of the world’s billionaire population.

This year will also be a significant milestone for the number of millionaires or high-net-worth people, defined as having at least $1m in net assets. In 2019, the figure will exceed 20 million for the first time, with around 6.6 million in North America, 5.9 million in Europe and 5.8 million in Asia.

In the Middle East, there are around 8,300 ultra-wealthy people, of which 693 are in the UAE and 950 in Saudi Arabia. Turkey, with 1,695 ultra-rich, was also included as part of the region.

"As we're coming out into a stronger period for the region, we expect wealth to grow quite significantly going forward," Taimur Khan, research manager at Knight Frank Middle East, told The National. "It's going to be mainly focused in the four major economic cities of the region – Abu Dhabi, Riyadh, Dubai and Jeddah."

Those four cities are projected to increase their ultra-wealthy population by an average 15 per cent. UAE leads the GCC in terms of wealth seeking new property investment opportunities with $2.8 billion, followed by Saudi Arabia with $1.9bn.

Three quarters of ultra-wealthy people in the Middle East own second homes outside their country of residence, the highest proportion in the world. The top choices for Middle East buyers are the UK, US, France, UAE and Switzerland, according to the Wealth Report Attitudes Survey 2019 included in the report.

The report, in its 13th year, also includes Knight Frank’s City Wealth Index and Knight Frank’s Prime International Residential Index (PIRI 100), offering a global perspective on prime property and investment. Despite the risks from Brexit, London retook its number one spot in the city wealth index, pushing New York into second place.

Manila led the rankings in the PIRI 100, which tracks the movement in luxury prices across the world's top residential markets, with 11 per cent growth. A lack of supply and a thriving economy in the Philippines has motivated buyers, the report said.

However, the index witnessed its lowest rate of annual growth since 2012 with prices rising on average by 1.3 per cent. Even Manila's 11 per cent growth is low in comparison to PIRI data over the past 12 years, which has never recorded annual growth below 21 per cent in the top-performing market.

Key global hubs including New York, London and Dubai all decreased in growth by 2.5 per cent, 4.4 per cent and 3.4 per cent respectively.

While the Dubai luxury market has slowed, Mr Khan said it still offers relative value. For $1m, Dubai offers 143 square metres of property, in comparison to 31 square metres in New York or London and 36 square metres in Singapore.

Average gross yields of 6 to 8 per cent in Dubai are double those of locations like London, New York and Singapore, he said.

Considering the relative number of square metres “combined with the high yield, combined with the fact that there are effectively no property taxes here, for investors it’s actually a really attractive proposition,” Mr Khan said.

Developments in Dubai, which includes DIFC, the World Trade Centre and Zabeel, is highlighted in the report among 18 global residential property hotspots.

“Dubai is becoming much more interesting to add a property either as an investment or as a second home,” Mr Khan said.